- United States

- /

- Gas Utilities

- /

- NYSE:NWN

A Look at Northwest Natural Holding's Valuation Following Robust Results and Oregon Rate Hike

Reviewed by Simply Wall St

Northwest Natural Holding (NWN) just issued third quarter results that show rising sales and a firmer earnings outlook for 2025. These updates coincide with new rate increases in Oregon that recently took effect.

See our latest analysis for Northwest Natural Holding.

Following these robust quarterly results and a brighter earnings outlook, Northwest Natural Holding’s shares have gathered real momentum, delivering a 17.1% share price return over the past 90 days, and a solid total shareholder return of 19.9% for the past year. With customer growth, new rate approvals, and another consecutive annual dividend increase, investors seem to be recognizing the company’s improved performance and steady long-term potential.

If this momentum has you thinking about what else is on the rise, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares surging and analyst targets still implying upside, the key question now is whether Northwest Natural Holding is offering a true bargain at current levels, or if the market has already factored in the improved outlook.

Most Popular Narrative: 10% Undervalued

At $46.80, Northwest Natural Holding's share price is running below the most widely followed fair value estimate. This active narrative builds its case around the company's bold moves and emerging growth areas, setting the tone for deeper investor debate.

Diversification through renewable projects and water utilities enhances earnings stability and regulatory alignment. Modernizing infrastructure also boosts operational efficiency. Ongoing investments in infrastructure modernization and system upgrades, combined with supportive regulatory outcomes (recent rate increase and higher allowed ROE), are likely to improve net margins, operating efficiency, and future earnings reliability.

Curious what financial drivers are fueling this optimistic price target? The full narrative breaks down aggressive revenue assumptions and ambitious margin gains. Ready to see what’s propelling that valuation skyward? Get the details that analysts are betting on.

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating state decarbonization policies or slower Texas housing growth could challenge forecasts and reshape the future outlook for Northwest Natural Holding.

Find out about the key risks to this Northwest Natural Holding narrative.

Another View: Market Comparisons Add Caution

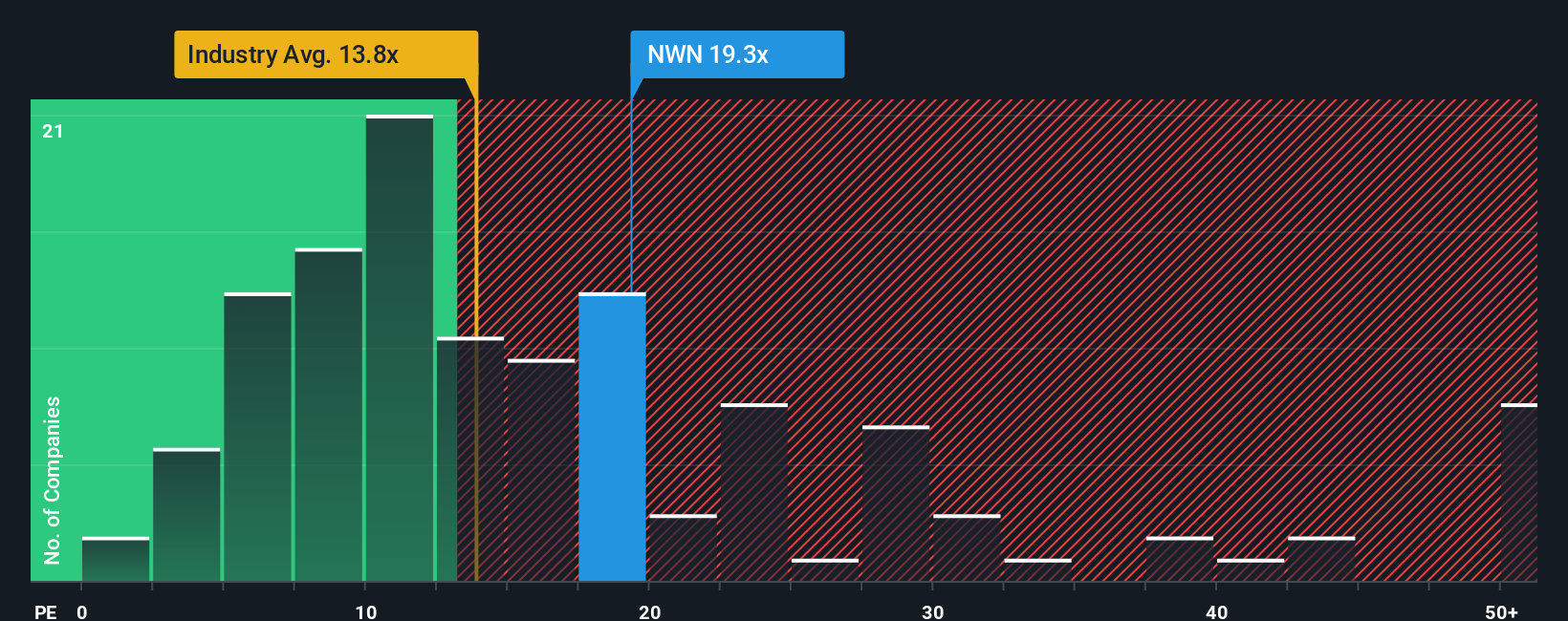

Looking through another lens, Northwest Natural Holding is trading at a price-to-earnings ratio of 19.3 times, which is a clear premium compared to both the global gas utilities industry average of 13.8 times and its peer average of 18.9 times. Even the fair ratio sits lower, at 18.2 times. This higher valuation carries extra risk if market expectations shift, so is the premium deserved?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Natural Holding Narrative

If you have your own perspective or want to see how the numbers stack up differently, you can build a custom narrative for Northwest Natural Holding in just a few minutes, so why not Do it your way

A great starting point for your Northwest Natural Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to stay a step ahead of the market? The Simply Wall Street Screener is your shortcut to more opportunities. Don’t miss what tomorrow’s leaders look like today.

- Uncover high-yield opportunities and secure your income stream by checking out these 16 dividend stocks with yields > 3% with attractive yields above 3%.

- Stay at the forefront of innovation by tracking these 24 AI penny stocks making headlines for their breakthroughs in artificial intelligence.

- Tap into strong upside potential and value by reviewing these 870 undervalued stocks based on cash flows that stand out based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record with concerning outlook.

Similar Companies

Market Insights

Community Narratives