- United States

- /

- Electric Utilities

- /

- NYSE:NRG

NRG Energy (NRG): Evaluating Valuation After Strong Year-to-Date Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for NRG Energy.

Momentum continues to build for NRG Energy, with a 1-month share price return of 4.6% and an outstanding 83% rise since the start of the year. The long-term picture is even stronger. Investors who have held on for several years have enjoyed a remarkable 307% total shareholder return over three years and 531% over five years, showing just how sustained the stock's performance has been.

If you’re searching for what else might be powering ahead, now is a good time to broaden your outlook and discover fast growing stocks with high insider ownership

With such eye-catching gains already, investors might wonder if NRG Energy’s stellar fundamentals are still undervalued or if the market has already priced in all the future growth, leaving little room for a new buying opportunity.

Most Popular Narrative: 17.9% Undervalued

According to the most widely followed narrative, NRG Energy’s estimated fair value stands well above the recent closing price. The crowd is betting on robust future earnings and growth, highlighting a striking gap that could indicate potential upside for the stock.

“The accelerated adoption of data centers, electrification, and the signing of long-term, premium-margin agreements for large, multi-year power delivery significantly increases NRG's exposure to growing electricity demand. This points to higher recurring revenue and margin expansion through 2030 and beyond.”

Curious what numbers are fueling this optimism? The key: analysts are projecting a leap in future profits and margins, and the valuation hinges on whether growth in these segments will truly materialize. Want to uncover the set of ambitious assumptions driving such a dramatic price target? Dive deeper into the narrative and discover what could make or break this bullish case.

Result: Fair Value of $207.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution and integration challenges, combined with increased regulatory scrutiny of natural gas assets, could quickly dampen the bullish case for NRG Energy.

Find out about the key risks to this NRG Energy narrative.

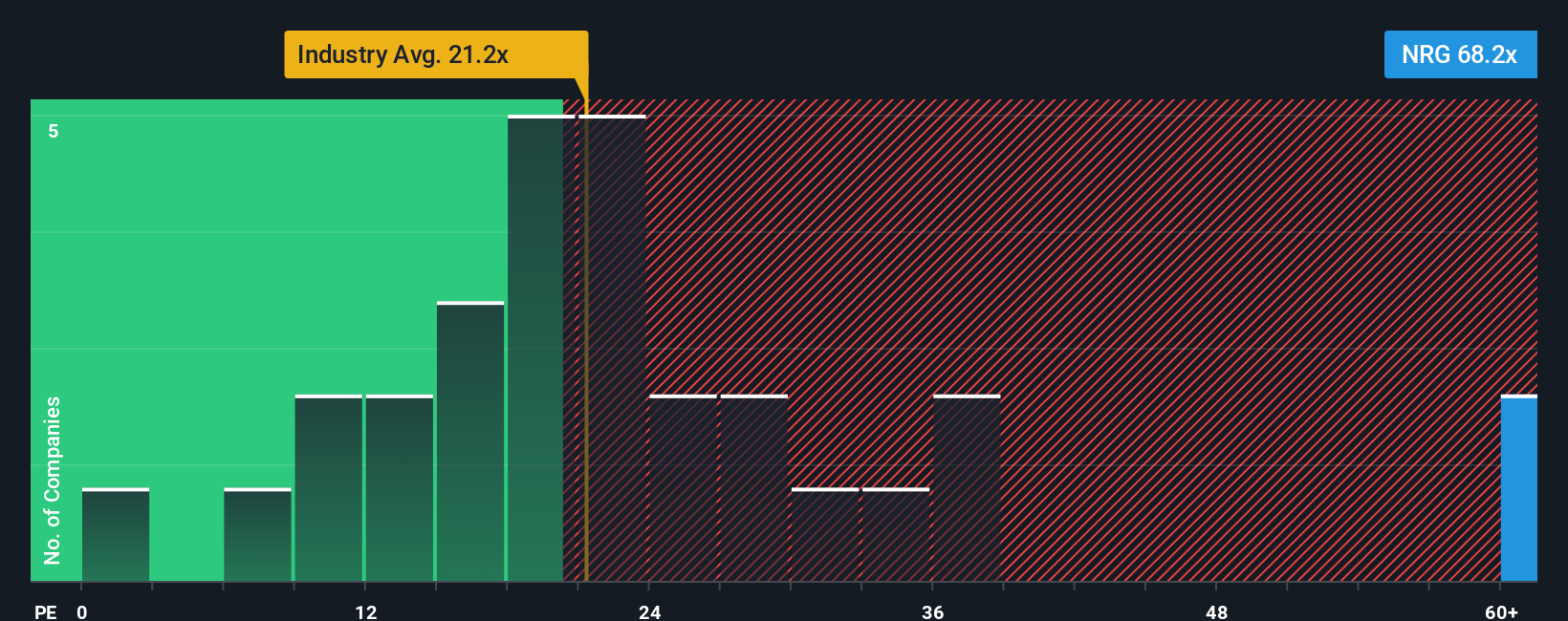

Another View: Multiples Tell a Cautionary Tale

Looking through a different lens, NRG is currently trading at a price-to-earnings ratio of 23.9x, which is noticeably higher than both its industry average of 20.5x and main peer average of 20.6x. Although its ratio sits well below the fair ratio estimate of 34.1x, this premium suggests the market might be pricing in significant future growth or perhaps taking on more valuation risk than it realizes. Does this higher valuation indicate lasting strength, or could it leave the stock vulnerable to a change in sentiment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NRG Energy Narrative

If you see things differently or want to dive deeper into the numbers yourself, it’s quick and easy to build your own story around NRG Energy in just a few minutes. Do it your way

A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Unlock the market’s most compelling ideas. Don’t miss your chance to find stocks with game-changing growth, unique potential, and untapped value tailored to your goals.

- Tap into explosive returns by checking out these 3586 penny stocks with strong financials that have strong financials and the potential to multiply your investment.

- Capitalize on the AI revolution and spot trendsetters early by reviewing these 25 AI penny stocks setting the pace in cutting-edge innovation.

- Secure your future and strengthen your portfolio with these 17 dividend stocks with yields > 3% to potentially benefit from reliable income and attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives