- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR): Valuation Perspective Following Strong Q3 Results and Dividend Hike

Reviewed by Simply Wall St

Entergy (ETR) caught attention after announcing its third quarter and nine-month financial results, revealing higher revenue and net income compared to the previous year, along with a quarterly dividend increase.

See our latest analysis for Entergy.

Entergy’s strong third quarter results and dividend hike follow its board appointment of retired Admiral Frank Caldwell and a completed $600 million bond offering, all combining to signal momentum for the business. The stock’s 27.7% year-to-date price return and 35.8% total shareholder return over one year underscore a resurgence, while triple-digit returns over three and five years suggest sustained gains and growing investor optimism around Entergy’s strategy and outlook.

If you’re watching utility stocks making bold moves, consider broadening your perspective and discover fast growing stocks with high insider ownership

With shares rallying and the company delivering robust financials, investors must now ask whether Entergy remains a bargain undervalued by the market or if today’s price already reflects all its projected growth.

Most Popular Narrative: 6% Undervalued

Entergy’s most widely followed narrative pins a fair value of $102.46, nearly $6 above the last close at $96.28. This implies greater upside potential from the current price. This viewpoint is based on robust long-term growth projections and significant infrastructure investments.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above-average EPS and earnings growth for several years. Expedited regulatory frameworks and legislative support for economic development, storm cost recovery, and infrastructure riders (especially in Arkansas, Louisiana, and Texas) are likely to accelerate cash flow and enhance earnings consistency, limiting regulatory lag and improving overall credit metrics.

Curious how ambitious capital plans translate into a higher fair value? The narrative's math leans on outsized future earnings, climbing margins, and a premium multiple as the key factors behind the price target. Can these projections hold up under real-world conditions, or is there a bigger story behind this bullish stance? Dive into the full narrative to uncover exactly which financial leaps power this valuation.

Result: Fair Value of $102.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming challenges around Entergy's large-scale capital needs and climate vulnerability could quickly shift this optimistic outlook if conditions change unexpectedly.

Find out about the key risks to this Entergy narrative.

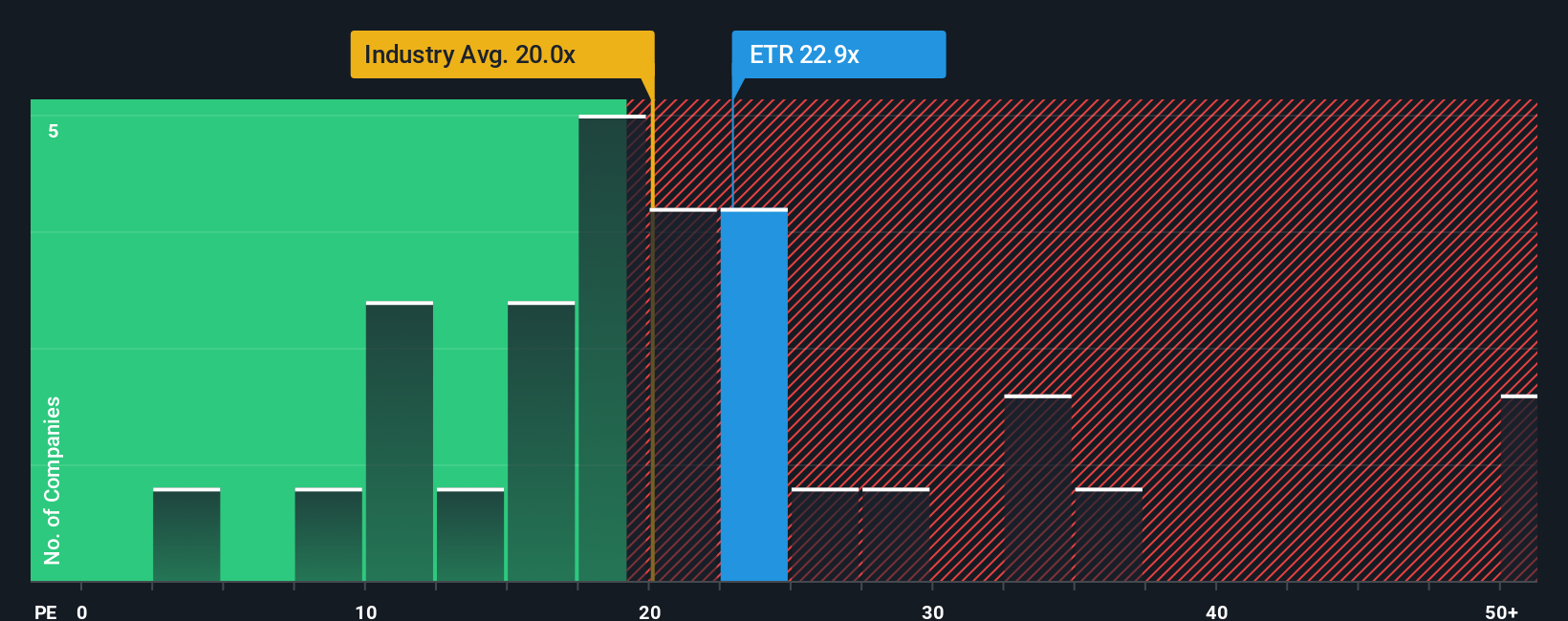

Another View: Multiples Suggest a Premium

While the popular narrative points to Entergy being undervalued, a closer look at the company’s earnings multiple offers a different angle. Entergy trades at 24.1 times earnings, which is not only above the US utility sector average of 21.6x but also slightly higher than the fair ratio of 23.8x. This suggests the market prices in some optimism already, introducing more risk if growth expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If you see the numbers differently or want to put your unique perspective to the test, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Pick up your investing momentum by checking out fresh opportunities beyond Entergy. These screeners spotlight unique trends and sectors, all waiting for your attention.

- Target stronger yields and enhance your income strategy by checking out these 20 dividend stocks with yields > 3% with sustainable payouts and proven growth.

- Fuel your portfolio’s innovation edge when you scan these 26 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs and automation trends.

- Tap into potential upside when you review these 849 undervalued stocks based on cash flows, which the market may be overlooking and could give you a smart advantage early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives