- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Exploring Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Duke Energy.

Despite the recent dip, Duke Energy's 2024 momentum remains intact, with a year-to-date share price return of nearly 15% and a robust 1-year total shareholder return of just over 14%. Short-term softness may simply reflect shifting sentiment around utility stocks after a broadly positive run. Long-term shareholders have seen gains build steadily, with total returns nearing 57% over the last five years.

If you’re watching how sector trends evolve, it could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

So as Duke Energy’s price softens after a strong run, the key question is whether the stock is now undervalued with more room to grow, or if the market has already factored in all its future prospects.

Most Popular Narrative: 9.9% Undervalued

Duke Energy’s most followed fundamental narrative sees more than just stability at current prices. With the last close at $123.66, analysts envision notable upside before the valuation truly reflects all the company’s strengths.

Major economic development wins (for example, AWS's $10B data center in North Carolina), paired with accelerated migration and manufacturing demand in Duke's service territory, are expected to drive robust, multi-year load and volume growth. This supports higher revenues and long-term EPS growth. Supportive state and federal legislation, such as the Power Bill Reduction Act in North Carolina and the Energy Security Act in South Carolina, streamlines cost recovery for new generation and grid investments. This reduces regulatory lag and improves cash flow and earnings stability over the next decade.

Want to know the secret behind this optimistic price? There’s a mix of long-range revenue plans, profit margin targets, and a future valuation multiple well above the sector’s average. Intrigued by the projections powering this price? Dive deeper to uncover the bold assumptions driving the narrative.

Result: Fair Value of $137.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster adoption of distributed energy such as solar or increased capital needs could pressure Duke Energy’s long-term revenue growth and profit margins.

Find out about the key risks to this Duke Energy narrative.

Another View: Checking the Numbers with Discounted Cash Flow

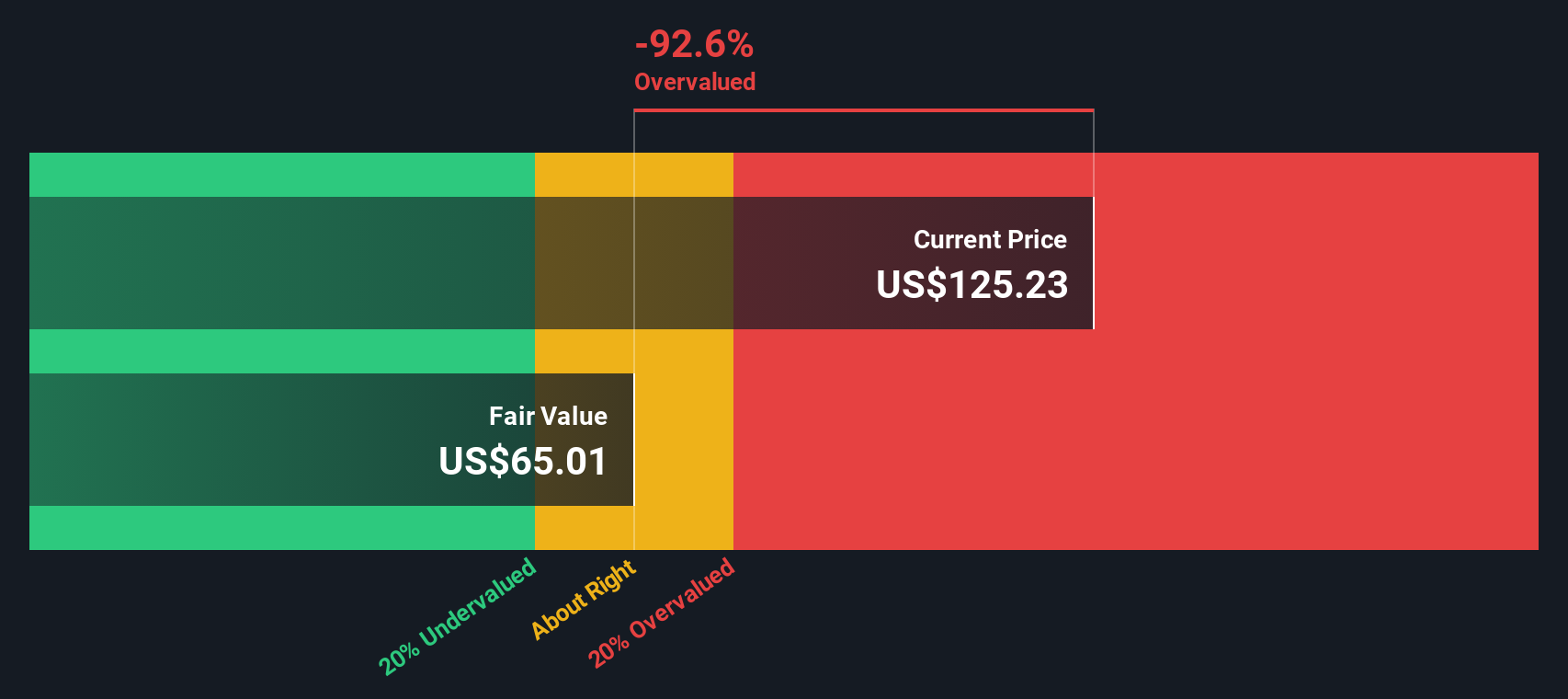

While many analysts focus on earnings multiples, another approach is the SWS DCF model, which estimates Duke Energy’s fair value based solely on future cash flows. According to this method, the current price appears to be well above the model’s fair value, indicating less upside than you might expect. This raises the question: is the market pricing in more optimism than the numbers support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you'd rather craft your own viewpoint or dig into the numbers yourself, you can easily pull together a personalized narrative in just a few minutes. Do it your way

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t sit on the sidelines while others find tomorrow’s best opportunities. Jump in now to target rising trends, strong dividends, and niche sectors that are shaping future winners.

- Tap into companies offering reliable income streams by checking out these 16 dividend stocks with yields > 3% with above-average yields and solid fundamentals.

- Ride the surge of artificial intelligence by uncovering these 25 AI penny stocks at the forefront of innovation and market disruption.

- Accelerate your search for value with these 877 undervalued stocks based on cash flows that trade at attractive prices based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives