- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Evergy (EVRG): Assessing Valuation Following Strong Year-to-Date Share Price Gains

Reviewed by Simply Wall St

Evergy (EVRG) has caught the attention of investors this month after demonstrating notable gains throughout the year. Shares have climbed 23% year-to-date, with momentum building around its steady revenue and income growth.

See our latest analysis for Evergy.

Much of Evergy’s momentum this year has come on the heels of steady performance, with the share price gaining over 22% year-to-date and recent moves reflecting renewed optimism about utilities in today’s market. While the stock has seen some short-term pullback, its long-term track record stands out, delivering total shareholder returns of nearly 26% in the past year and more than 61% over five years. This points to consistent value creation for investors.

If you’re aiming to spot the next wave of movers and shakers, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With steady gains and rising earnings, it is worth asking whether Evergy’s recent run has created a true bargain for value-seeking investors or if the market has already factored in all the good news.

Most Popular Narrative: 7.9% Undervalued

Evergy's widely followed narrative pins a fair value above the most recent close, suggesting room for upside if growth drivers play out as forecast. With the share price trailing the narrative valuation, investors are watching how capital projects and regulatory initiatives shape the road ahead.

Accelerated investment in grid modernization, new natural gas, and solar generation, enabled by supportive state regulatory approvals and legislative mechanisms (for example, PISA, CWIP), positions Evergy to efficiently deploy and recover capital, benefitting future net margins and regulated earnings.

Increasing state and federal incentives for clean energy infrastructure, combined with Evergy's ongoing transition to renewables and emissions reductions targets, are set to unlock multi-year capital deployment opportunities and provide stable, predictable returns, lifting EPS and rate base growth.

Want to know what really drives this multi-billion dollar valuation? The secret sauce blends ambitious profit expansion with state-backed projects and a pipeline of electrification. Curious about the financial leap analysts anticipate? Dive in and uncover the bold assumptions behind this price target.

Result: Fair Value of $82.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around large-scale investments and potential delays in customer ramp-up could quickly change the outlook and challenge current growth assumptions.

Find out about the key risks to this Evergy narrative.

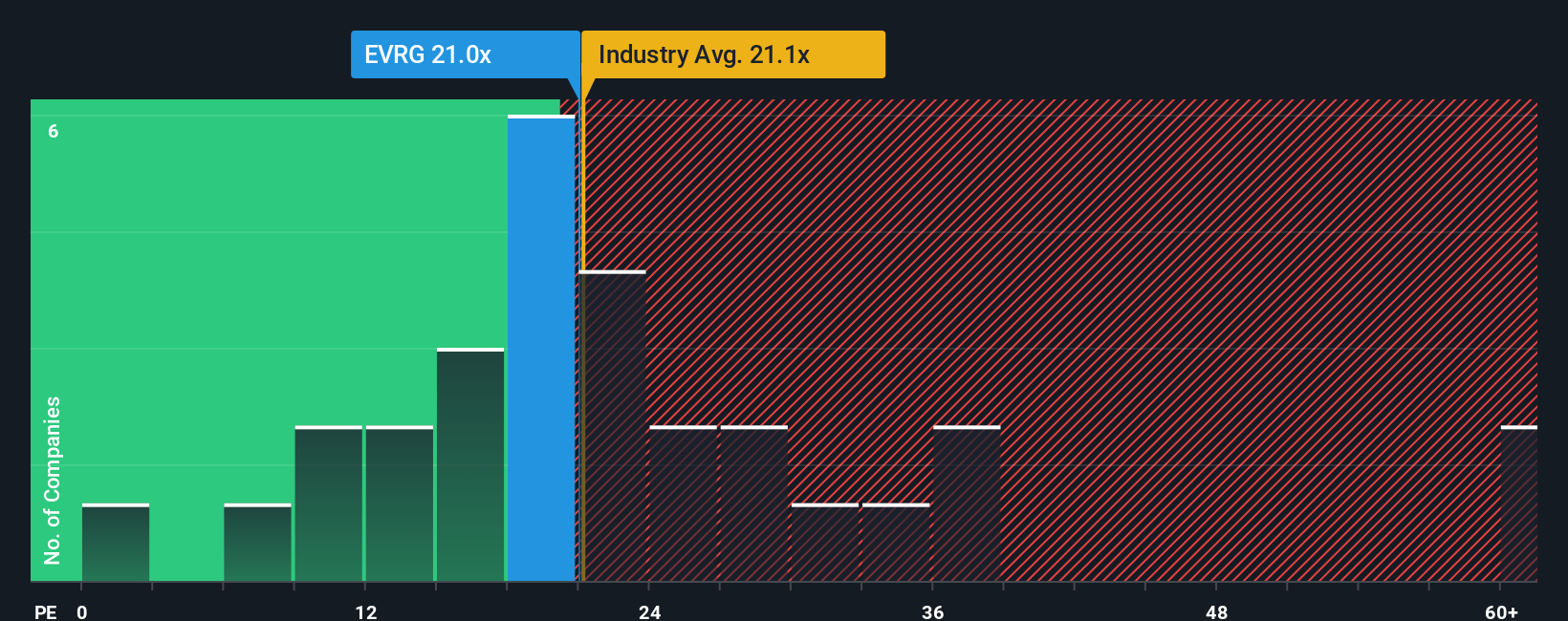

Another View: Looking Through the Lens of Earnings Multiples

While analysts see upside based on growth forecasts, Evergy's current valuation tells a more cautious story. The company's price-to-earnings ratio stands at 20.5x, which is above the average of its peers (17.2x) and slightly richer than its own fair ratio of 20.4x. This suggests the market is already pricing in a lot of optimism, leaving less margin for error if future growth falls short. With that in mind, does Evergy offer a true value opportunity or does it carry a higher risk of disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evergy Narrative

If you see things differently or would rather dig into the numbers on your own, you can shape your own take in just a few minutes with Do it your way.

A great starting point for your Evergy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your portfolio by tapping into exciting sectors. Missing out could mean leaving potential gains behind.

- Boost your growth strategy by targeting tomorrow's healthcare breakthroughs with these 32 healthcare AI stocks, keeping you on the forefront of medical innovation.

- Capture big yields and steady income streams by checking out these 16 dividend stocks with yields > 3%, offering attractive cash returns for income-focused portfolios.

- Seize the potential for massive upside by tapping into these 3590 penny stocks with strong financials where emerging players are making their mark before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives