- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

How AEP and Quanta’s Grid Partnership Could Shape Its $72 Billion Investment Plan

Reviewed by Sasha Jovanovic

- Earlier this week, American Electric Power announced long-term strategic partnerships with Quanta Services to support its announced US$72 billion capital plan, enhance supply chain resilience, and expand high-voltage transmission to serve customers including the growing data center market.

- These initiatives also include agreements to expand domestic manufacturing capacity for critical power grid components, aiming to improve delivery certainty and infrastructure reliability across AEP’s operations.

- We'll explore how AEP's collaboration with Quanta Services may strengthen its investment narrative, particularly through grid modernization and supply chain improvements.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

American Electric Power Company Investment Narrative Recap

To be an AEP shareholder, you likely need confidence in the long-term growth of electricity demand from commercial and industrial customers, and the company’s ability to execute on large-scale capital investments while managing regulatory and supply chain risks. The recent Quanta Services partnership addresses important supply chain hurdles, but it does not materially shift the most immediate catalysts, such as regulatory approvals, nor does it fully resolve the largest current risk: exposure to tightening margins as load grows in lower-margin customer segments.

Among recent announcements, AEP’s confirmation of its 2025 operating earnings guidance range stands out as most relevant. While the Quanta partnership supports long-term reliability and execution, the company’s ability to maintain its earnings outlook in the short term remains tied to successfully managing both regulatory approvals and stable net margins.

In contrast, investors should also pay attention to how any changes in commercial and industrial demand growth could further impact margin trends, especially if ...

Read the full narrative on American Electric Power Company (it's free!)

American Electric Power Company's narrative projects $24.6 billion revenue and $4.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.5 billion earnings increase from $3.6 billion.

Uncover how American Electric Power Company's forecasts yield a $127.32 fair value, a 7% upside to its current price.

Exploring Other Perspectives

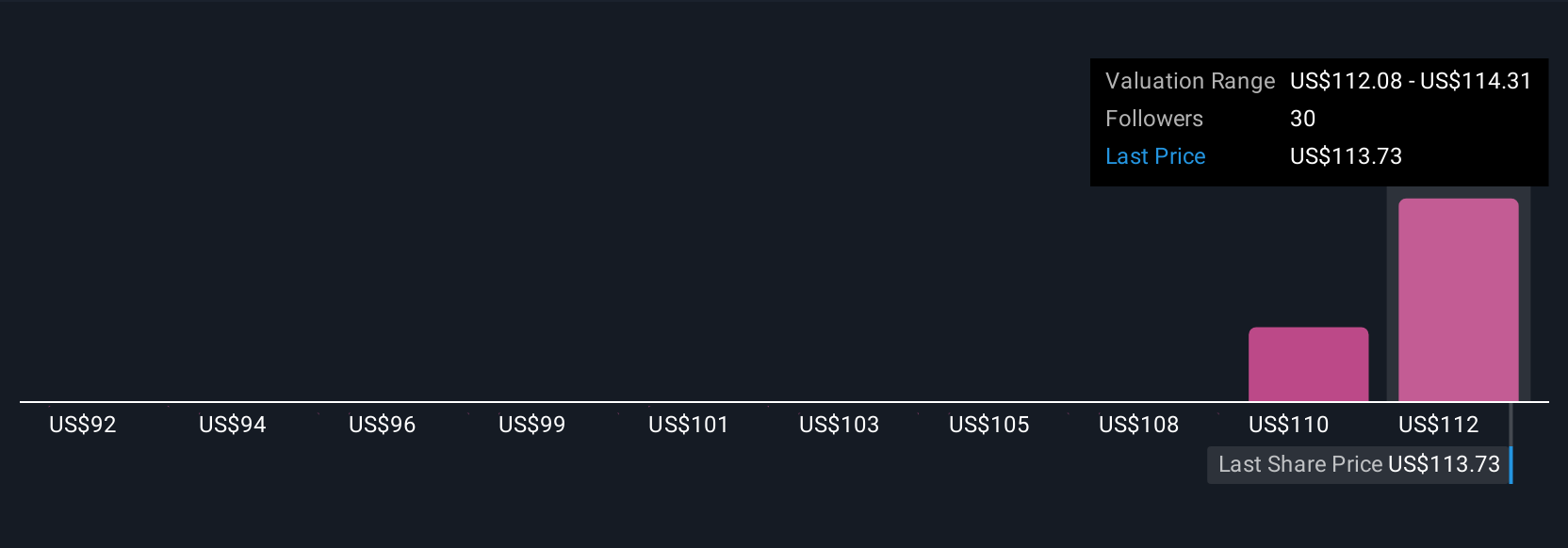

Simply Wall St Community members value AEP shares between US$92 and US$127.32, based on 3 separate forecasts. With such a spread, consider how continued reliance on commercial load growth could influence future earnings power and market perception.

Explore 3 other fair value estimates on American Electric Power Company - why the stock might be worth as much as 7% more than the current price!

Build Your Own American Electric Power Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Electric Power Company's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives