- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

A Look at American Electric Power’s Valuation Following New Grid Partnership with Quanta Services

Reviewed by Simply Wall St

American Electric Power (AEP) just unveiled long-term strategic agreements with Quanta Services in an effort to support its ambitious $72 billion capital plan. The partnership is intended to improve high-voltage transmission and enhance domestic manufacturing for critical grid equipment.

See our latest analysis for American Electric Power Company.

The news comes as American Electric Power Company rides clear momentum, with a 32% share price return so far in 2025 and a standout 29% total shareholder return over the last year. Recent strategic collaborations and capital-raising measures have fed optimism. Its long-term performance remains robust, underpinned by consistent earnings growth and ambitious infrastructure investment plans.

If you’re curious about what other companies are capturing investor interest right now, this could be the perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

But after such a strong run, is American Electric Power still trading at an appealing value, or has the market already accounted for its growth ambitions and near-term momentum? Is there a genuine buying opportunity here, or is future upside already priced in?

Most Popular Narrative: 4.6% Undervalued

At $121.43, American Electric Power Company trades slightly below the most widely followed narrative’s fair value target of $127.32. Context around this modest undervaluation? It hinges on expectations for future revenue and earnings strength, not just recent price run-ups.

The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution, indicating future growth in earnings.

What is really driving this bullish outlook? There is a multi-billion dollar expansion blueprint at the heart of this valuation, built on accelerating demand and major strategic investments. Wondering which bold financial assumptions power that price target? Dive in to uncover the key projections behind the fair value math.

Result: Fair Value of $127.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainties and rising capital requirements could present challenges for American Electric Power’s growth story and may affect future earnings projections.

Find out about the key risks to this American Electric Power Company narrative.

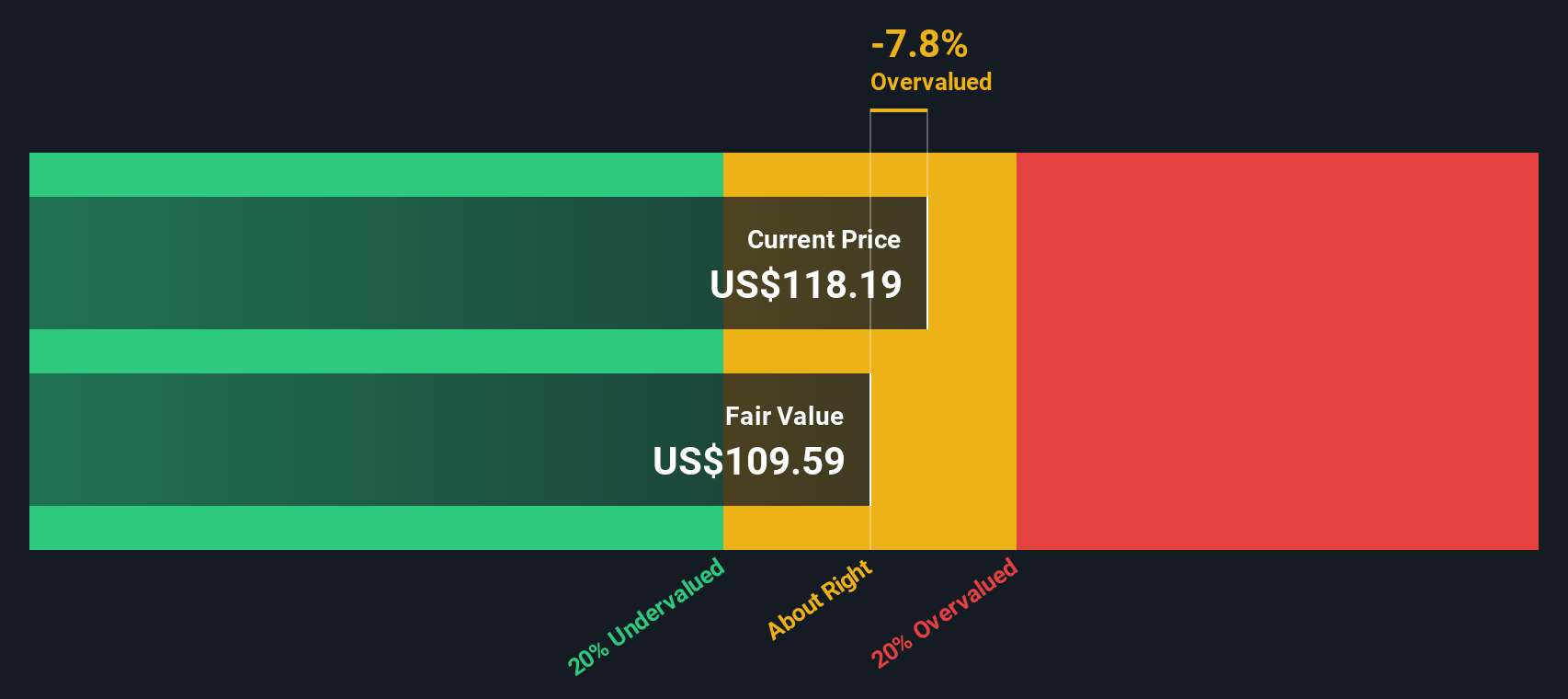

Another View: DCF Model Tells a Different Story

Looking at valuation from another angle, our SWS DCF model arrives at a lower fair value for American Electric Power Company: $106.33 per share, compared to both the analyst target and current market price. This suggests the market might be pricing in more optimism than fundamentals currently justify. Could the real value be hiding behind future growth assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you see things differently or want to take control of your own analysis, you can quickly generate your own perspective in just a few minutes: Do it your way

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop here when even more promising opportunities could be within reach? Use the Simply Wall Street Screener to take control of your investment journey today.

- Uncover high-yield opportunities and boost your portfolio income with these 16 dividend stocks with yields > 3% offering attractive returns above 3%.

- Get ahead of the tech curve by spotting potential game-changers in artificial intelligence through these 25 AI penny stocks as they power tomorrow’s innovation.

- Capitalize on groundbreaking applications and future trends by targeting these 28 quantum computing stocks to shape advanced computing and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives