- United States

- /

- Airlines

- /

- NYSE:SRFM

Surf Air Mobility (SRFM): Valuation in Focus After $100M Strategic Funding and Stronger Q3 Revenue Guidance

Reviewed by Simply Wall St

Surf Air Mobility (NYSE:SRFM) just announced a $100 million strategic transaction, which features new equity and debt refinancing. This move aims to accelerate development of SurfOS and push Q3 revenue above previous guidance, sparking fresh investor attention.

See our latest analysis for Surf Air Mobility.

This fresh capital injection and upbeat Q3 revenue outlook follow a string of recent milestones for Surf Air Mobility, including the completion of a follow-on equity offering and upcoming earnings release. Despite these positive signals, the company’s one-month share price return sits at -40.74% and it remains down 48.56% year-to-date. However, its one-year total shareholder return of 66.12% shows some investors are keeping faith for the longer haul. Momentum has been volatile, but catalysts for renewed interest are clearly building.

If you're looking for fresh ideas beyond Surf Air Mobility's story, it might be the perfect moment to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst targets despite improving fundamentals, investors are left to wonder if the current price is a bargain entry or if the market is already factoring in the company’s future growth.

Most Popular Narrative: 61% Undervalued

With Surf Air Mobility’s widely followed narrative assigning a much higher fair value than the current $3.04 share price, the upside potential becomes hard to ignore. Enthusiasm is building, especially as the stock lags analyst expectations.

The accelerating demand for regional, point-to-point air mobility as urban congestion worsens is expected to increase the addressable market for Surf Air Mobility, especially as it expands scheduled service on new routes and accepts new aircraft deliveries in 2026. This supports future revenue growth. Widespread digitization and adoption of app-driven travel is enabling Surf Air Mobility's software-first approach. This includes the commercial rollout of the SurfOS platform (powered by Palantir) in 2026, bringing new high-margin recurring revenue streams and improved customer acquisition efficiency, supporting both revenue and net margin expansion.

Curious which bold assumptions set this price target so high? The narrative banks on remarkable growth rates and margin expansions most airlines never see. Ready to discover the unexpected drivers pushing this ambitious valuation even further? Click to unravel the full quantitative story.

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in SurfOS commercialization or loss of key government contracts could quickly undermine this bullish scenario and put the growth narrative at risk.

Find out about the key risks to this Surf Air Mobility narrative.

Another View: Is the Price Justified?

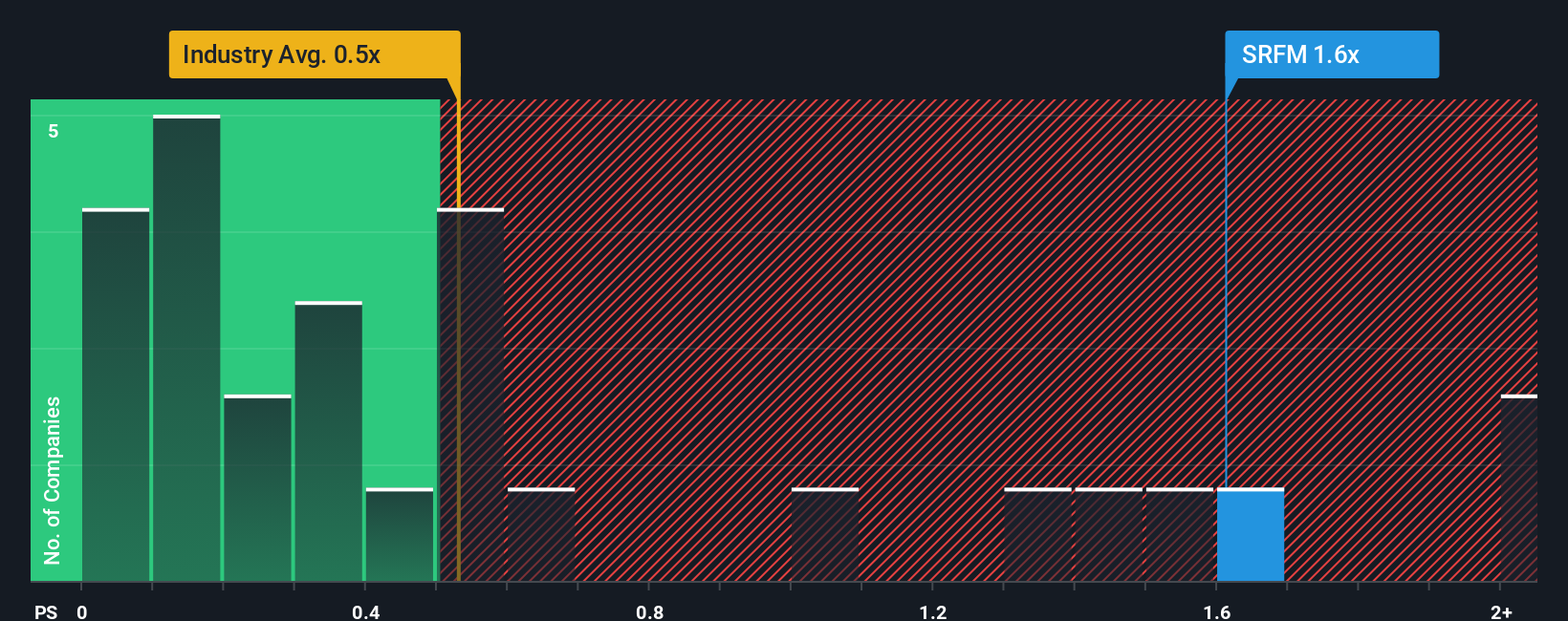

Looking at Surf Air Mobility through the lens of its price-to-sales ratio, the story shifts. The company trades at 1.5x sales, which is much higher than the global airline industry average of 0.6x and above its own fair ratio of 0.8x. That premium suggests investors expect much faster growth or turnarounds than the market typically rewards.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Surf Air Mobility Narrative

Not convinced by the current analysis or keen to dig into the numbers yourself? You can craft your own Surf Air Mobility narrative in under three minutes, all on your terms. Do it your way

A great starting point for your Surf Air Mobility research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your portfolio with stocks that offer potential upside in trending sectors and catch the next wave before the crowd.

- Tap into big yields by checking out these 15 dividend stocks with yields > 3% with a history of delivering strong income even as markets shift.

- Uncover the future of healthcare by screening these 32 healthcare AI stocks at the intersection of AI innovation and medical breakthroughs.

- Capitalize on tech's next leap when you scan these 27 quantum computing stocks powering tomorrow’s breakthrough computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRFM

Surf Air Mobility

Engages in the air mobility business in the United States and internationally.

Slight risk with limited growth.

Market Insights

Community Narratives