- United States

- /

- Airlines

- /

- NYSE:SRFM

Surf Air Mobility (SRFM) Raises Fresh Capital—What Does It Mean for Growth and Dilution Risk?

Reviewed by Sasha Jovanovic

- Surf Air Mobility Inc. recently completed a follow-on equity offering comprising both common stock and warrants through a registered direct offering.

- This move suggests the company is seeking additional capital that could support its expansion ambitions or bolster its financial flexibility.

- We will explore how this latest capital-raising effort could impact Surf Air Mobility’s long-term growth outlook and shareholder dilution risk.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Surf Air Mobility Investment Narrative Recap

To own Surf Air Mobility, an investor needs conviction in the company’s ability to capitalize on the growing demand for regional air mobility and its push toward electrified aircraft. The recent follow-on equity offering provides fresh capital but could put more pressure on the key short-term risk, shareholder dilution, while not materially altering the near-term catalyst tied to software commercialization or operational progress.

Among recent developments, the June launch of the SurfOS AI-enabled operating system stands out, as it directly supports Surf Air Mobility's software-first vision. This milestone is timely, given the company’s need for new revenue streams to offset both ongoing losses and the dilution arising from the latest capital raise.

By contrast, investors should be aware that persistent capital raises could reduce long-term value for existing shareholders if...

Read the full narrative on Surf Air Mobility (it's free!)

Surf Air Mobility's projections target $258.5 million in revenue and $17.6 million in earnings by 2028. This outlook assumes 34.0% annual revenue growth and an increase in earnings of $75.0 million from the current earnings of -$57.4 million.

Uncover how Surf Air Mobility's forecasts yield a $7.88 fair value, a 151% upside to its current price.

Exploring Other Perspectives

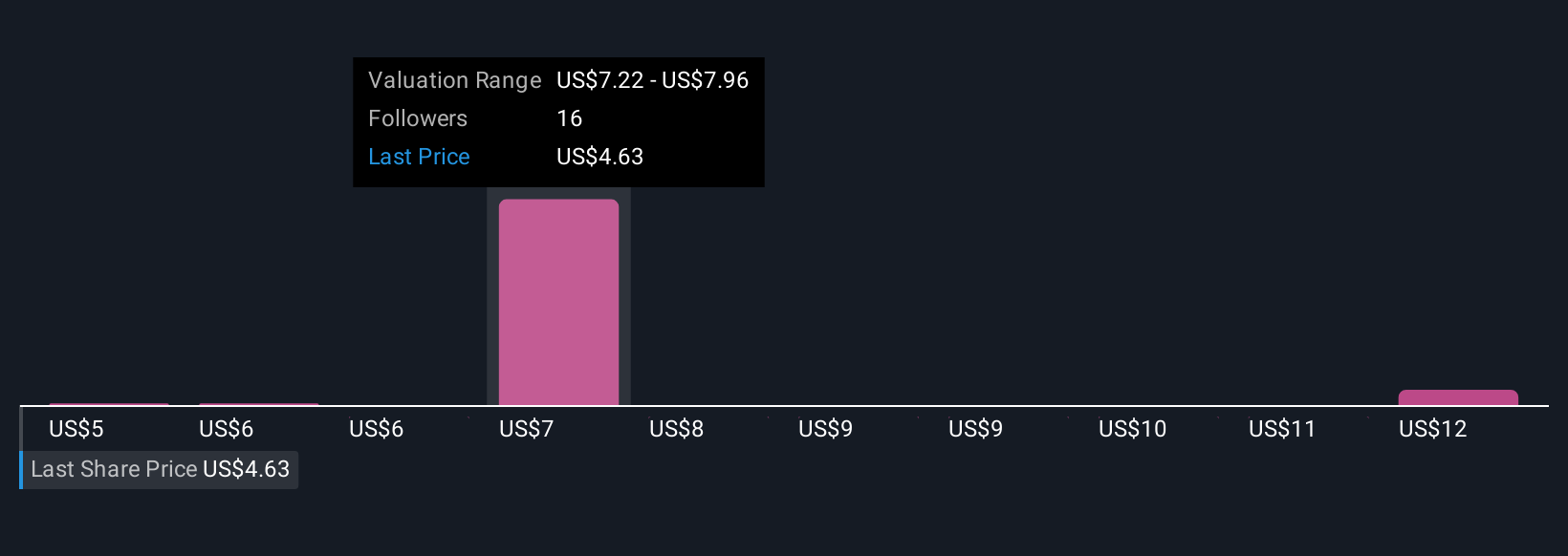

Seven individual assessments from the Simply Wall St Community estimate Surf Air Mobility’s fair value between US$5.00 and US$12.39 per share. With ongoing shareholder dilution risks highlighted by the latest offering, you can see how views across the market can be wide ranging, consider reviewing multiple perspectives before forming your own outlook.

Explore 7 other fair value estimates on Surf Air Mobility - why the stock might be worth over 3x more than the current price!

Build Your Own Surf Air Mobility Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surf Air Mobility research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Surf Air Mobility research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surf Air Mobility's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRFM

Surf Air Mobility

Engages in the air mobility business in the United States and internationally.

Slight risk with limited growth.

Market Insights

Community Narratives