- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

Did Power Generation-Driven Growth Just Redefine Kirby's (KEX) Investment Case?

Reviewed by Sasha Jovanovic

- In October 2025, Kirby Corporation announced third quarter results showing increased revenue of US$871.16 million and net income of US$92.5 million, alongside updated progress on its multi-year share repurchase program.

- Management emphasized strong power generation performance as the key driver of growth, highlighting robust demand linked to data center and AI infrastructure investment.

- We'll examine how power generation’s emergence as Kirby's growth engine could shape the company’s broader investment outlook moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kirby Investment Narrative Recap

Kirby’s investment case increasingly centers on whether the surge in power generation demand, especially for data center and AI infrastructure, can drive consistent revenue growth despite ongoing softness in the inland marine segment. The recent third-quarter results reinforce this narrative, spotlighting power generation as the primary near-term catalyst, while lingering risks tied to chemical shipping and US market concentration still warrant attention; so far, the quarterly update does not materially shift these risk-reward dynamics.

Kirby’s ongoing multi-year share repurchase program stands out in the recent news cycle, with 3.11% of shares bought back for US$156 million this quarter alone. This capital return initiative supports near-term shareholder value, yet its sustainability remains closely linked to steady cash flow, largely dependent on the same power generation and infrastructure trends driving the company’s latest growth story.

But while optimism is rising around Kirby’s power generation exposure, investors should not underestimate the potential impact if inland marine weakness persists and...

Read the full narrative on Kirby (it's free!)

Kirby's narrative projects $3.9 billion revenue and $445.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a $142.6 million earnings increase from $303.0 million.

Uncover how Kirby's forecasts yield a $116.17 fair value, a 8% upside to its current price.

Exploring Other Perspectives

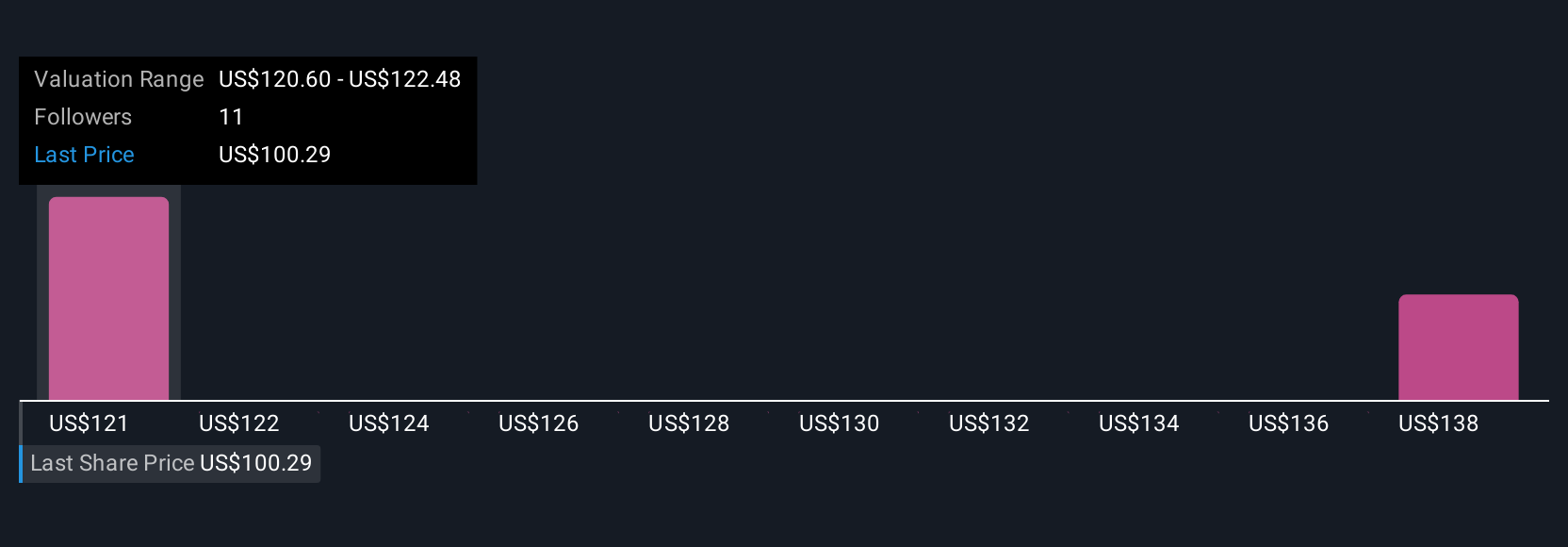

Simply Wall St Community contributors estimate fair value for Kirby between US$89.20 and US$116.17, based on 2 individual models. As enthusiasm around AI-driven power generation builds, some remain cautious about cyclical risks in chemicals and marine transport, prompting a wide range of expectations for future performance.

Explore 2 other fair value estimates on Kirby - why the stock might be worth 17% less than the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

No Opportunity In Kirby?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives