- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

A Fresh Look at Kirby (KEX) Valuation Following Its Recent Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for Kirby.

Kirby's recent surge has captured investor attention, with the share price jumping nearly 20% in the past month and now trading at $100.99. While this short-term momentum is impressive, it is set against a more challenging backdrop: the 1-year total shareholder return sits at -12.63%, hinting that long-term holders have faced tougher conditions despite the current bounce. Momentum appears to be building again as market sentiment shifts, potentially reflecting renewed optimism about Kirby's growth outlook.

If Kirby’s strong rally has you thinking about what else could be on the move, consider discovering opportunities among fast growing stocks with high insider ownership.

With recent gains and a rebound in sentiment, the key question is whether Kirby’s latest rally still leaves room for upside or if investors are already factoring in all of the company’s future growth potential.

Most Popular Narrative: 13% Undervalued

Kirby’s current trading price of $100.99 is below the most followed narrative’s fair value estimate of $116.17. This reflects notable upside still projected by analysts for long-term investors. The following perspective offers a look into the factors driving this narrative’s bullish stance.

Supply constraints and industry-wide aging of the barge fleet are restraining new capacity growth. This is positioning Kirby to benefit from limited vessel availability, capacity consolidation, and rising charter rates over time, which should support steady revenue growth and expanding net margins.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $116.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softness in chemical markets and mounting inflationary pressures could act as headwinds. These factors may potentially challenge Kirby's current growth trajectory.

Find out about the key risks to this Kirby narrative.

Another View: What Do Market Ratios Say?

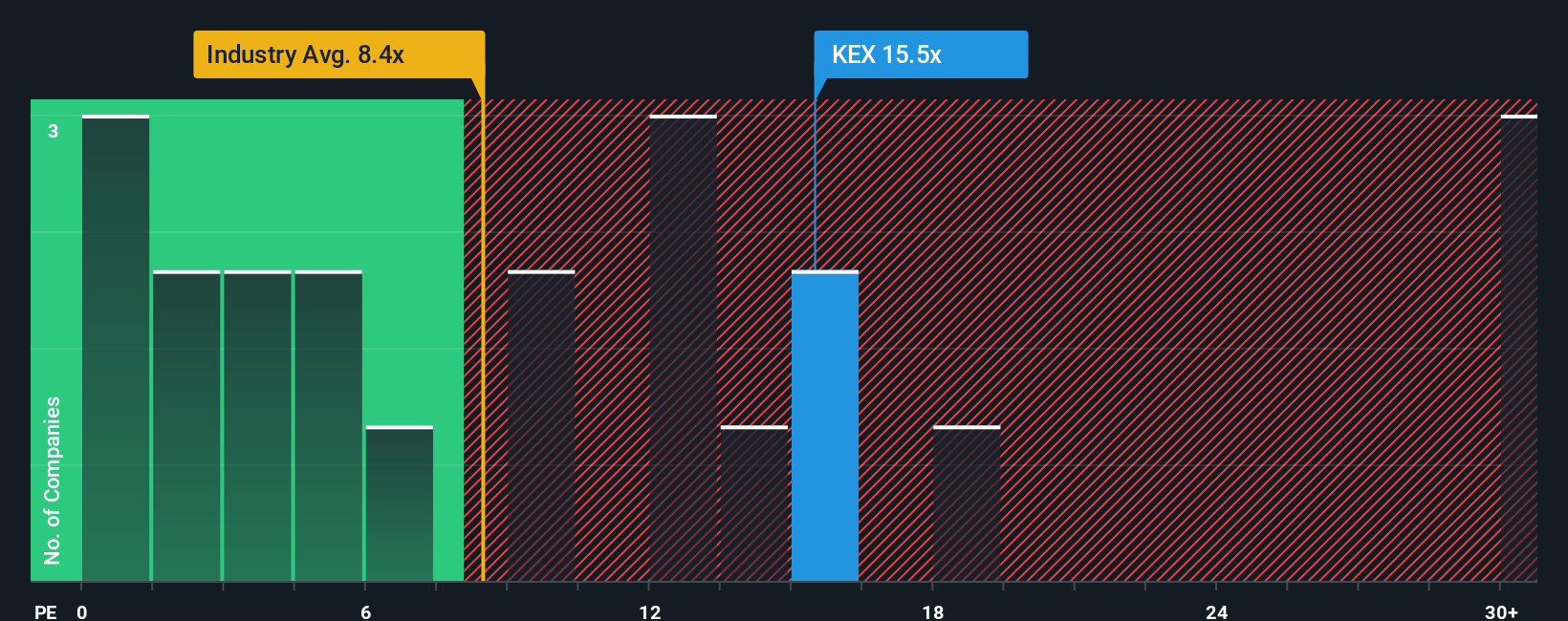

While analyst targets see room for upside, Kirby’s current market ratio tells a different story. Its price-to-earnings ratio sits at 18.6x, which is much higher than both the US Shipping industry average of 7.2x and its peer average of 7.9x. Even compared to a fair ratio of 12.1x, the current multiple looks steep, which may signal valuation risk if growth expectations stall. Does this premium reflect future strength or added risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you have a different view or prefer drawing your own conclusions from the data, you can craft your own Kirby narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kirby.

Looking for more investment ideas?

Don't let your next winning stock pass you by. Take control of your strategy and target trends that could power your portfolio’s growth with these handpicked collections.

- Unlock potential returns by scanning these 848 undervalued stocks based on cash flows with strong cash flows that remain overlooked by much of the market.

- Get positioned early by tapping into these 26 AI penny stocks where artificial intelligence is transforming entire industries with breakthrough innovation.

- Take charge of your income strategy with these 21 dividend stocks with yields > 3% that consistently deliver yields over 3%, helping you compound wealth with confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives