- United States

- /

- Airlines

- /

- NasdaqGS:SKYW

Does SkyWest's (SKYW) Buybacks and Upbeat Results Signal a Lasting Shift in Analyst Confidence?

Reviewed by Sasha Jovanovic

- SkyWest, Inc. recently reported its third quarter 2025 results, posting revenue of US$1,050.03 million and net income of US$116.36 million, both up from the prior year, and completed a share buyback totaling 5,407,557 shares under its existing program.

- The company’s strong operational performance and ongoing share repurchases have been accompanied by a wave of analyst upgrades and upward earnings revisions, reflecting increased confidence in SkyWest’s earnings outlook.

- We’ll examine how these upbeat analyst upgrades and consistent earnings estimate revisions could influence SkyWest’s broader investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

SkyWest Investment Narrative Recap

To own SkyWest, investors need to believe in the durability of strong demand for regional air service and the company’s capacity to manage rising labor and regulatory costs. The latest quarterly results, featuring rising revenue and net income alongside upbeat analyst revisions, may support sentiment around earnings momentum, but do little to ease concerns about the ongoing pilot shortage, which remains the most pressing short-term risk.

Among recent company updates, SkyWest’s completed share buyback program stands out as particularly relevant, as it underscores management’s commitment to returning value to shareholders during a period of expanding earnings. While this capital return is encouraging, its effect on core operating risks, most notably, the pressure from industry-wide pilot shortages, remains limited in scope.

However, investors should also be aware that persistent pilot shortages could still threaten…

Read the full narrative on SkyWest (it's free!)

SkyWest's narrative projects $4.5 billion revenue and $456.5 million earnings by 2028. This requires 5.7% yearly revenue growth and a $48.6 million earnings increase from $407.9 million.

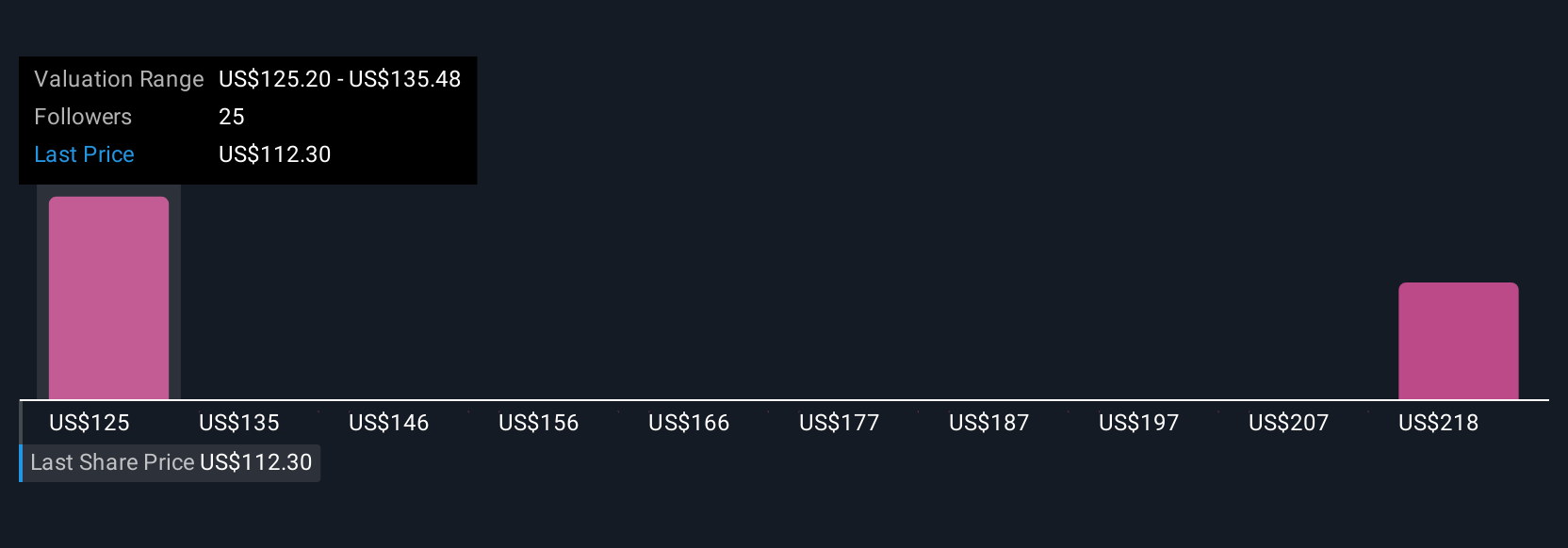

Uncover how SkyWest's forecasts yield a $131.80 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Three private investors in the Simply Wall St Community estimate SkyWest’s fair value spread between US$131.80 and US$217.34. While earnings growth has been robust, the acute pilot shortage remains a key consideration shaping future performance.

Explore 3 other fair value estimates on SkyWest - why the stock might be worth over 2x more than the current price!

Build Your Own SkyWest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWest research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SkyWest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWest's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKYW

SkyWest

Through its subsidiaries, engages in the operation of a regional airline in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives