- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

A Look at Hertz (HTZ) Valuation Following Q3 Profit Turnaround and Operational Milestones

Reviewed by Simply Wall St

Hertz Global Holdings (HTZ) delivered a financial comeback in its third-quarter results, swinging back to net income after running losses for several periods. This shift was powered by disciplined fleet management, tighter cost controls, and a revamped car sales strategy.

See our latest analysis for Hertz Global Holdings.

Hertz’s share price has been on a tear, with a 1-year total shareholder return of 108.9% and a year-to-date price return of 76.4%. This reflects renewed investor confidence after its sharp financial turnaround. The momentum is clear as the recent string of operational milestones, strong quarterly results, and improved customer metrics have powered the stock well above its summer lows and suggest potential for further gains as the recovery story unfolds.

If Hertz’s rebound caught your attention, now is the perfect moment to broaden your search and discover See the full list for free.

This stellar rebound raises the question: are Hertz shares still undervalued at current levels, or has the recent rally already priced in the company’s renewed growth prospects, leaving little room for further upside?

Most Popular Narrative: 49.8% Overvalued

With Hertz Global Holdings' widely followed narrative fair value set at $4.39, the latest close of $6.58 positions shares substantially above this estimate. This gap highlights differing views about how transformative Hertz's recovery truly is.

The company's transformation includes digital partnerships (e.g., with Cox Automotive and Amadeus) to modernize both vehicle sales channels and revenue management, providing opportunities to boost utilization, optimize pricing, and increase total revenue per available car for the long term.

Is Hertz really poised to outpace the old rental car model? The most popular narrative relies on bold projections about digital disruptions, rapid operational shifts, and revenue reinvention. Find out which surprising business levers and future financial estimates are behind this curious consensus value; they might challenge your expectations.

Result: Fair Value of $4.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational improvements such as a younger fleet and digital upgrades could boost future profits. These factors have the potential to challenge current bearish valuations if trends persist.

Find out about the key risks to this Hertz Global Holdings narrative.

Another View: Multiples Paint a Contrasting Picture

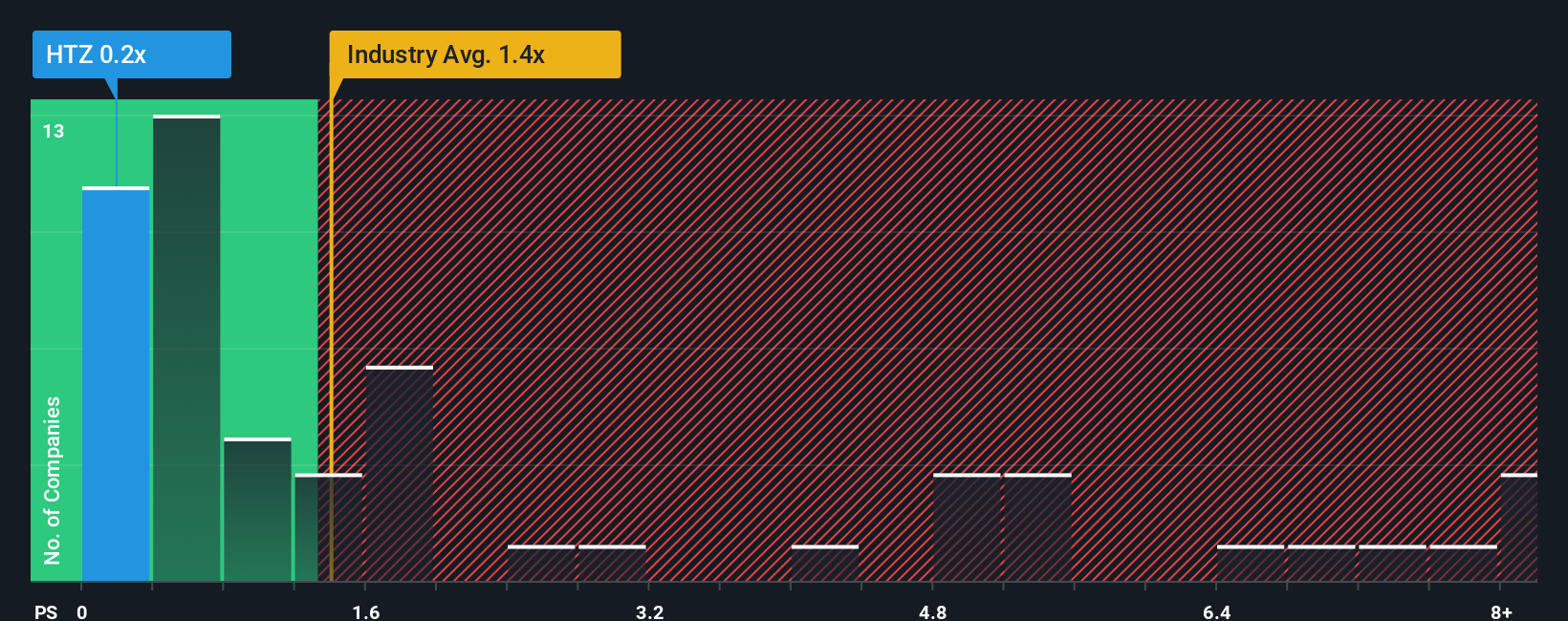

Metrics like the price-to-sales ratio suggest Hertz might be undervalued, trading at just 0.2x compared to an average of 1.2x for the US Transportation industry and a fair ratio of 0.5x. Such a gap highlights both potential opportunity and valuation risk. Could the market be missing Hertz's rebound, or are challenges being underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hertz Global Holdings Narrative

If you see the numbers differently or want to draw your own conclusions, it takes just a few minutes to craft your personal outlook. Do it your way.

A great starting point for your Hertz Global Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let remarkable opportunities pass you by. Use the Simply Wall Street Screener to capitalize on emerging trends and strengthen your investment portfolio with standout stocks.

- Capture the growth potential of tomorrow’s innovations by reviewing these 28 quantum computing stocks. These companies are making strides in computing and real-world applications.

- Target regular income and stability with these 16 dividend stocks with yields > 3%, which offers attractive yields above 3% while maintaining strong financials.

- Seize the upswing in intelligent tech by analyzing these 25 AI penny stocks, a group powering breakthroughs in automation and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives