- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Is Grab a Bargain After Recent Southeast Asia Expansion and 34.7% Rally?

Reviewed by Bailey Pemberton

- Wondering if Grab Holdings is a good value right now? You are not alone, and the numbers might surprise you.

- The stock has soared 99.3% over the past three years and is up 34.7% in the past year. However, it did dip 2.8% in the last week.

- Recent partnerships and strategic expansions, such as Grab’s moves into new payment services and ride-hailing launches in Southeast Asia, have fueled optimism and driven notable price shifts. Ongoing developments keep investors and industry watchers tuned in to what’s next for Grab.

- On valuation, Grab Holdings scores just 2 out of 6 on our undervaluation checks. Raw numbers can only tell you so much. Next, we will break down what those traditional valuation metrics reveal and why there is an even more insightful way to see the bigger picture by the article’s end.

Grab Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Grab Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation model projects a company's future cash flows and discounts them back to today's value, aiming to estimate what the business is intrinsically worth. For Grab Holdings, this involves looking ahead at how much cash the company could generate and assessing its current value accordingly.

Grab Holdings recently posted Free Cash Flow (FCF) of $141 million. Analyst estimates suggest a remarkable climb in upcoming years, forecasting FCF to reach $886 million by 2027. Going even further, Simply Wall St extrapolates these growth trends and projects the company could generate over $1.7 billion in FCF by 2035.

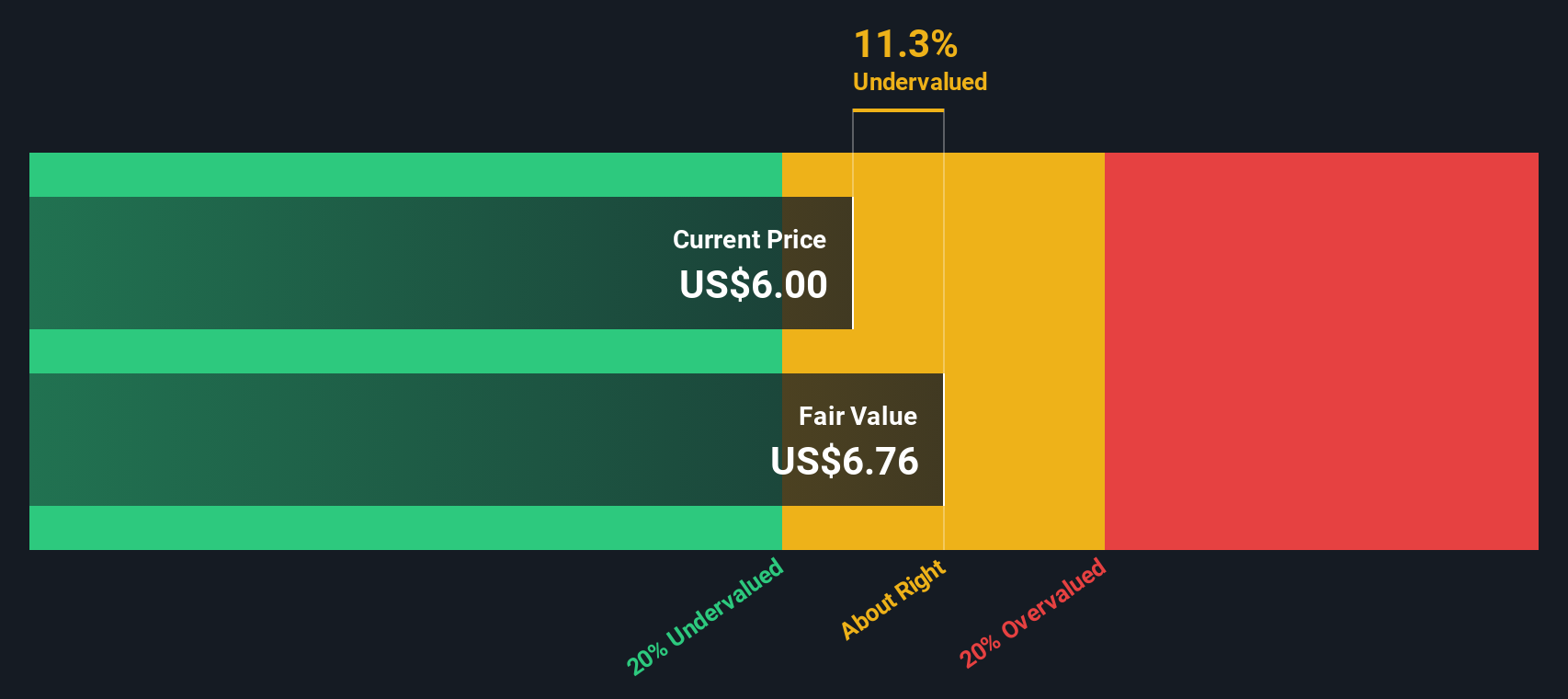

By factoring these future cash flows into its discounted cash flow model, the estimated fair value per share comes out to $6.92. Since this value is 14.8% above the current share price, the DCF indicates Grab Holdings stock may be undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Grab Holdings is undervalued by 14.8%. Track this in your watchlist or portfolio, or discover 869 more undervalued stocks based on cash flows.

Approach 2: Grab Holdings Price vs Sales

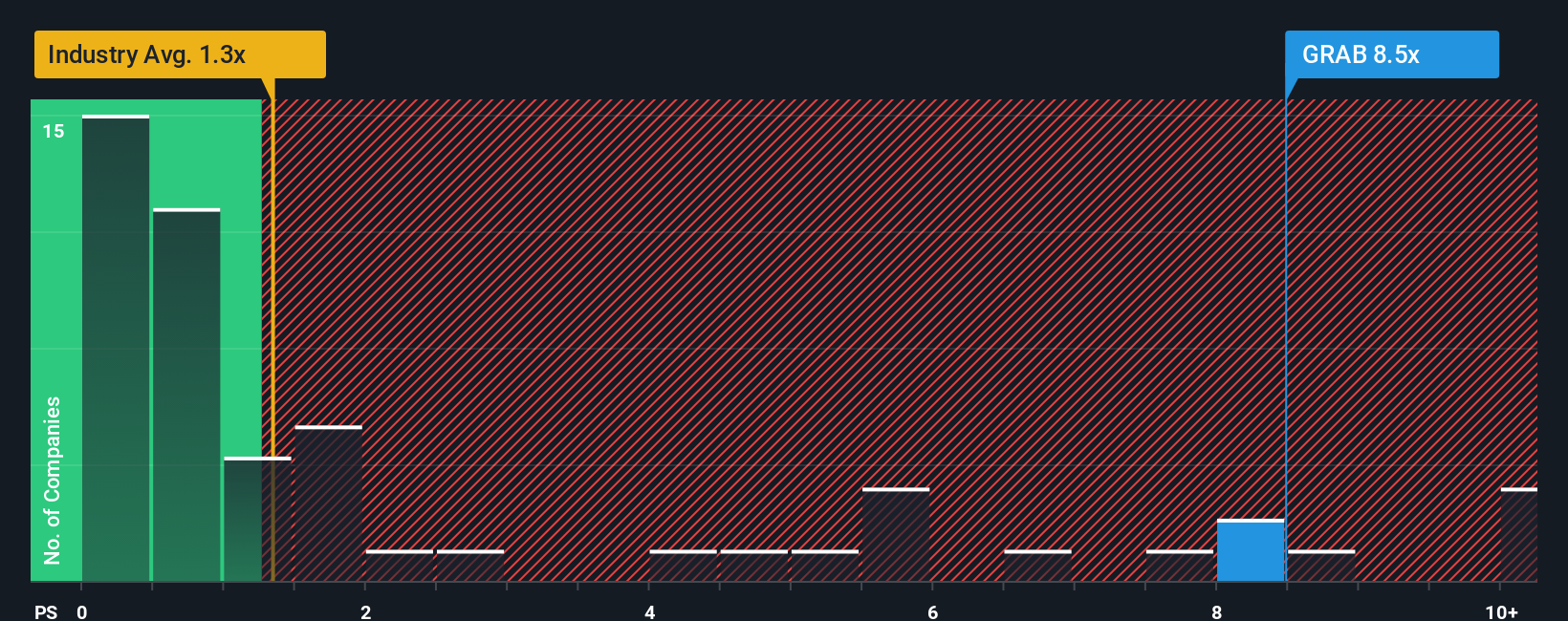

For technology and platform companies like Grab Holdings, the Price-to-Sales (P/S) ratio is a widely accepted valuation metric, especially when profitability is still emerging or earnings are volatile. The P/S ratio lets investors compare company value relative to its actual sales, making it useful for fast-growing businesses where profits might lag behind revenue expansion.

A “normal” or “fair” P/S ratio can shift quite a bit; higher growth expectations usually justify a higher multiple, while higher risks tend to pull the ratio lower. For Grab Holdings, the current P/S ratio is 7.47x, which is notably above the transportation industry average of 1.17x and the peer average of 1.68x. These comparisons signal that investors are pricing in significant growth and potential.

To add deeper context, Simply Wall St’s proprietary Fair Ratio blends factors like Grab’s expected growth rates, industry, profit margins, market cap, and risk profile into a tailored benchmark. For Grab, the calculated Fair Ratio is 3.56x. This approach is more insightful than a straight peer or industry comparison because it accounts for what actually drives value for this specific company, not just averages.

Weighing the Fair Ratio (3.56x) against Grab’s current P/S (7.47x), the stock trades at roughly double its fair value on this metric, which suggests that it is overvalued based on sales alone.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Grab Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story that connects a company’s real-world journey—its growth strategy, competition, risks, and ambitions—with financial forecasts and a fair value view. Unlike static spreadsheets, Narratives let investors bring their own perspective to the numbers, shaping assumptions about things like future revenue, profit margins, and valuation multiples. On the Simply Wall St platform, Narratives are accessible to everyone in the Community page, drawing on insights from millions of investors globally.

By mapping a company’s strategic story to its financial future, Narratives make it easy to decide when to buy or sell. You simply compare your Fair Value to the current price. As new information from news or earnings emerges, Narratives update automatically, making them a living, breathing view of what a stock is truly worth right now. For example, one investor might believe Grab Holdings can capture even more market share in Southeast Asia, forecasting a fair value as high as $8.20, while another, wary of competitive risks and thin margins, could estimate a fair value closer to $5.10.

In short, Narratives empower you to see beyond the numbers, personalize your investment analysis, and respond quickly as the story evolves.

Do you think there's more to the story for Grab Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives