- United States

- /

- Transportation

- /

- NasdaqGS:CAR

Will Overbooking Cases Challenge Avis Budget Group's (CAR) Brand Trust and Demand Outlook?

Reviewed by Sasha Jovanovic

- In a recent incident, a Michigan woman arrived to collect her reserved and prepaid vehicle from Budget Car Rental only to discover no cars were available, despite her confirmed booking.

- This situation draws attention to ongoing customer frustrations around reservation management, as overbooking practices risk undermining trust in rental car companies.

- We'll explore how renewed worries over operational reliability and demand outlook could influence Avis Budget Group's investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Avis Budget Group Investment Narrative Recap

To invest in Avis Budget Group today, you’d need to believe that the company can execute on premiumization and tech-driven efficiency, overcoming current demand softness and regaining customer trust. While the recent Michigan overbooking incident reinforces ongoing short-term concerns around operational reliability, a key risk, it does not appear material enough by itself to affect the most important growth catalyst, which remains Avis’s digital transformation and premium service expansion efforts.

The launch of Avis First, its new premium rental service, is especially relevant in this context. It aims to attract higher-value customers with enhanced experiences, but will need to succeed in raising service standards and address reservation issues for this catalyst to deliver meaningful upsides.

Yet, against this push for higher-margin offerings, investors should also be aware that continued operational missteps risk...

Read the full narrative on Avis Budget Group (it's free!)

Avis Budget Group's outlook forecasts $12.2 billion in revenue and $1.0 billion in earnings by 2028. This scenario is based on a 1.4% annual revenue growth rate and a $3.2 billion improvement in earnings from the current -$2.2 billion.

Uncover how Avis Budget Group's forecasts yield a $148.00 fair value, in line with its current price.

Exploring Other Perspectives

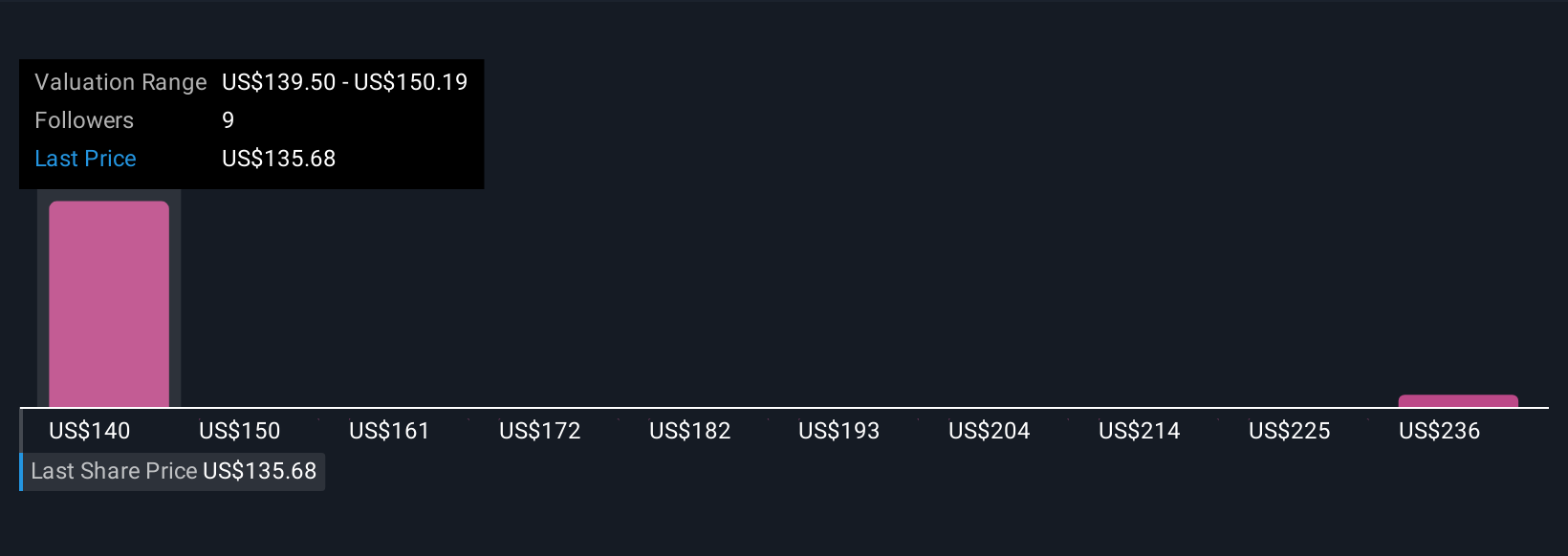

Two Simply Wall St Community fair value estimates span from US$148 to US$246.44. Against this backdrop, recent operational missteps highlight just how differently market participants may view near-term disruption versus longer-term opportunity.

Explore 2 other fair value estimates on Avis Budget Group - why the stock might be worth as much as 68% more than the current price!

Build Your Own Avis Budget Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avis Budget Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avis Budget Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives