- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL): Assessing Valuation After Recent 13% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for American Airlines Group.

While American Airlines Group’s 13% share price return over the past month is impressive, the bigger story is its continued recovery from a rocky start to the year. Long-term momentum, however, remains mixed. A 1-year total shareholder return of -3.5% and a 5-year figure of 12% remind investors that progress still comes in fits and starts.

If the market’s shifting sentiment around travel stocks has you reassessing your own strategy, this could be the perfect moment to discover See the full list for free.

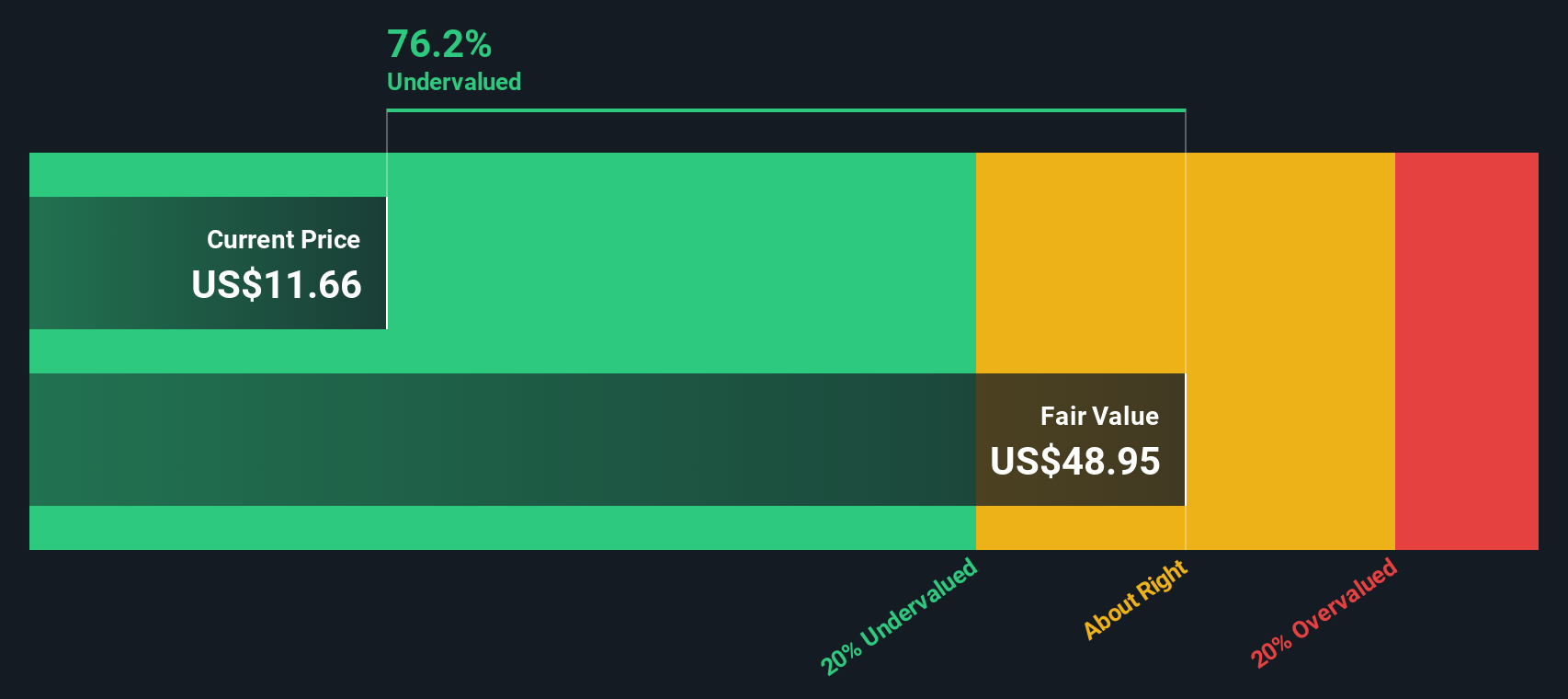

That leaves a critical question for investors today: Is American Airlines stock undervalued after its recent rebound, or has the market already priced in every bit of its potential recovery and future growth?

Most Popular Narrative: 23.9% Overvalued

According to PittTheYounger, the most-followed narrative sets a fair value for American Airlines at $10.61, noticeably below the stock’s recent close of $13.15. This signals that the current rally might be getting ahead of the company’s true potential, especially when weighed against fundamental financial concerns.

There’s a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity. Any startup would go belly-up with a balance sheet such as this one. Now, you can survive and even generate decent returns with a precarious capital structure, but of course you’re super-sensitive to any shock on the demand side of your business, hitting both revenues and margins. That is where the clouds gather on American.

Curious about why this valuation feels so harsh? The narrative’s conclusion pivots on bold assumptions around profit margins and future market dynamics, yet leaves some numbers just out of reach. The real twist is how one specific financial metric makes or breaks the case for American’s long-term upside. Ready to uncover exactly which lever, if pulled, could change the story for good?

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if refinancing conditions improve or if American successfully boosts yields with its Premium Economy strategy, the narrative could quickly shift in their favor.

Find out about the key risks to this American Airlines Group narrative.

Another View: Discounted Cash Flow Model Points to Undervaluation

Looking at American Airlines through the lens of our DCF model, the story shifts. This method estimates a fair value of $23.15 per share, which is significantly higher than the current price of $13.15. According to this approach, the market might be underestimating the company’s long-term potential.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Airlines Group Narrative

If you think there’s another side to this story or want to dig into the details yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next investing breakthrough slip away. See what else is out there by checking these handpicked opportunities tailored to different strategies and goals:

- Fuel your portfolio with passive income and steady returns by targeting these 17 dividend stocks with yields > 3%, which offers yields over 3%.

- Tap into the future of medicine by analyzing these 32 healthcare AI stocks, which is pushing boundaries with artificial intelligence in healthcare.

- Capitalize on potential bargains by tracking these 864 undervalued stocks based on cash flows, which is poised for a breakout based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives