- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

Gogo (GOGO): Exploring Valuation Gaps After Recent Share Price Slide

Reviewed by Simply Wall St

Gogo (GOGO) has been trading lower recently, after a stretch of challenges that have weighed on its stock. Investors are starting to reassess the company's outlook in light of these developments, looking for signs of a potential turnaround or continued volatility.

See our latest analysis for Gogo.

After falling sharply over the past quarter, Gogo’s share price has now lost 40.81% in the last 90 days alone, reflecting a shift in sentiment as investors show caution around the company’s evolving prospects. While the 1-year total shareholder return is down 7.09%, longer-term holders have also felt the pinch, with a 3-year total return of -48.92%. Momentum is clearly fading, and the market is waiting for fresh signals before regaining confidence in the stock’s growth story or valuation potential.

If you’re watching the shifts in Gogo and thinking about what else might be gaining momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Gogo’s share price well below analyst targets, but the company still facing headwinds, some investors are asking whether the stock now trades at a true discount or if the market has already factored in all its future potential.

Most Popular Narrative: 51% Undervalued

Gogo’s current share price sits far below the most widely followed narrative’s fair value estimate. This creates a striking gap between recent market caution and analysts’ confidence in the company’s long-term trajectory.

The combination of Gogo's multi-bearer, multi-band, and multi-orbit technologies is expected to extend customer lifetimes and increase recurring revenue from easily upgradable systems. This could improve overall earnings stability and reduce churn.

Curious how this seemingly bold valuation is built? The narrative’s math leans on some ambitious shifts in future earnings and margin expansion, all powered by untapped market potential. If you want to uncover which growth drivers and profit upgrades define this price target, the full breakdown might surprise you.

Result: Fair Value of $15.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks such as potential delays in new technology rollouts or intensified competition could quickly challenge the current bullish outlook for Gogo.

Find out about the key risks to this Gogo narrative.

Another View: Market Ratios Paint a Different Picture

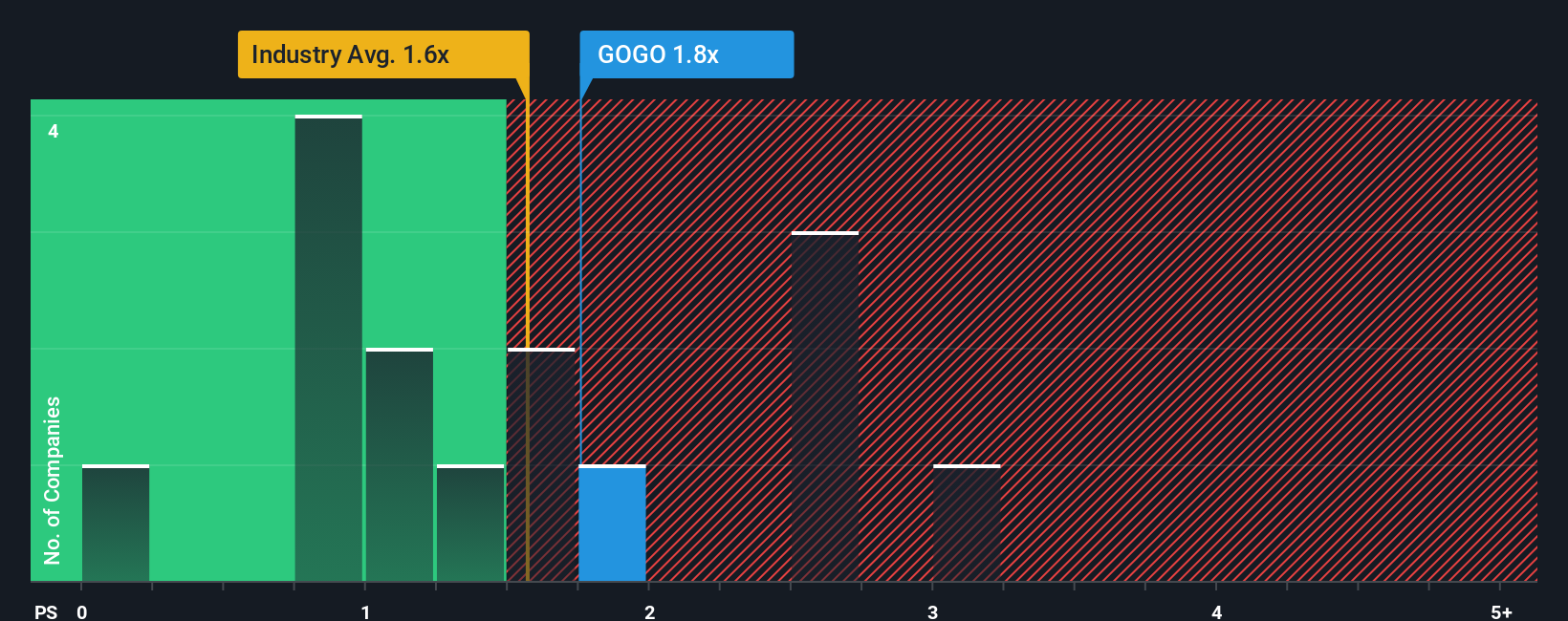

Looking at Gogo’s price-to-sales ratio of 1.2x, the stock appears more affordable than the global industry average of 1.6x and its peer group’s 1.7x. However, this is still above its own fair ratio of 1x, which suggests some valuation risk remains if the market corrects toward that benchmark. Does this multiples-based review challenge or support the optimism of the analyst target?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gogo Narrative

If you’re skeptical of headline valuations or simply want to explore the numbers for yourself, it’s easy to craft your own perspective in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gogo.

Looking for More Investment Ideas?

Your next winning stock could be just a click away with Simply Wall Street’s powerful Screener. Don’t wait while others get ahead; seize these unique investing opportunities now.

- Snap up potential bargains as you size up these 865 undervalued stocks based on cash flows poised for a turnaround based on healthy underlying cash flows.

- Accelerate your search for passive income by checking out these 16 dividend stocks with yields > 3% showing impressive yields and strong fundamentals.

- Get ahead of the curve with these 24 AI penny stocks powering innovation at the cutting edge of artificial intelligence applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives