- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

Could Gogo’s (GOGO) 5G Test Progress Hint at a New Era of Competitive Advantage?

Reviewed by Sasha Jovanovic

- Gogo has begun in-flight testing of its next-generation 5G air-to-ground connectivity network for North American customers, marking a significant step toward commercial rollout before the end of 2025 and following validation of key hardware and software.

- An interesting detail is that 400 aircraft have already been pre-provisioned for the new 5G service, up from 300 in the last three months, highlighting growing client anticipation ahead of full activation and expected service-driven revenue in early 2026.

- We’ll now examine how the start of Gogo’s 5G flight testing shapes the company’s long-term potential for revenue growth and competitiveness.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Gogo Investment Narrative Recap

For me, the core premise behind holding Gogo stock rests on the continued adoption of advanced inflight connectivity, especially as only a fraction of global business jets are currently connected. The start of 5G flight testing supports the company’s most critical near-term catalyst (a successful rollout and first revenue in 2026), while also reducing technical execution risk. With the testing campaign underway, I don’t see a material change in the main short-term risks, such as potential delays in regulatory approvals or capital expenditure pressures.

Of the latest announcements, Gogo’s five-year multi-band satellite contract with a US government agency stands out. This agreement not only consolidates significant MilGov demand under one roof, but also reinforces Gogo’s pitch that it can deliver consistent, high-bandwidth connectivity across government and business use cases. It may help offset competitive threats and provide a recurring revenue model as Gogo pushes toward commercial 5G service activation.

However, investors should also be alert to the fact that, in contrast, regulatory approval delays or slips in the 5G activation timeline...

Read the full narrative on Gogo (it's free!)

Gogo's narrative projects $1.1 billion in revenue and $160.2 million in earnings by 2028. This requires 17.0% yearly revenue growth and a $152.9 million increase in earnings from the current $7.3 million.

Uncover how Gogo's forecasts yield a $15.50 fair value, a 77% upside to its current price.

Exploring Other Perspectives

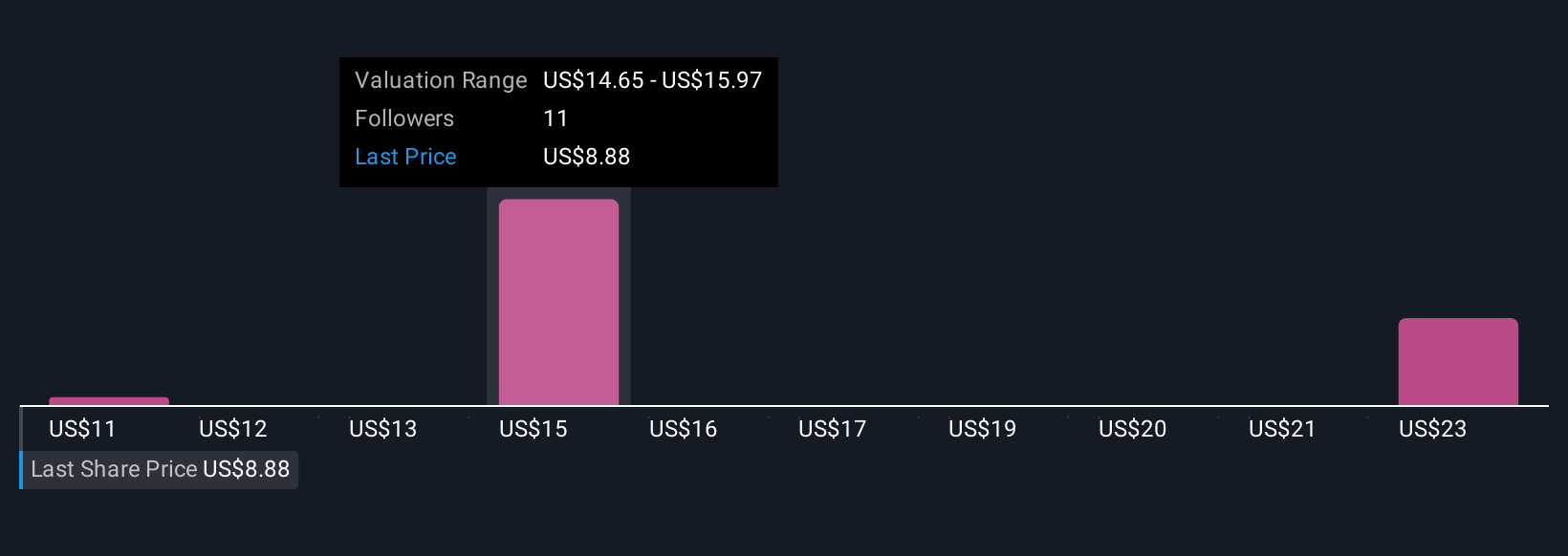

Simply Wall St Community members estimate Gogo’s fair value between US$10.69 and US$23.88, based on 3 distinct forecasts. While the 5G rollout is a major catalyst, execution delays could impact how soon the market reflects these differing viewpoints.

Explore 3 other fair value estimates on Gogo - why the stock might be worth over 2x more than the current price!

Build Your Own Gogo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gogo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gogo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gogo's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives