ENMP.Y Stock Overview

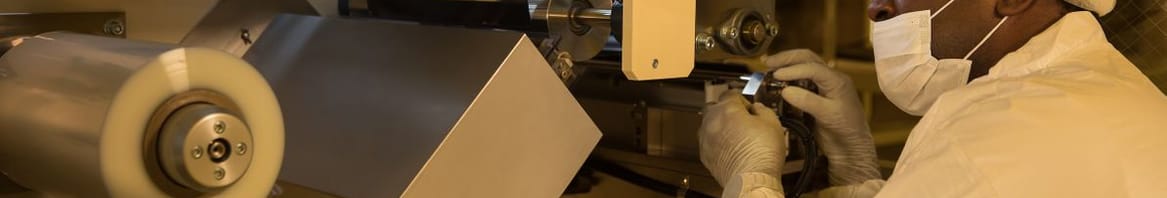

Manufactures and sells ultrathin energy storage solutions for wearable devices, connected sensors, and other applications.

| Snowflake Score | |

|---|---|

| Valuation | 0/6 |

| Future Growth | 0/6 |

| Past Performance | 0/6 |

| Financial Health | 2/6 |

| Dividends | 0/6 |

Ensurge Micropower ASA Competitors

Price History & Performance

| Historical stock prices | |

|---|---|

| Current Share Price | kr0.85 |

| 52 Week High | kr2.30 |

| 52 Week Low | kr0.15 |

| Beta | 1.93 |

| 1 Month Change | -5.56% |

| 3 Month Change | -15.00% |

| 1 Year Change | 125.76% |

| 3 Year Change | -95.14% |

| 5 Year Change | -98.70% |

| Change since IPO | -99.97% |

Recent News & Updates

Recent updates

Shareholder Returns

| ENMP.Y | US Tech | US Market | |

|---|---|---|---|

| 7D | -5.6% | 2.2% | 1.7% |

| 1Y | 125.8% | 13.9% | 26.0% |

Return vs Industry: ENMP.Y exceeded the US Tech industry which returned 10.9% over the past year.

Return vs Market: ENMP.Y exceeded the US Market which returned 26.1% over the past year.

Price Volatility

| ENMP.Y volatility | |

|---|---|

| ENMP.Y Average Weekly Movement | n/a |

| Tech Industry Average Movement | 6.5% |

| Market Average Movement | 5.9% |

| 10% most volatile stocks in US Market | 16.1% |

| 10% least volatile stocks in US Market | 2.8% |

Stable Share Price: ENMP.Y's share price has been volatile over the past 3 months.

Volatility Over Time: Insufficient data to determine ENMP.Y's volatility change over the past year.

About the Company

| Founded | Employees | CEO | Website |

|---|---|---|---|

| 2005 | 28 | Lars Eikeland | ensurge.com |

Ensurge Micropower ASA manufactures and sells ultrathin energy storage solutions for wearable devices, connected sensors, and other applications. Its solid-state lithium battery technology enables it to produce rechargeable batteries. The company was formerly known as Thin Film Electronics ASA and changed its name to Ensurge Micropower ASA in June 2021.

Ensurge Micropower ASA Fundamentals Summary

| ENMP.Y fundamental statistics | |

|---|---|

| Market cap | US$76.32m |

| Earnings (TTM) | -US$17.12m |

| Revenue (TTM) | US$158.00k |

483.0x

P/S Ratio-4.5x

P/E RatioIs ENMP.Y overvalued?

See Fair Value and valuation analysisEarnings & Revenue

| ENMP.Y income statement (TTM) | |

|---|---|

| Revenue | US$158.00k |

| Cost of Revenue | US$0 |

| Gross Profit | US$158.00k |

| Other Expenses | US$17.28m |

| Earnings | -US$17.12m |

Last Reported Earnings

Mar 31, 2024

Next Earnings Date

Aug 20, 2024

| Earnings per share (EPS) | -0.031 |

| Gross Margin | 100.00% |

| Net Profit Margin | -10,837.34% |

| Debt/Equity Ratio | -64.2% |

How did ENMP.Y perform over the long term?

See historical performance and comparison