- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Will Pure Storage's (PSTG) New CRO and AI Alliances Shift Its Enterprise Ambitions?

Reviewed by Sasha Jovanovic

- Pure Storage® recently announced the appointment of Patrick Finn as Chief Revenue Officer, taking over global sales leadership, and highlighted a new collaboration with Cisco and NVIDIA to deliver unified enterprise AI infrastructure solutions.

- This dual development not only signals a refreshed direction in executive leadership but also reinforces Pure Storage's growing emphasis on powering large-scale AI deployments for enterprise customers.

- We'll examine how Patrick Finn's appointment as CRO could influence Pure Storage's investment narrative and AI market ambitions.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Pure Storage Investment Narrative Recap

To be a Pure Storage shareholder, you need to believe that the company’s push into next-generation enterprise data and AI storage will deliver sustainable growth amid rapid tech change and competitive threats. The appointment of Patrick Finn as Chief Revenue Officer highlights a potential shift in sales execution, but is not likely to materially change the near-term catalyst of accelerating AI-driven demand, nor does it address the primary risk of cloud transition uncertainty and unpredictable revenue mix.

The November launch of the enhanced FlashStack Cisco Validated Design stands out, as it ties directly into Pure Storage’s ambitions for AI infrastructure, supporting the critical catalyst of enterprise AI adoption and new software-driven revenue streams. As organizations worldwide move from AI pilots to full-scale deployment, Pure Storage’s unified SaaS platform and partner integrations are positioned to help customers simplify their data pipelines, a step essential for unlocking further growth.

Yet, on the flip side, investors should remain aware that the volatility around Pure Storage’s as-a-service and product revenue mix could …

Read the full narrative on Pure Storage (it's free!)

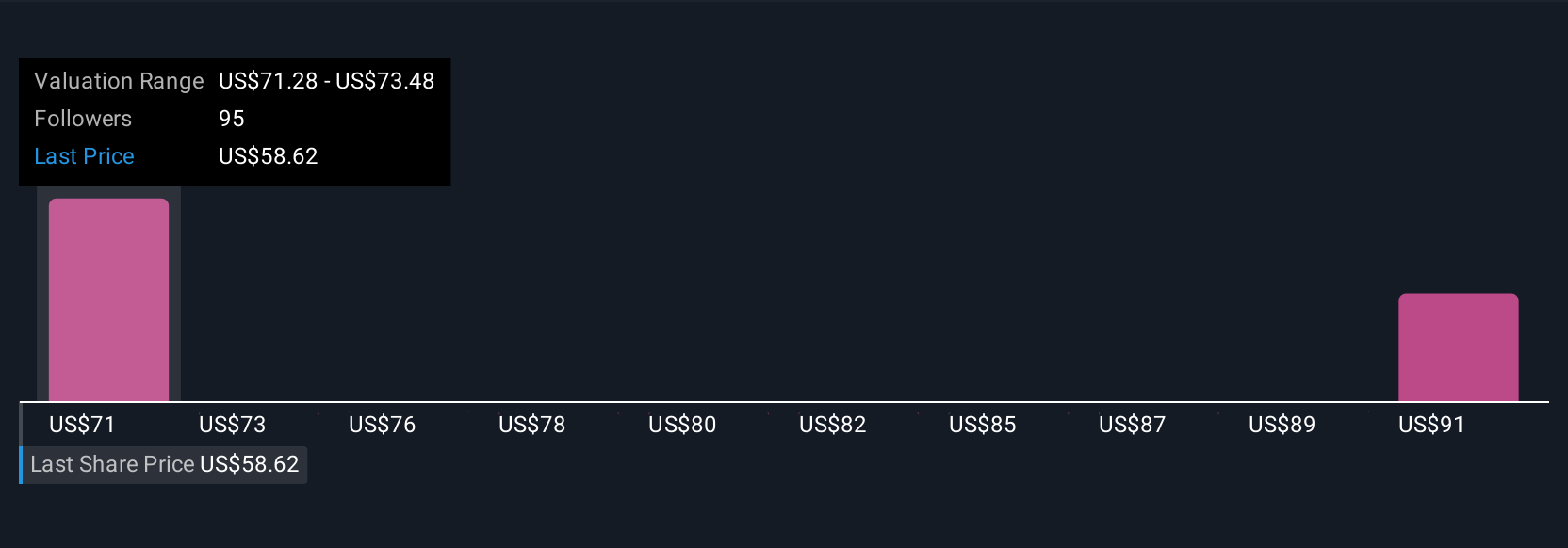

Pure Storage's outlook anticipates $5.1 billion in revenue and $571.5 million in earnings by 2028. This scenario is based on analysts expecting a 15.2% annual revenue growth rate and an increase in earnings of $432.3 million from the current $139.2 million.

Uncover how Pure Storage's forecasts yield a $89.39 fair value, in line with its current price.

Exploring Other Perspectives

Four different Simply Wall St Community fair value estimates for Pure Storage currently range from US$89.34 to US$101.14 per share. While many anticipate growth from new AI collaborations, uncertainty around Pure Storage’s transition to scalable cloud-native services continues to shape market opinions, see how your outlook compares.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth just $89.34!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives