- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

A Look at Pure Storage (PSTG) Valuation Following Chief Revenue Officer Transition and Fresh Analyst Optimism

Reviewed by Simply Wall St

Pure Storage (PSTG) has appointed Patrick Finn as its new Chief Revenue Officer, taking over from Dan FitzSimons, who will support the transition as an advisor. The company reaffirmed its financial guidance along with this leadership update.

See our latest analysis for Pure Storage.

Pure Storage’s stock has soared 53.8% over the past three months, and total shareholder returns have hit an impressive 70% for the year. The company has outpaced many peers thanks to upbeat results, recurring analyst optimism, and bold moves such as the recent leadership shakeup. Momentum is clearly building, even as the share price dipped 3.2% after the latest announcement. This suggests that appetite for future growth remains high among long-term investors.

If you’re curious about where tech innovation and strong returns are heading next, the Simply Wall St screener lets you explore See the full list for free..

After such a remarkable run, investors might wonder if Pure Storage is now undervalued given its consistent outperformance, or if the market has already priced in the company’s future growth and earnings potential. Is there a genuine buying opportunity, or are expectations running ahead of reality?

Most Popular Narrative: Fairly Valued

Pure Storage’s current share price of $90.07 is very close to the narrative’s fair value estimate of $89.39, reinforcing a view that the company is now trading right in line with market expectations. Investors looking for a strong discount or obvious premium may not find it here, but the consensus still expects huge changes ahead.

The adoption of Pure's Enterprise Data Cloud architecture and software-defined solutions is accelerating among large enterprises, driven by the need to manage rapidly growing and increasingly valuable data assets in the evolving AI economy. This positions Pure to capture rising long-term revenue from digital transformation and AI/ML-driven workloads.

Ever wondered what future-defining assumptions got analysts this close to the current price? There is a big bet on compounding growth, ambitious profit margins, and a profit multiple that turns heads. Want to see just how optimistic these forecast numbers get? The deep dive reveals the full math behind this narrative.

Result: Fair Value of $89.39 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainties remain. Heavy investment needs and unpredictable demand could challenge Pure Storage’s path to sustained high growth.

Find out about the key risks to this Pure Storage narrative.

Another View: What Do Price Ratios Say?

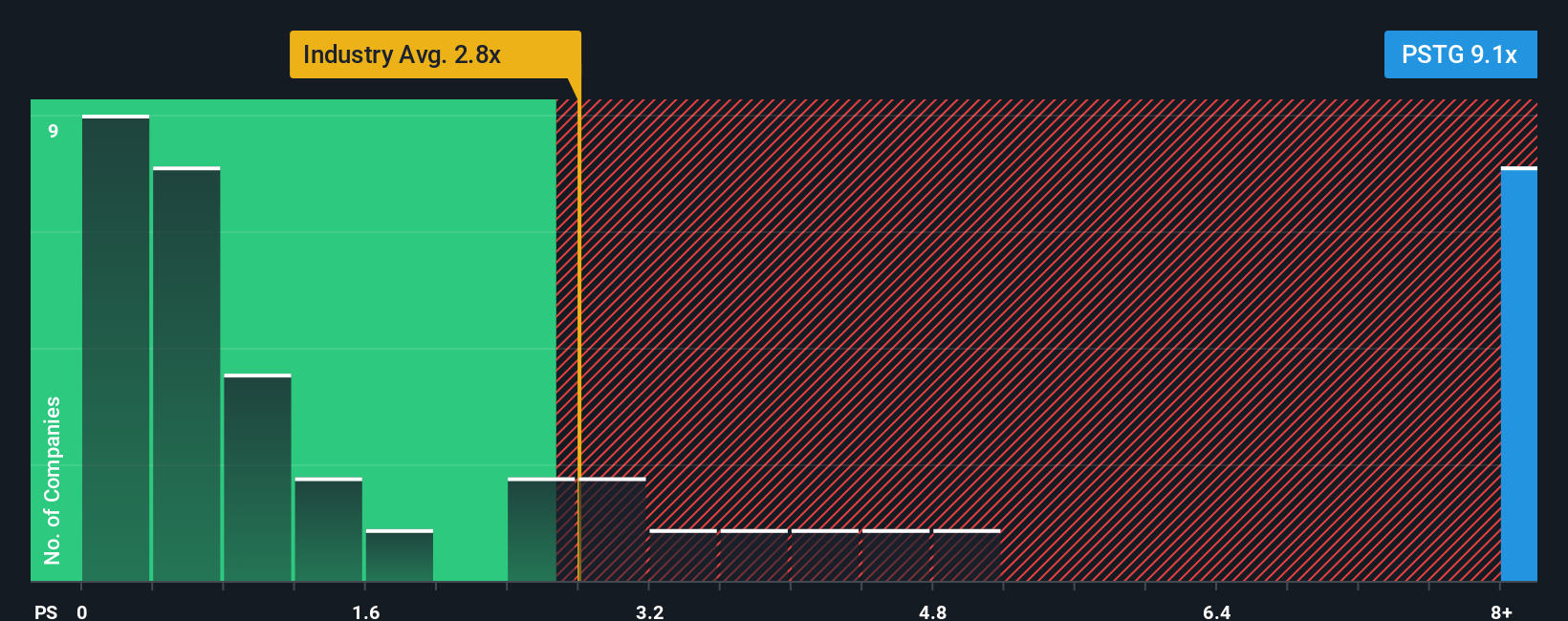

Beyond fair value estimates, Pure Storage’s price-to-sales ratio stands at 8.8x, which is notably higher than both its industry peers (2.3x) and the broader US tech industry (1.9x). While this signals the market is pricing in significant future growth, it also introduces higher valuation risk if expectations cool. Could such a premium persist if fundamentals shift?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pure Storage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pure Storage Narrative

Feel like you have a different perspective or prefer to rely on your own insights? You can quickly build your own forecast and narrative in just a few minutes. Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. The Simply Wall St Screener uncovers investment gems you might miss. Take a minute to check out these carefully selected ideas.

- Spot tomorrow's tech disruptors with these 24 AI penny stocks. Position yourself ahead of the curve in artificial intelligence innovation.

- Earn steady income as you browse these 16 dividend stocks with yields > 3%, tailored for those seeking robust yields above 3% in today’s market.

- Capture growth at the intersection of healthcare and technology through these 32 healthcare AI stocks. Discover transformative players reshaping the medical landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives