- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI): Assessing Valuation After Upbeat Q3 Results and Reaffirmed Growth Outlook

Reviewed by Simply Wall St

Motorola Solutions (MSI) is making headlines after its third quarter earnings report, showing year-over-year revenue growth and steady net income. The company also reaffirmed its outlook for rising revenue through the remainder of 2025.

See our latest analysis for Motorola Solutions.

Motorola Solutions’ upbeat earnings and confident revenue outlook have come amid a stretch of sharp share price declines, with a 1-day share price return of -1.37% and a steep 30-day slide of -15.14%. Over the past year, the stock’s total shareholder return is down 16.38%, even as the company continues buybacks and highlights growth ahead. Still, long-term investors remain well rewarded, with a 147.04% total shareholder return over five years. This suggests that momentum has faded lately, while the broader trajectory has stayed positive.

If Motorola’s recent moves have you reconsidering what’s next in tech and communications, explore further by browsing the latest list of See the full list for free..

With Motorola’s shares trading well below analyst targets even as the company forecasts solid growth, investors are left to wonder: Is the market overlooking value here, or is future success already reflected in the price?

Most Popular Narrative: 21.9% Undervalued

According to the most widely followed analyst narrative, Motorola Solutions’ recent close of $389.10 sits noticeably below the estimated fair value of $497.89. This narrative builds a higher target from a multi-year growth outlook and recurring revenue expansion, setting the stage for a potentially overlooked opportunity.

The rapid adoption of integrated smart technologies, including AI-enhanced video security, spectrum monitoring, and advanced mesh networking through offerings like SVX and Silvus Mobile Ad Hoc Networks, is positioning Motorola to capitalize on the proliferation of smart cities and next-generation public safety applications. This is enabling high double-digit growth in software and services and supports higher-margin, recurring revenue streams.

What is really fueling this bold forecast? The heart of the narrative hinges on ambitious projections for software-powered growth and margin expansion that could reshape Motorola’s valuation story. Can you guess which financial assumptions send the target surging above the current market price? Crack open the full narrative to see why analysts are doubling down on recurring revenue.

Result: Fair Value of $497.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on government contracts and rising competition in public safety tech could still challenge Motorola Solutions’ growth outlook and long-term valuation.

Find out about the key risks to this Motorola Solutions narrative.

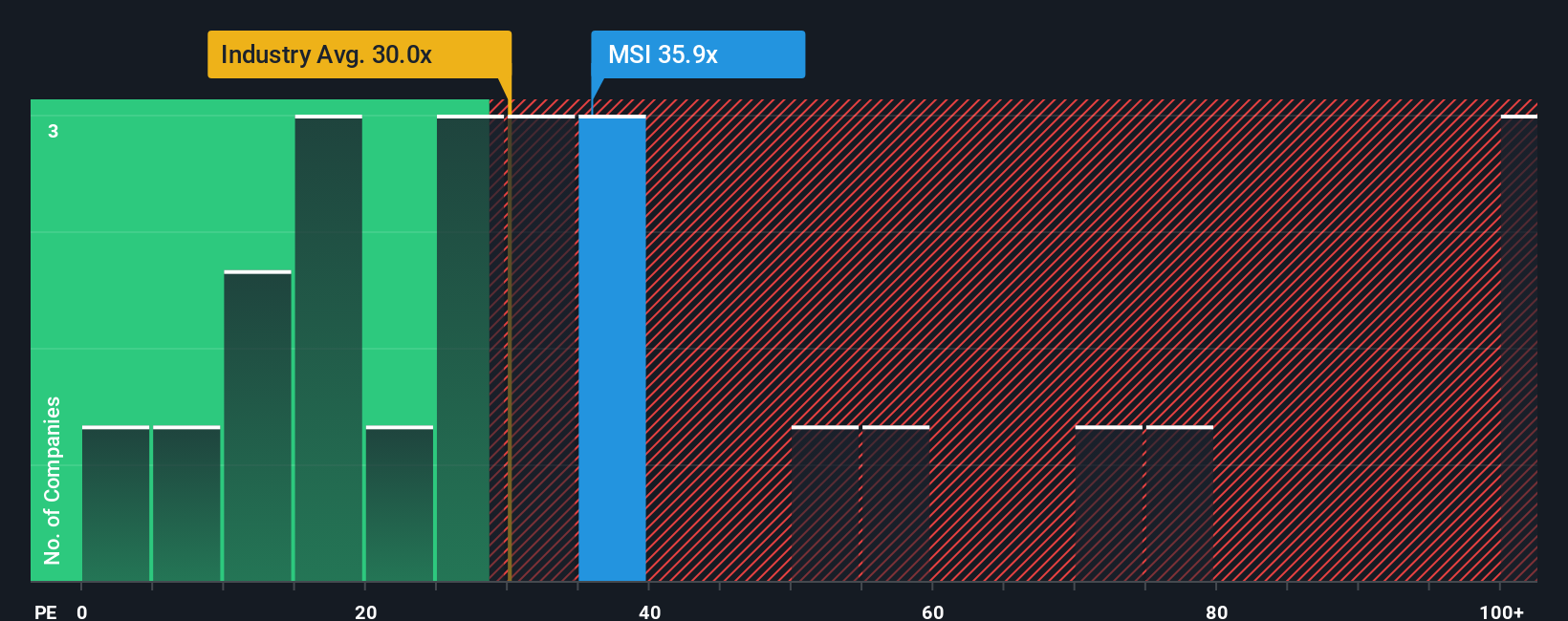

Another View: Market Ratios Tell a Different Story

Looking beyond fair value estimates, Motorola Solutions trades at a price-to-earnings ratio of 30.6x. This is higher than the US Communications industry average of 29.1x, but far below the peer group’s much loftier 86x level. However, it remains above its own fair ratio, calculated at 28.1x. This creates a valuation gap that may signal optimism or could leave the stock vulnerable if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Motorola Solutions Narrative

If you see the story unfolding differently, or want to analyze the numbers for yourself, you can build your own Motorola Solutions narrative in just minutes. Do it your way

A great starting point for your Motorola Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investment opportunities never last long, so seize the moment and check out what else Simply Wall Street's powerful tools can uncover for you.

- Spot potential value movers when you scan for companies trading below their fair value using these 864 undervalued stocks based on cash flows.

- Uncover steady income possibilities by targeting these 17 dividend stocks with yields > 3% with robust yields that can enhance your portfolio's cash flow.

- Stay ahead of the curve and monitor innovators at the crossroads of medicine and technology with these 32 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives