A Look at Mirion Technologies’s Valuation Following Strong Q3 Results and Updated Growth Guidance

Reviewed by Simply Wall St

Mirion Technologies (NYSE:MIR) released its third quarter results this week, moving from a net loss to a net profit and posting higher revenue compared to the same period last year. The company also reaffirmed its full-year growth outlook, citing recent acquisitions and positive currency trends as contributing factors.

See our latest analysis for Mirion Technologies.

Mirion Technologies’ recent earnings turnaround and confirmed outlook have sparked strong investor momentum. This is reflected in a 62.8% year-to-date share price return and a 77.1% total shareholder return over the past 12 months. Over three years, the stock has delivered a 338.7% total shareholder return, highlighting long-term growth as the company continues to pursue acquisitions and operational improvements.

If the story behind Mirion’s breakout has you thinking bigger, now might be the time to broaden your search and discover fast growing stocks with high insider ownership

But with shares up so strongly, investors may wonder whether Mirion Technologies is still undervalued relative to its future prospects. Alternatively, recent gains could mean that most of the growth story is already priced in.

Most Popular Narrative: 11.9% Undervalued

Mirion Technologies closed at $27.55, while the most widely followed narrative calculates a fair value of $31.29. Compelling upside remains in play, especially given the company's rapid business transformation and aggressive expansion strategy.

Strong momentum in advanced nuclear projects, including utility-scale new builds and rapid activity in the small modular reactor (SMR) market, has materially broadened Mirion's pipeline of large, multi-year opportunities. This is creating potential for significant step-changes in future order intake, backlog, and top-line revenue.

Curious how those large-scale nuclear bets could translate into shareholder gains? The future valuation rests on powerful growth forecasts and rising profit margins. The real financial levers behind this target may surprise you. Click to uncover the full blueprint that analysts are betting on.

Result: Fair Value of $31.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Mirion's significant exposure to the nuclear sector and the integration challenges from recent acquisitions could introduce volatility and limit long-term growth potential if not managed carefully.

Find out about the key risks to this Mirion Technologies narrative.

Another View: Is the Multiple Telling a Different Story?

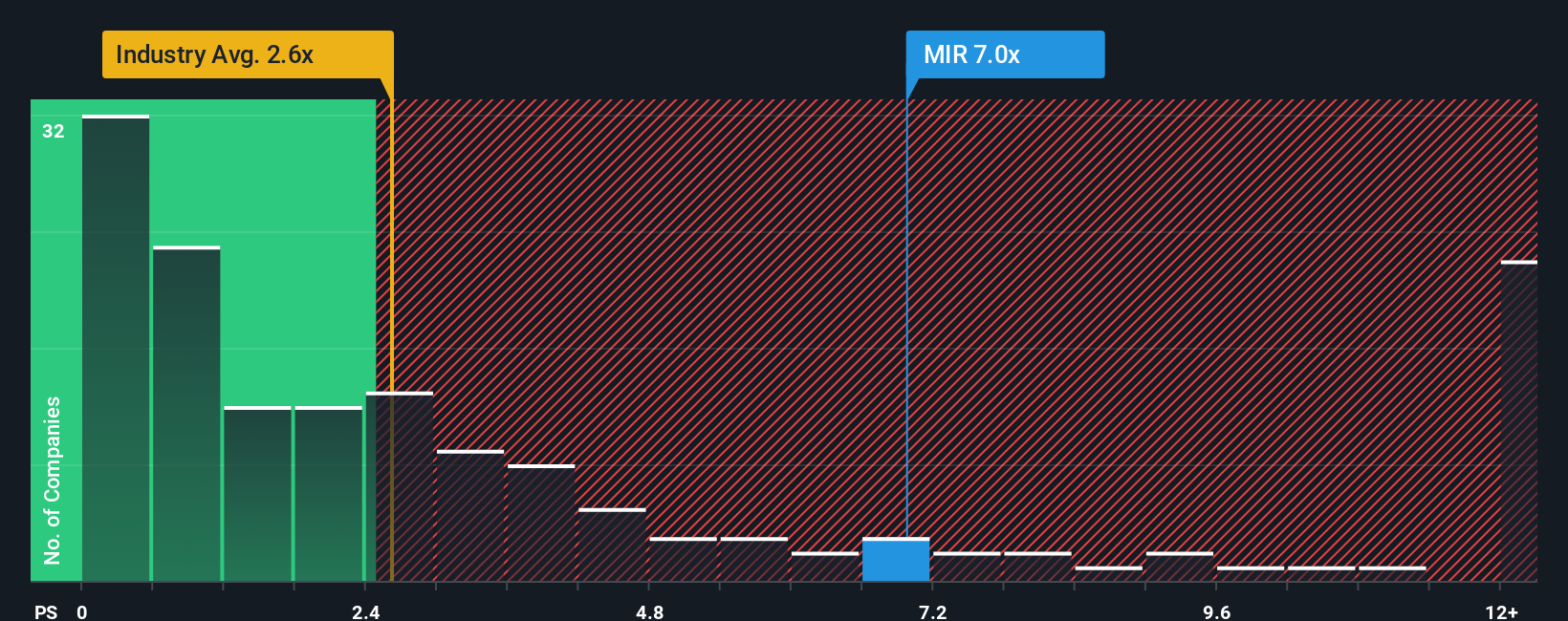

While fair value estimates suggest upside, the stock’s current price-to-sales ratio sits at 7 times. This is well above both its peer average of 4.9 and the US Electronic industry average of 2.6. This significant premium signals investors may be paying up upfront, raising the stakes if future growth underdelivers. Will the company justify this valuation gap or is the risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirion Technologies Narrative

If you’re curious to dig into the numbers or want to build your own case, you can assemble your unique Mirion Technologies story in just a few minutes by using Do it your way

A great starting point for your Mirion Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never wait for opportunities to appear; they track them down. Broaden your investing playbook by checking out these powerful stock ideas from Simply Wall Street:

- Boost your portfolio with growing income streams as you scan these 17 dividend stocks with yields > 3% offering yields above 3% and a track record of rewarding shareholders.

- Catch early-stage innovation by targeting these 25 AI penny stocks poised to transform industries with artificial intelligence breakthroughs.

- Capitalize on value plays and seek out these 860 undervalued stocks based on cash flows that stand out based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives