- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (HPE): Evaluating Valuation After Major AI and Supercomputing Contract Announcements

Reviewed by Simply Wall St

Hewlett Packard Enterprise (HPE) is making a calculated shift away from its historical server roots as it aligns its business more with AI infrastructure and networking. Recent announcements and contract wins showcase how this strategy is starting to reshape the company’s operating profile and market narrative.

See our latest analysis for Hewlett Packard Enterprise.

It has been a busy stretch for HPE, from unveiling major supercomputing deals with Los Alamos National Laboratory to joining forces in the Quantum Scaling Alliance and powering sovereign AI projects like those at the University of Utah and the Town of Vail. The stock’s momentum has been solid, though recently cooling with a 1-month share price return of -6.2%. Long-term shareholders are well in the green, enjoying an 8.2% total return over the past year and a remarkable 60.7% total return over three years. This points to meaningful progress as HPE leans into higher-margin AI and networking markets.

If you’re watching the AI infrastructure race heat up, this is an ideal moment to discover See the full list for free.

Yet with shares still trading at a noticeable discount to analyst targets and sector peers, investors must now weigh whether HPE remains undervalued or if the current price already takes into account its transformation and growth potential.

Most Popular Narrative: 13.7% Undervalued

With Hewlett Packard Enterprise’s fair value pegged at $26.51 by the most popular narrative and shares last closing at $22.89, the stage is set for a debate over whether this legacy tech player is truly on the verge of a re-rating.

Strategic acquisitions and expansion in high-growth technologies, including the integration of Juniper, launches of next-gen Gen12 servers, and AI-driven management platforms, are enhancing HPE's competitive positioning in edge, networking, and AI. This is laying the groundwork for continued share gains and outsized revenue growth relative to traditional industry averages.

Which bold projections shape this bullish outlook? The real story lies beneath headline numbers, hinging on sustained double-digit growth and a profit model that rewards top-tier execution. See what underpins these lofty expectations and whether the narrative justifies a premium.

Result: Fair Value of $26.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain. A slower shift from legacy hardware or hiccups integrating Juniper could stall the expected gains from HPE’s AI transformation.

Find out about the key risks to this Hewlett Packard Enterprise narrative.

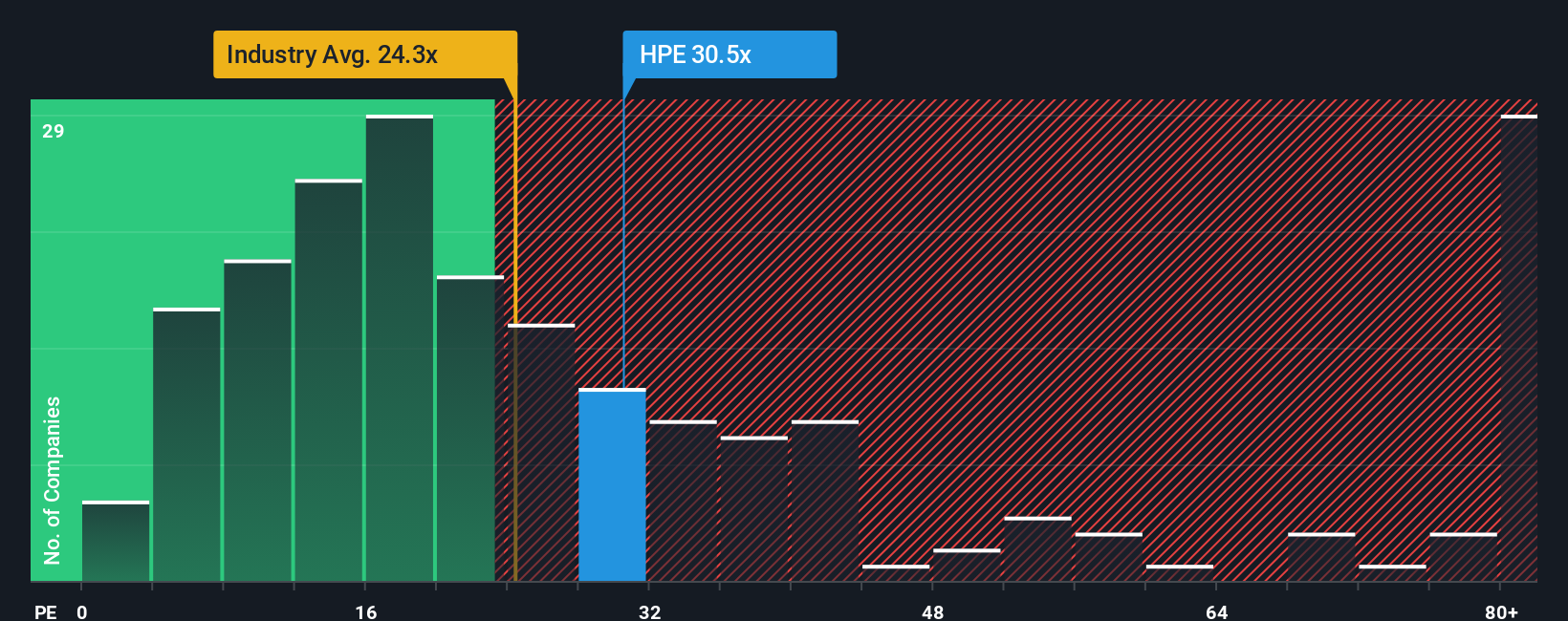

Another Perspective: How Do Valuation Ratios Stack Up?

Looking beyond fair value estimates, HPE’s price-to-earnings ratio stands at 26.6x. This is higher than both its peer average of 21.9x and the global tech industry’s average of 22.8x. However, it remains well below the fair ratio of 44.4x that our models suggest the market could eventually move toward. This premium could signal confidence in future growth, but it also raises the risk that expectations are already priced in. If smoother integration and margins fall short, today’s multiple might leave less room for upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hewlett Packard Enterprise Narrative

If these perspectives don’t match your own, or you prefer digging into the numbers yourself, you can quickly create your own company narrative and analysis in just minutes: Do it your way

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to stay ahead of the market by tracking stocks and themes everyone will be talking about tomorrow. Don’t let these opportunities pass you by. See which ideas best fit your goals:

- Access stable cash flows and attractive valuations in the current market by checking out these 869 undervalued stocks based on cash flows that could be flying under the radar.

- Ride powerful trends in healthcare transformation by evaluating these 32 healthcare AI stocks revolutionizing medicine, diagnostics, and patient care using artificial intelligence.

- Capture income and resilience for your portfolio through these 16 dividend stocks with yields > 3% consistently delivering yields over 3% in a shifting economic landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives