- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Does Hewlett Packard Enterprise’s AI Expansion Signal an Opportunity After Recent Price Pullback?

Reviewed by Bailey Pemberton

- Wondering if Hewlett Packard Enterprise is a bargain or fully priced right now? Let's break down the numbers to see if this stock could give your portfolio an edge.

- The share price has pulled back around 4% over the last week, but for the year to date, it is still up more than 9%. It also boasts a nearly 157% gain over five years, suggesting significant long-term momentum.

- Recent headlines have spotlighted HPE's expanding presence in the AI infrastructure space and a series of new cloud partnerships that are fueling future growth stories. At the same time, market watchers have debated whether investors are underestimating its strategic moves or if the excitement is now already reflected in the price.

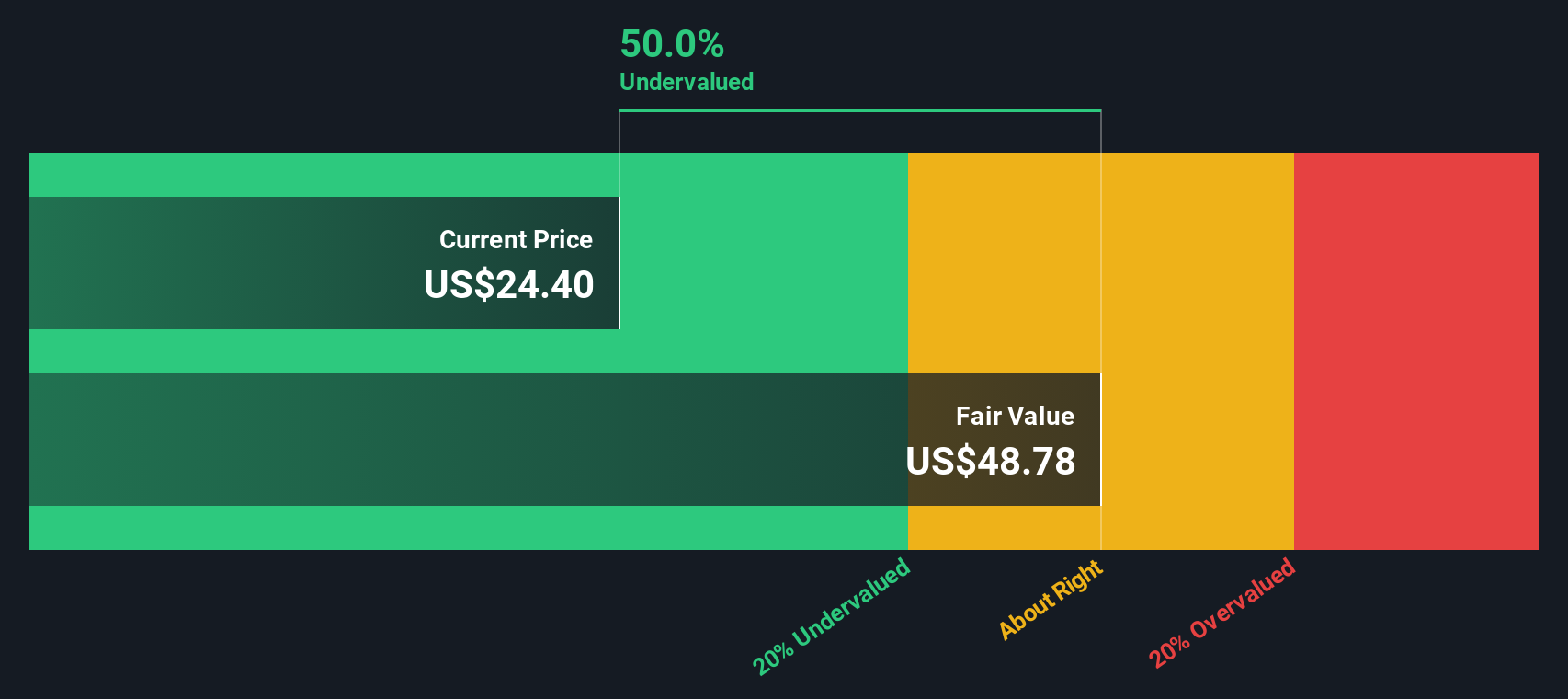

- On our 6-point valuation check, Hewlett Packard Enterprise scores 3 out of 6. This means it is undervalued in half of the key metrics we track. We'll explore how each valuation method compares, but stay tuned as we'll also uncover a smarter way to judge value by the end of our analysis.

Approach 1: Hewlett Packard Enterprise Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and "discounting" them back to today's value. This method tries to answer: If we could add up all the cash Hewlett Packard Enterprise (HPE) is expected to generate in the years ahead, how much would that be worth right now?

For HPE, the most recent twelve months of Free Cash Flow (FCF) totaled negative $344.4 Million, but analysts forecast a turnaround in the years ahead. By 2029, the company's FCF is projected to climb to around $3.6 Billion, according to these models and estimates. Longer-range projections beyond five years are extrapolated for a full decade, which helps create a more complete picture of HPE's potential cash generation using the 2 Stage Free Cash Flow to Equity method.

After crunching these numbers, the DCF model suggests Hewlett Packard Enterprise has an intrinsic value of $34.64 per share. That implies the shares are trading at a 32.3% discount to their fair value, which indicates a strong case for undervaluation at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hewlett Packard Enterprise is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Hewlett Packard Enterprise Price vs Earnings

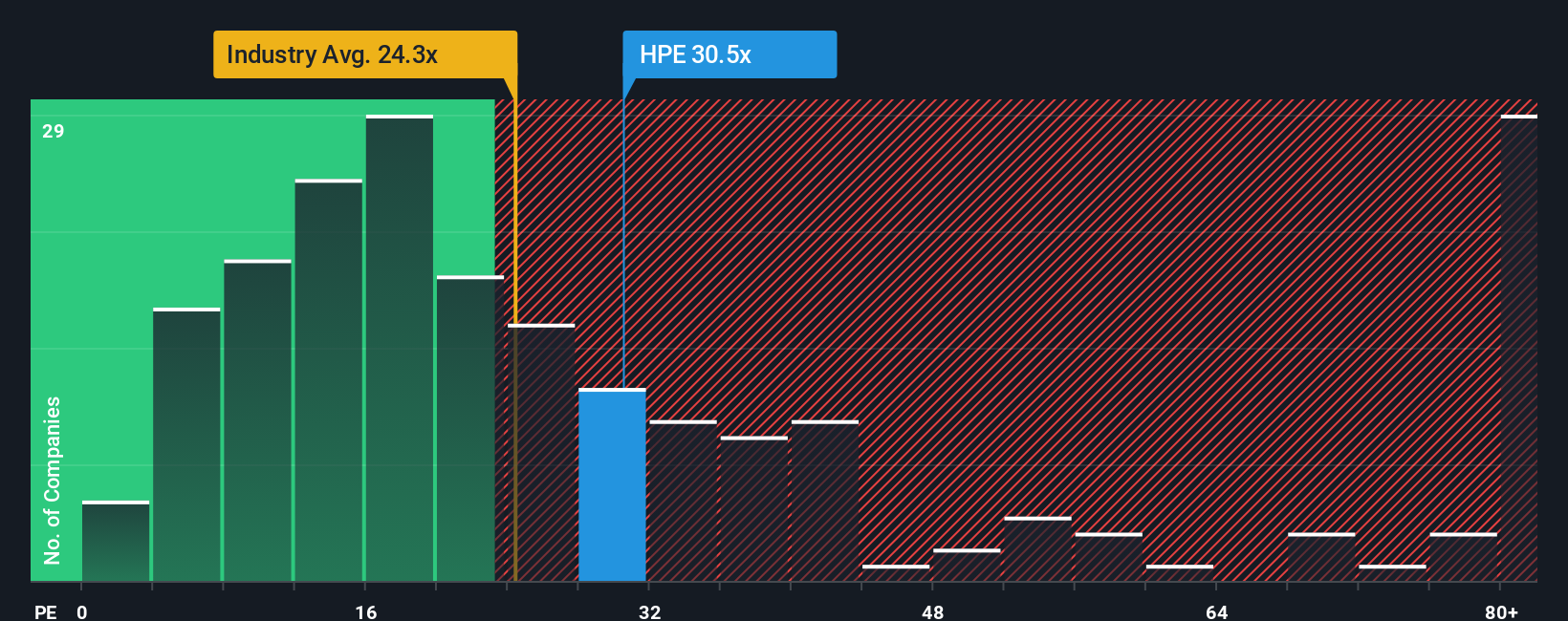

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Hewlett Packard Enterprise, as it allows investors to gauge how much the market is willing to pay for a dollar of earnings. This measure is especially useful when a company has consistent profits, making it easier to compare with industry peers and broader benchmarks.

A company's "normal" or "fair" PE ratio is influenced by factors like its expected earnings growth, risk profile, and the overall climate of its industry. Higher growth prospects or lower perceived risks typically justify a higher PE ratio, while companies with slower growth or greater uncertainties often trade at lower multiples.

Right now, Hewlett Packard Enterprise trades at a PE ratio of 27.24x. This is above both the industry average of 22.90x and the peer average of 21.20x, suggesting that the market is pricing in stronger earnings expectations or lower risks for HPE compared to its peers.

However, Simply Wall St's proprietary "Fair Ratio" goes a step further. Instead of simply comparing with industry or peer averages, the Fair Ratio incorporates specific details about HPE, such as its earnings growth outlook, profit margins, industry, market capitalization, and risk factors, to estimate the multiple that would be justified for this particular company. This tailored approach gives a more complete view of whether a stock is truly mispriced.

For Hewlett Packard Enterprise, the Fair PE Ratio is calculated at 44.28x, significantly higher than its actual PE ratio. This suggests HPE is actually trading well below what would be considered fair given its characteristics. Based on this, the stock appears to be undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hewlett Packard Enterprise Narrative

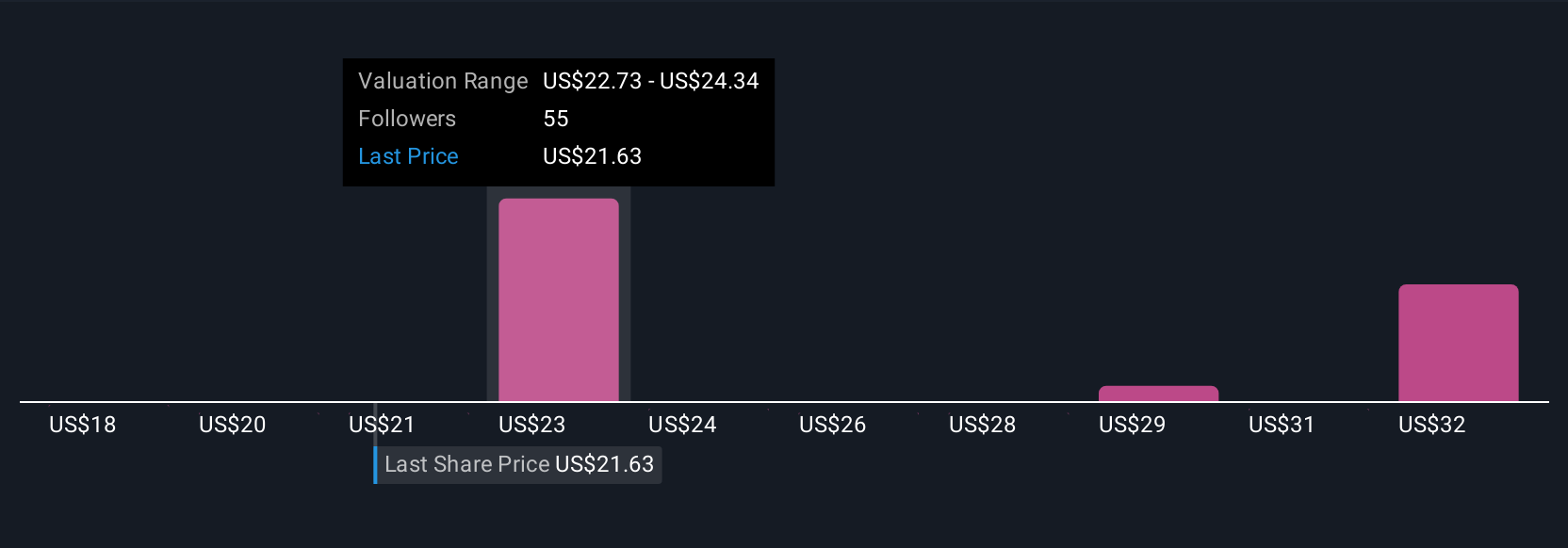

Earlier we mentioned that there is a better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company's future, connecting what you believe about Hewlett Packard Enterprise with concrete numbers such as projected revenue, earnings, and margins, to a forecast and fair value. Instead of just looking at static ratios or past trends, Narratives let you link the company’s story to a dynamic financial model, making your investment outlook more meaningful and actionable.

Narratives are an easy and accessible feature on Simply Wall St’s Community page, where millions of investors share and refine their views. By creating or following a Narrative, you can see how your expectations would value HPE, and then quickly compare your fair value estimate to the current share price. This helps you decide when to buy or sell. As news breaks or earnings are released, Narratives dynamically update, so you can confidently adjust your strategy without starting from scratch.

For example, one investor may be optimistic about HPE’s recent AI and cloud expansion, projecting higher margins and stronger revenue growth for a bullish fair value of $30 per share. Another may take a cautious view of legacy hardware risks and assign a conservative target of $19 per share. Narratives give you the tools to see, compare, and act on these different perspectives in real time.

Do you think there's more to the story for Hewlett Packard Enterprise? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives