Will Benchmark Electronics (BHE) Leverage New Board Expertise to Sharpen Its Semiconductor Strategy?

- Earlier this month, Benchmark Electronics announced the appointment of Dr. Michael Slessor, CEO of FormFactor and a semiconductor industry veteran, to its Board of Directors.

- Slessor's extensive leadership experience and successful track record in acquisitions and integrations may further strengthen Benchmark’s technical expertise and industry reach.

- We’ll explore how the addition of Dr. Slessor’s semiconductor leadership could influence Benchmark Electronics’ future opportunities and earnings quality.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Benchmark Electronics Investment Narrative Recap

To be a shareholder in Benchmark Electronics, you need to believe the company can leverage its specialist manufacturing and industry partnerships, particularly in semiconductor and high-performance computing segments, despite ongoing headwinds from flat industrial revenues and unpredictable geopolitical challenges. The recent addition of Dr. Michael Slessor to the board introduces valuable semiconductor expertise, but is unlikely to materially shift the immediate trajectory of Benchmark’s most critical near-term catalyst: a recovery in advanced computing and AI contract wins. Meanwhile, the biggest near-term risk remains persistent softness in the semi-cap sector due to trade restrictions and regulatory uncertainties, factors that even strong board appointments cannot resolve overnight.

Of the company’s recent developments, the completion of a $700 million Amended and Restated Credit Agreement in June 2025 stands out. With a $550 million revolving credit facility and $150 million term loan, Benchmark has given itself additional flexibility to invest in growth areas like high-complexity manufacturing and global operational expansion, factors tightly linked to its next growth phase and potential catalysts for revenue acceleration.

But in contrast with the company’s expansion efforts, investors should also be aware that sustained trade restrictions and tariff instability could...

Read the full narrative on Benchmark Electronics (it's free!)

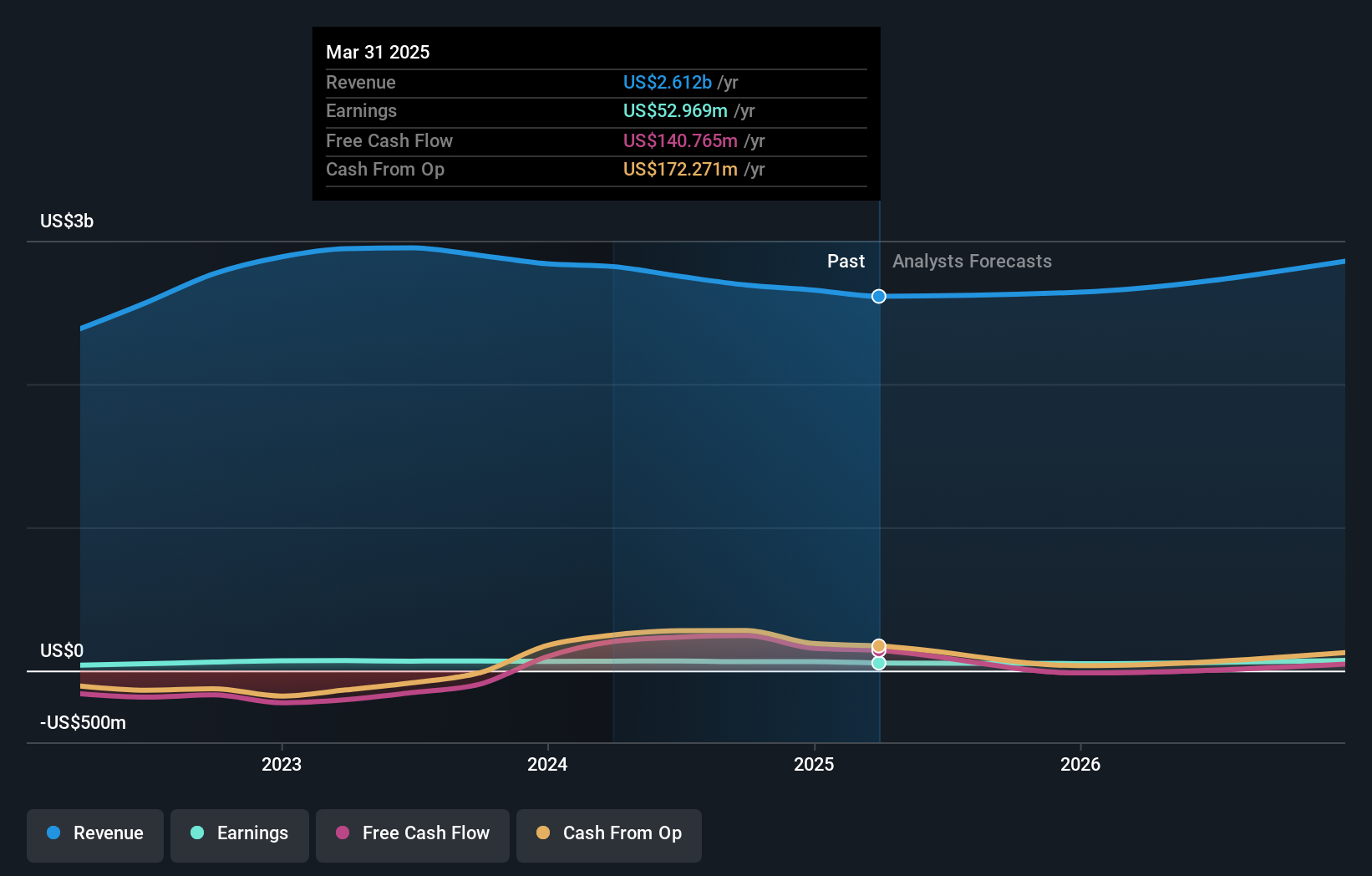

Benchmark Electronics' narrative projects $3.0 billion revenue and $95.5 million earnings by 2028. This requires 5.3% yearly revenue growth and a $57.1 million earnings increase from $38.4 million.

Uncover how Benchmark Electronics' forecasts yield a $44.67 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated Benchmark Electronics’ fair value between US$10.73 and US$44.67, across 3 different analyses. While optimism surrounds opportunities in advanced computing, ongoing trade and regulatory uncertainties continue to influence market conviction and future revenue potential.

Explore 3 other fair value estimates on Benchmark Electronics - why the stock might be worth as much as 8% more than the current price!

Build Your Own Benchmark Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Benchmark Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Benchmark Electronics' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.