Benchmark Electronics (BHE): Is the Stock Undervalued After Recent Share Price Slide?

Reviewed by Kshitija Bhandaru

See our latest analysis for Benchmark Electronics.

After sliding 3% today, Benchmark Electronics is extending its losing streak and momentum seems to be fading. The company’s 1-year total shareholder return is negative, despite its impressive 3- and 5-year total returns of 56% and 95%. This hints at solid long-term potential even as near-term sentiment cools.

If you’re on the lookout for more names with staying power and breakout potential, broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and strong long-term growth in mind, it raises the question: Is Benchmark Electronics currently undervalued, or is the market already factoring in all its future potential?

Most Popular Narrative: 16.4% Undervalued

Benchmark Electronics closed at $37.36, yet the most popular narrative values the shares noticeably higher. This difference is fueling new debate, especially with analyst expectations pointing up while the stock drifts lower in the short term.

Benchmark is positioned to benefit from the surging demand for advanced computing and AI infrastructure, as evidenced by recent contract wins in water-cooling for high-performance computing and AI data centers, and ramping opportunities expected to drive a return to revenue growth in AC&C by late 2025 and into 2026. This supports both revenue acceleration and an upward mix in gross margin due to the complexity of these projects.

What makes the current valuation so compelling? The narrative hinges on surging AI and tech opportunities, but also leans on tightly managed costs and ambitious earnings targets. Just what kind of profit leap is being projected? Big assumptions are built in. See what’s driving this surprising price target.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in the semi-cap sector or renewed supply chain challenges could stall the anticipated recovery and place pressure on revenue growth.

Find out about the key risks to this Benchmark Electronics narrative.

Another View: Is the Market Overlooking Key Risks?

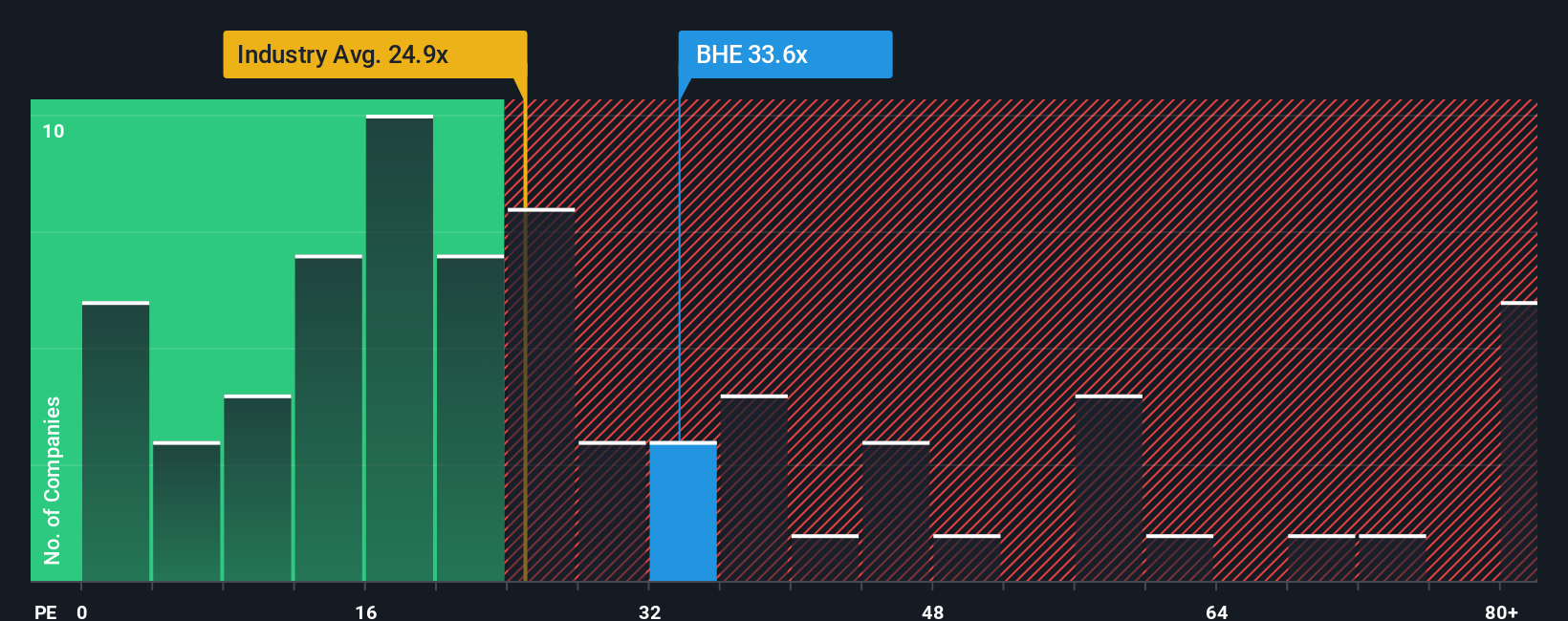

While the analyst-based fair value puts Benchmark Electronics in undervalued territory, a closer look at its price-to-earnings ratio tells a different story. At 34.9x, it is noticeably higher than both the industry average (25.2x) and peer average (26.9x), which could signal elevated valuation risk if growth fails to accelerate. The fair ratio stands at 40.4x, suggesting room for further market adjustment. Could investors be too optimistic, or is the company justifiably commanding a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Benchmark Electronics Narrative

If you see things differently, or want to test your own ideas against the data, you can quickly shape your own perspective using available tools such as Do it your way.

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and unlock tomorrow’s opportunities by tapping into these handpicked investment screens. Don’t risk missing the next big mover in the market.

- Spot tomorrow’s potential standouts early with these 3579 penny stocks with strong financials, featuring robust financials and promising growth trajectories.

- Secure steady income and portfolio stability by browsing these 19 dividend stocks with yields > 3%, with yields above 3% backed by reliable fundamentals.

- Capitalize on the future of medicine by reviewing these 32 healthcare AI stocks, where innovation in AI is transforming healthcare outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives