Arrow Electronics (ARW): Assessing Valuation After Strong Q3 Earnings and Updated Guidance

Reviewed by Simply Wall St

Arrow Electronics released its third quarter results, revealing higher sales and net income compared to last year, along with updated guidance for the next quarter. These updates often matter to investors, as they highlight current performance and management expectations moving forward.

See our latest analysis for Arrow Electronics.

Arrow Electronics’ updated guidance and stronger quarterly numbers caught some attention, but the momentum in its share price has been less inspiring lately, with a 1-year total shareholder return of -7.1%. Over the longer term, though, Arrow has still posted solid gains, up 28.4% on a five-year basis. This highlights how quickly sentiment can shift as the company delivers results.

If you’re weighing your next move after this earnings update, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

So after Arrow Electronics’ recent lift in revenue and guidance, should investors see today’s share price as leaving room for upside, or is the market already factoring in the company’s growth outlook?

Most Popular Narrative: 30% Undervalued

With Arrow Electronics closing at $111.71 and the most-followed narrative estimating fair value at $146, a sharp value gap jumps out. The latest consensus pulls together growth themes and margin forecasts, framing a bullish case rooted in industry trends and broader operational shifts.

Accelerating adoption of cloud, infrastructure software, cybersecurity, and mid-market as-a-service offerings, notably through ArrowSphere, is increasing Arrow's exposure to higher-margin, recurring revenue streams. This is expected to support both revenue growth and margin stability in future quarters.

What hidden force is powering this optimistic price target? The answer lies in the narrative’s focus on recurring revenue and a margin rebound rarely seen in the distribution space. Want the full story and the specific financial drivers that analysts say could make all the difference? Click in and weigh the potential for yourself.

Result: Fair Value of $146 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising supply chain automation and global trade uncertainties could challenge Arrow's recurring revenue story and test its long-term growth assumptions.

Find out about the key risks to this Arrow Electronics narrative.

Another View: The Multiples Perspective

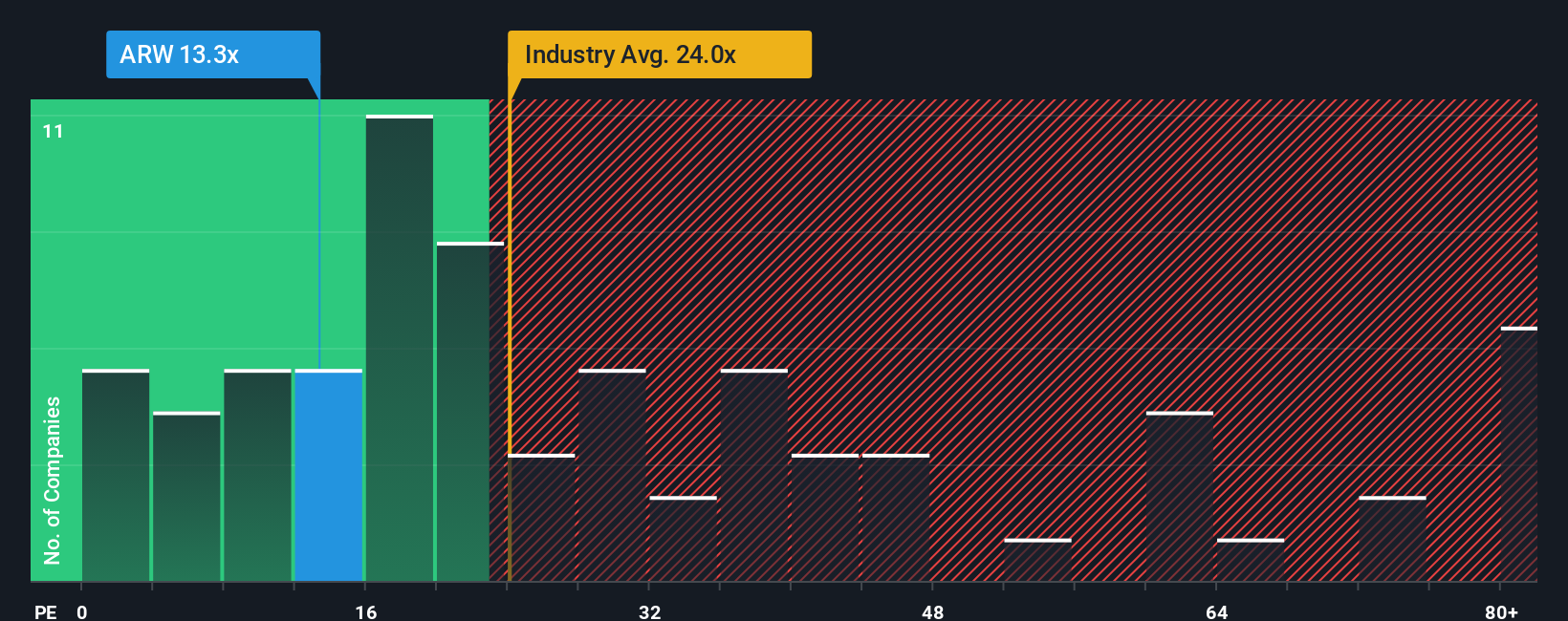

Looking at Arrow Electronics through the lens of its price-to-earnings ratio, the company trades at 12.1x, noticeably less than both its peer average (17.5x) and the industry average (24.9x), and also below the fair ratio of 21.2x. This suggests the market may be pricing in caution, but could this gap also signal a potential undervalued opportunity, or is there a real risk the market is ignoring?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arrow Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arrow Electronics Narrative

If you think there’s a different angle or want to dive into the numbers yourself, you can build your own narrative in just a few minutes, and Do it your way.

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and give yourself a real edge. Top investors are already acting on hidden opportunities. Don’t let these next-level stock picks pass you by.

- Unlock new income potential by checking out these 16 dividend stocks with yields > 3% generating reliable yields above 3% for portfolio stability.

- Get ahead of the curve and spot breakthroughs by jumping into these 24 AI penny stocks targeting disruptive advancements in artificial intelligence innovation.

- Secure value for your money by screening these 870 undervalued stocks based on cash flows that are trading well below their intrinsic cash flow worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives