Why Arlo Technologies (ARLO) Fell 16.9 Percent After Record Earnings and Free Cash Flow Concerns

Reviewed by Sasha Jovanovic

- Arlo Technologies recently reported its third-quarter 2025 earnings, delivering record results including revenue of US$139.53 million and a turnaround to net income of US$6.87 million, along with significant gains in subscriptions and annual recurring revenue.

- Despite surpassing analyst expectations and raising guidance for the next quarter, concerns emerged around a decline in free cash flow margin, which led to some uncertainty regarding the strength of Arlo’s underlying cash profitability.

- We’ll explore how the headlines of record subscription growth and new product launches may reshape Arlo Technologies’ investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Arlo Technologies Investment Narrative Recap

To be a shareholder in Arlo Technologies, you need to believe that high-margin recurring subscription revenue can offset hardware commoditization and fuel sustainable profit growth. The latest earnings renew optimism around subscriber and services expansion, but renewed concerns about weakened free cash flow margins continue to weigh on sentiment. For now, the impact on subscription momentum, the central near-term catalyst, appears limited, while cash generation remains the biggest question mark for investors tracking Arlo’s underlying profitability story.

Among recent announcements, Arlo’s record-breaking third-quarter additions of 281,000 paid accounts, driving a total of 5.4 million subscriptions and 34% annual recurring revenue growth, stands out as most relevant, reinforcing the company's push toward a subscription-first model. This surge is directly tied to the ongoing catalyst of expanding the addressable market through device launches and partnerships, strengthening recurring revenue streams even as headline hardware margins face pressure.

However, investors should also be aware that, despite the impressive growth in paid accounts, one risk remains front and center...

Read the full narrative on Arlo Technologies (it's free!)

Arlo Technologies' narrative projects $632.0 million in revenue and $103.1 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $110.1 million earnings increase from current earnings of -$7.0 million.

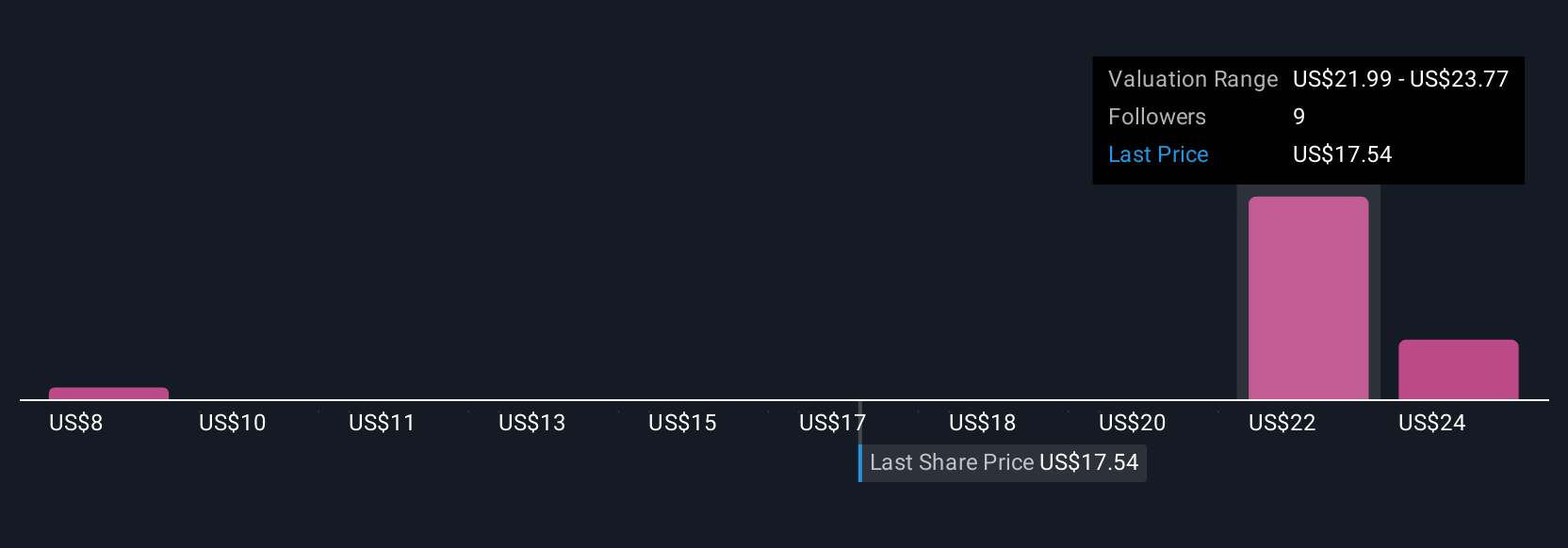

Uncover how Arlo Technologies' forecasts yield a $23.20 fair value, a 47% upside to its current price.

Exploring Other Perspectives

With fair value estimates from four Simply Wall St Community members spanning US$7.79 to US$23.20, there is clear diversity in expectations. While services revenue growth is fueling Arlo’s momentum, differing views on cash flow and profitability continue to spark debate about the company’s longer-term performance.

Explore 4 other fair value estimates on Arlo Technologies - why the stock might be worth less than half the current price!

Build Your Own Arlo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arlo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arlo Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives