- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Does Viavi Solutions' (VIAV) Open RAN Partnership Signal a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Viavi Solutions and Calnex Solutions announced a partnership to deliver comprehensive test solutions for Open RAN products, aiming to streamline network validation and reduce development costs for telecom manufacturers.

- This collaboration supports the industry's shift toward multivendor, innovative telecom networks by enabling immediate access to integrated, advanced testbeds that address performance, security, and interoperability standards.

- We'll explore how this move to simplify Open RAN testing may influence Viavi Solutions' investment outlook and growth trajectory.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Viavi Solutions Investment Narrative Recap

At its core, the case for Viavi Solutions centers on continued demand for advanced network testing and growth in data center and fiber broadband markets. The new partnership with Calnex Solutions aims to make Open RAN testing faster and more accessible, which supports Viavi's role in a shifting telecom landscape, but is not likely to materially shift the most immediate catalyst, sustained hyperscale and data center spending. However, it does little to alleviate the persistent weakness in wireless infrastructure testing, which remains a key risk for near-term growth.

Among recent updates, Viavi’s fiscal first-quarter 2026 results stand out: revenue exceeded expectations, helping reinforce the importance of momentum in data center and network enablement segments, the same areas driving the stock’s short-term outlook alongside developments like the Calnex partnership. Meanwhile, ongoing integration of recent acquisitions and strong guidance could support that momentum further, but risks from cyclicality and execution remain close at hand.

By contrast, investors should be aware that ongoing delays and unpredictability in service provider spending could...

Read the full narrative on Viavi Solutions (it's free!)

Viavi Solutions' outlook anticipates $1.3 billion in revenue and $227.3 million in earnings by 2028. This is based on a projected 5.8% annual revenue growth rate and a $192.5 million increase in earnings from the current $34.8 million.

Uncover how Viavi Solutions' forecasts yield a $14.57 fair value, a 18% downside to its current price.

Exploring Other Perspectives

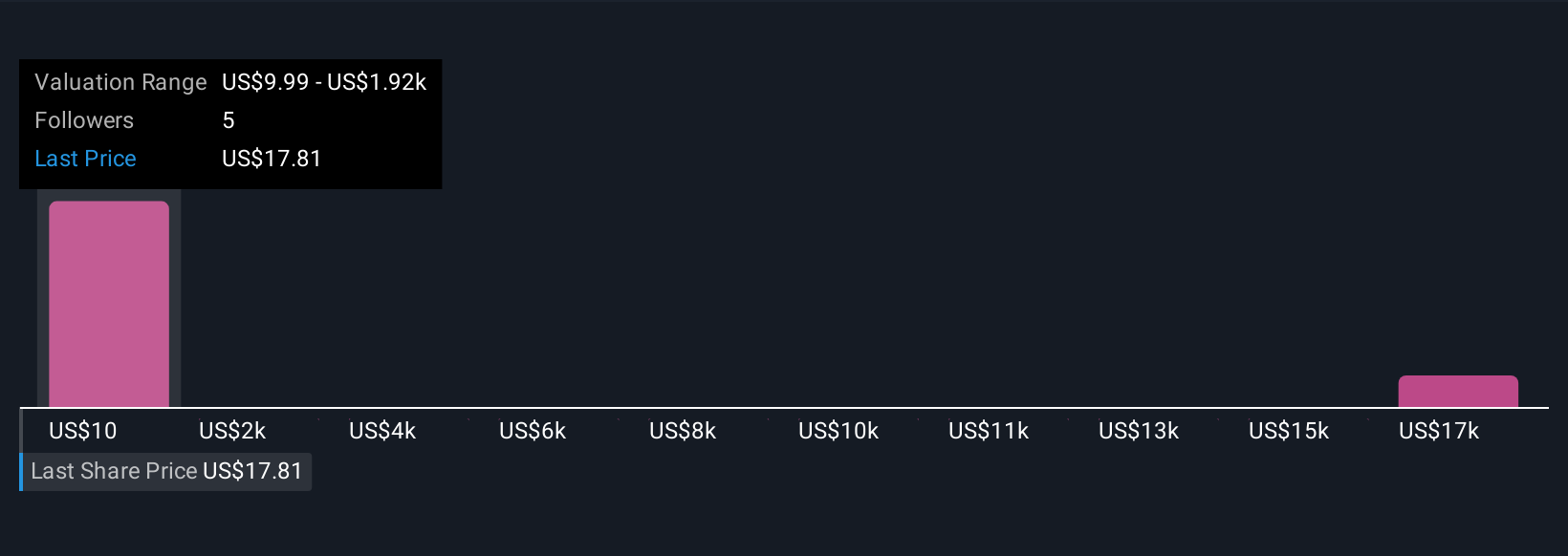

Three retail investors in the Simply Wall St Community estimated Viavi’s fair value from US$9.94 to over US$19,000 per share. Such a vast spread reflects very different expectations for the company’s growth, especially with data center demand as a core catalyst shaping near-term performance. Explore these views to see how others weigh both opportunity and risk in Viavi’s future.

Explore 3 other fair value estimates on Viavi Solutions - why the stock might be a potential multi-bagger!

Build Your Own Viavi Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Viavi Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viavi Solutions' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives