- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

Will Sandisk's (SNDK) Pricing Power Shift the Memory Market Narrative Ahead of Q1 Results?

Reviewed by Sasha Jovanovic

- Sandisk Corp. announced it will release its first quarter fiscal 2026 results after market close on November 6, 2025, accompanied by a live webcast presentation.

- Investor interest in Sandisk has been amplified by recent bullish analyst sentiment and pricing momentum across the memory sector, following reports of price hikes by major competitors.

- To explore the impact on Sandisk’s investment narrative, we’ll examine how sector-wide memory chip pricing trends influence market expectations ahead of earnings.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Sandisk's Investment Narrative?

To be a shareholder in Sandisk right now, you have to believe in the long-term transformation fueled by memory chip demand, upcoming AI-focused products, and the ability of new management to turn unprofitability into sustainable growth. The latest surge in Sandisk’s share price, driven by upbeat price targets and sector-wide memory chip price hikes, has meaningfully shifted the short-term catalyst focus. Investor excitement is now tied tightly to the impact of these potential margin tailwinds ahead of the November results, so surprises, good or bad, could influence sentiment quickly. However, Sandisk remains expensive compared to peers, is still unprofitable, and has an inexperienced board, which hasn't changed. The recent rally amplifies the stakes for the upcoming quarter and increases the emphasis on execution and financial turnaround as the key risk for those looking ahead.

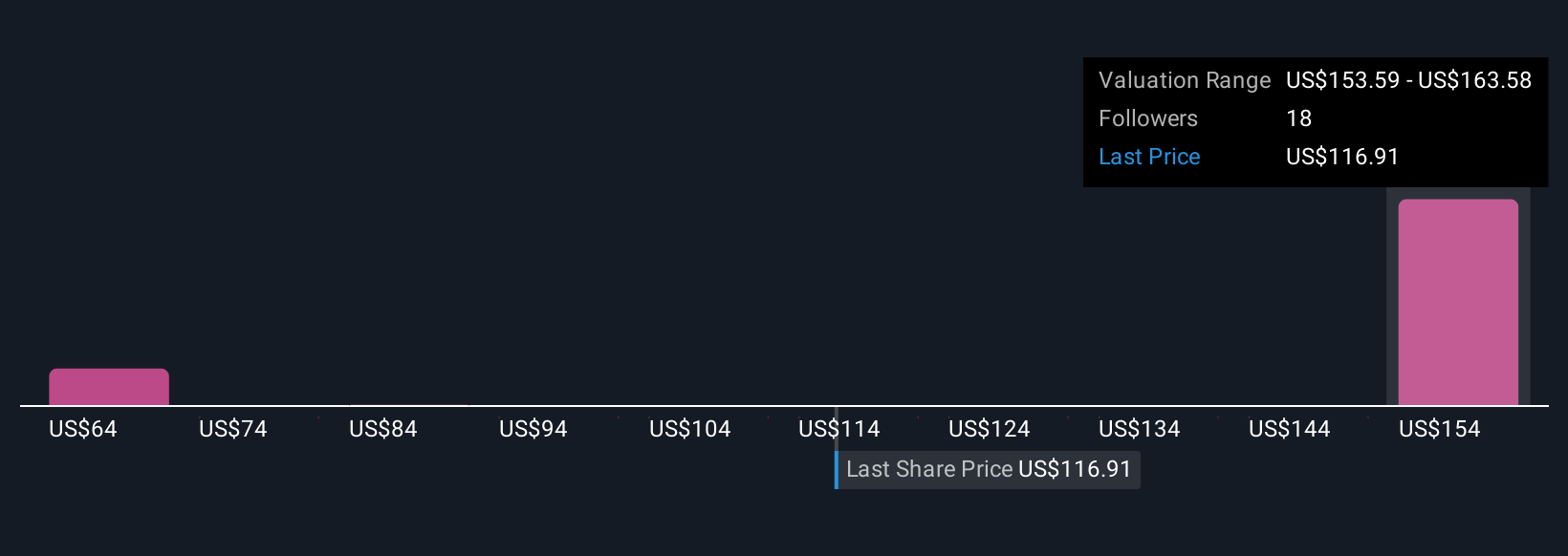

But results may reveal how a pricey stock can be pressured if momentum falters. Sandisk's shares are on the way up, but they could be overextended by 11%. Uncover the fair value now.Exploring Other Perspectives

Explore 6 other fair value estimates on Sandisk - why the stock might be worth less than half the current price!

Build Your Own Sandisk Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandisk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandisk's overall financial health at a glance.

No Opportunity In Sandisk?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives