- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Is Super Micro Computer at an Attractive Price After 26.8% Drop and AI Server Surge?

Reviewed by Bailey Pemberton

- Wondering if Super Micro Computer’s stock price is finally at a sweet spot or still running hot? You’re not alone. There’s plenty to dig into before making a decision.

- The stock has delivered a jaw-dropping 1312.8% return over five years and is still up 34.2% this year. However, it has pulled back sharply with a 26.8% drop in the past month alone.

- Much of this recent volatility has been driven by news highlighting surging demand for Super Micro’s AI-optimized servers, along with headline-grabbing partnerships with major tech players. Industry buzz is keeping investors on their toes as the company’s rapid expansion into next-generation data centers continues to draw attention.

- Right now, Super Micro Computer scores a 1 out of 6 on our valuation checks, suggesting it may only offer value in one area. We’ll break down each approach to valuation in the next sections, but stick around for the real key to understanding where the stock could head next.

Super Micro Computer scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Super Micro Computer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's current intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors determine if a stock is undervalued or overvalued compared to its actual earning power over time.

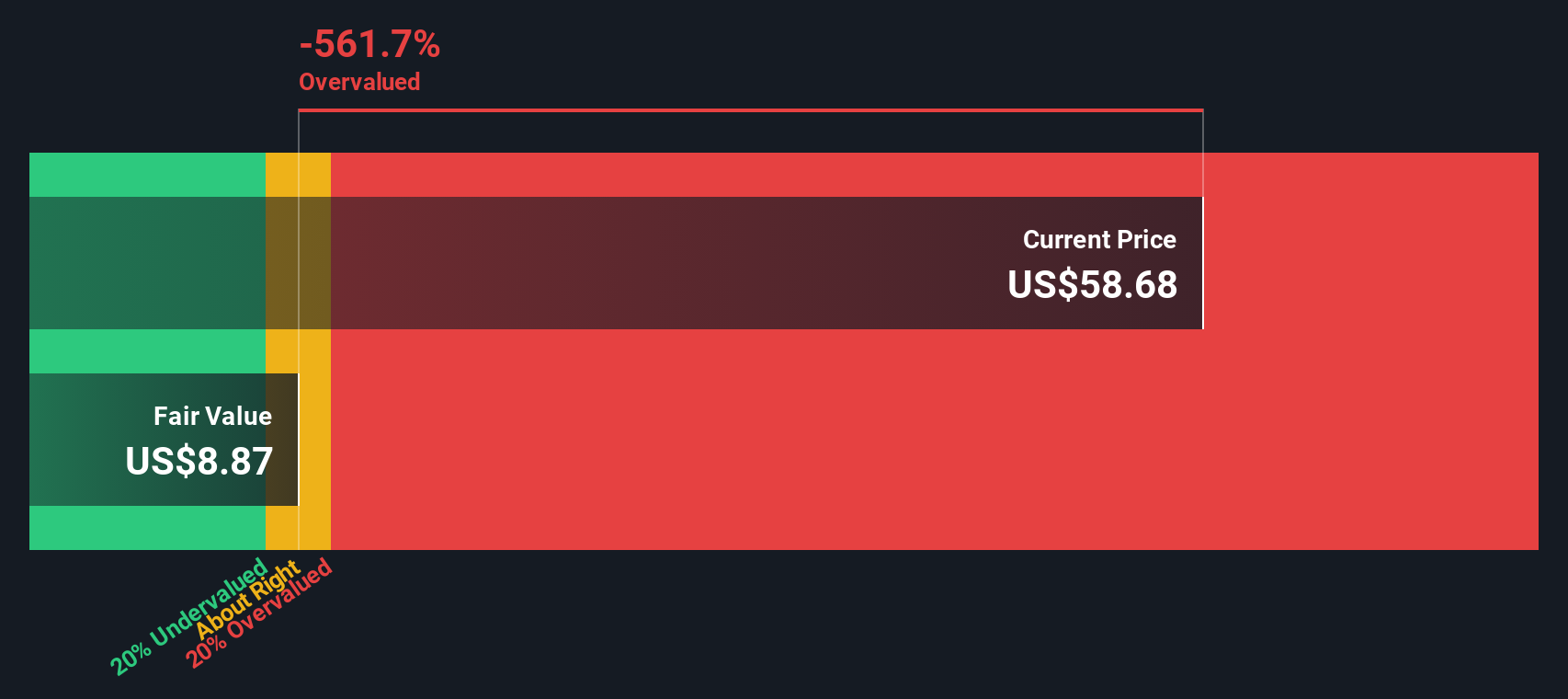

For Super Micro Computer, the current Free Cash Flow stands at $195.1 Million. Analysts predict significant growth over the coming years, with projections reaching approximately $1.33 Billion by 2027 and then moderating to about $365 Million by 2035. The model used here, a 2 Stage Free Cash Flow to Equity, relies on five years of analyst estimates and extrapolates further out using modeled growth assumptions.

Applying the DCF methodology, the estimated intrinsic value per share is $9.18. The current stock price is trading far above this level. According to the model, Super Micro Computer appears to be 339.5% overvalued based on future cash flow expectations alone.

Investors need to be cautious, as the DCF assessment currently points to a disconnect between the company's share price and its underlying long-term cash generation potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Super Micro Computer may be overvalued by 339.5%. Discover 860 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Super Micro Computer Price vs Earnings

For established and profitable companies like Super Micro Computer, the Price-to-Earnings (PE) ratio is a widely accepted way to gauge valuation. This metric tells investors how much they are paying for each dollar of the company’s earnings, making it especially useful for understanding companies that consistently generate profits.

Growth prospects and associated risks play a big role in what counts as a “normal” or “fair” PE ratio. Companies with stronger future earnings potential or lower risks often command higher PE multiples. Those facing headwinds or lower growth usually are valued with lower PEs.

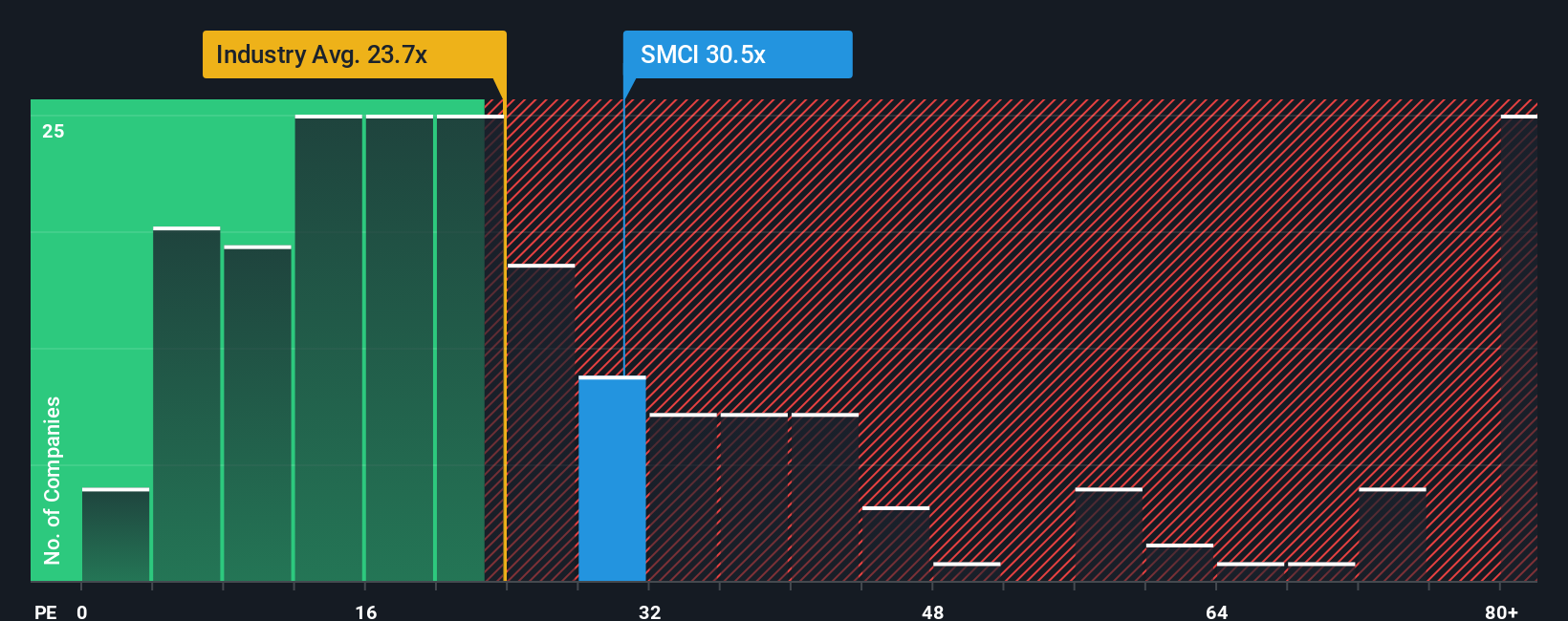

Right now, Super Micro Computer is trading at a PE ratio of 30.2x. To put this in perspective, the average PE for its industry peers is 22.6x, and the broader tech industry sits at 23.2x. Super Micro’s PE is noticeably higher than these benchmarks, reflecting the market’s enthusiasm for its growth and profitability.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio weighs factors like the company’s earnings growth, risk profile, profit margins, industry characteristics, and even market cap to arrive at a more tailored valuation target. This makes it a far more nuanced benchmark than simply looking at peer or industry averages alone.

For Super Micro Computer, the Fair Ratio is calculated at a hefty 93.0x. Compared to the current PE of 30.2x, the stock actually appears undervalued using this holistic approach, even though it trades above more traditional benchmarks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Super Micro Computer Narrative

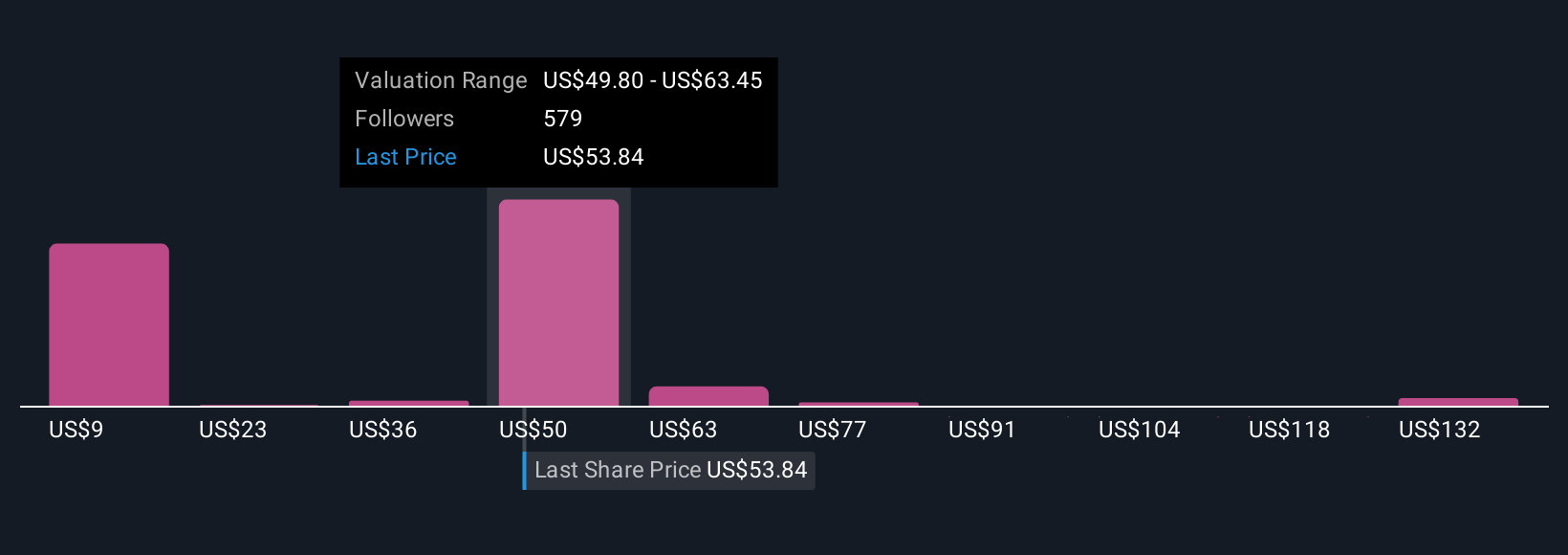

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable tool that allows you to tell the story you believe about a company by connecting your view of its future, such as revenue growth, margins, and market share, to a financial forecast and a personal estimate of fair value.

Narratives bridge the gap between the numbers and the big-picture vision, helping you see how your expectations shape a stock's value. Available within the Simply Wall St Community page, this tool is already trusted by millions of investors to compare their own fair value calculations against the current share price, offering clear buy or sell signals in real time.

Whenever new information like news, earnings, or company updates emerges, Narratives are updated dynamically, keeping your investment decision-making current and relevant. For example, some investors believe Super Micro Computer could be worth as much as $126.52 per share if its AI leadership and new partnerships deliver on ambitious revenue targets. Others see fair value as low as $15.00 if governance issues persist and competition intensifies. Narratives let you test both scenarios, so you can invest based on your own informed conviction, not just static ratios.

Do you think there's more to the story for Super Micro Computer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives