- United States

- /

- Tech Hardware

- /

- NasdaqCM:SCKT

Socket Mobile, Inc.'s (NASDAQ:SCKT) Prospects Need A Boost To Lift Shares

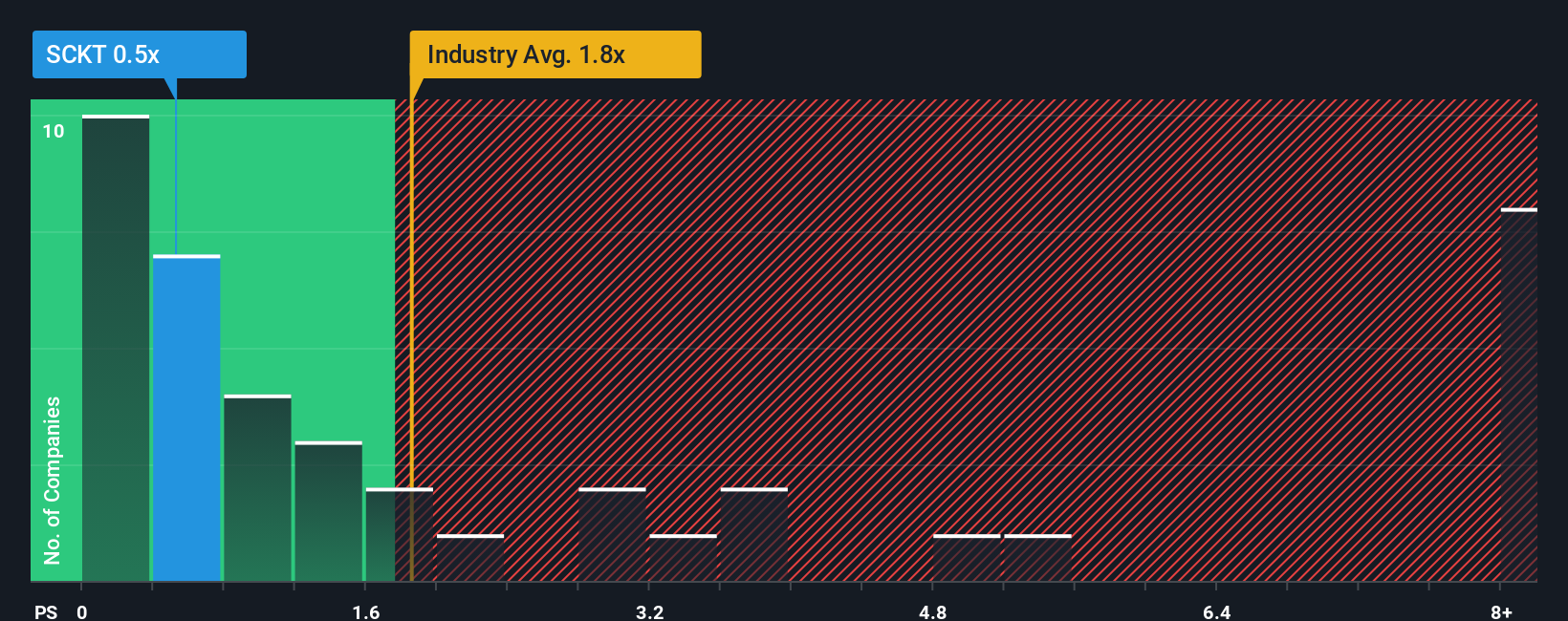

With a price-to-sales (or "P/S") ratio of 0.5x Socket Mobile, Inc. (NASDAQ:SCKT) may be sending bullish signals at the moment, given that almost half of all the Tech companies in the United States have P/S ratios greater than 1.8x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Socket Mobile

What Does Socket Mobile's Recent Performance Look Like?

For example, consider that Socket Mobile's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Socket Mobile will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Socket Mobile, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Socket Mobile's Revenue Growth Trending?

In order to justify its P/S ratio, Socket Mobile would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 28% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 10% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Socket Mobile is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Socket Mobile's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Socket Mobile confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Socket Mobile that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SCKT

Socket Mobile

Provides data capture and delivery solutions in the United States, Europe, Asia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives