- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Is It Time To Revisit ePlus (PLUS) After Recent Share Price Pullback

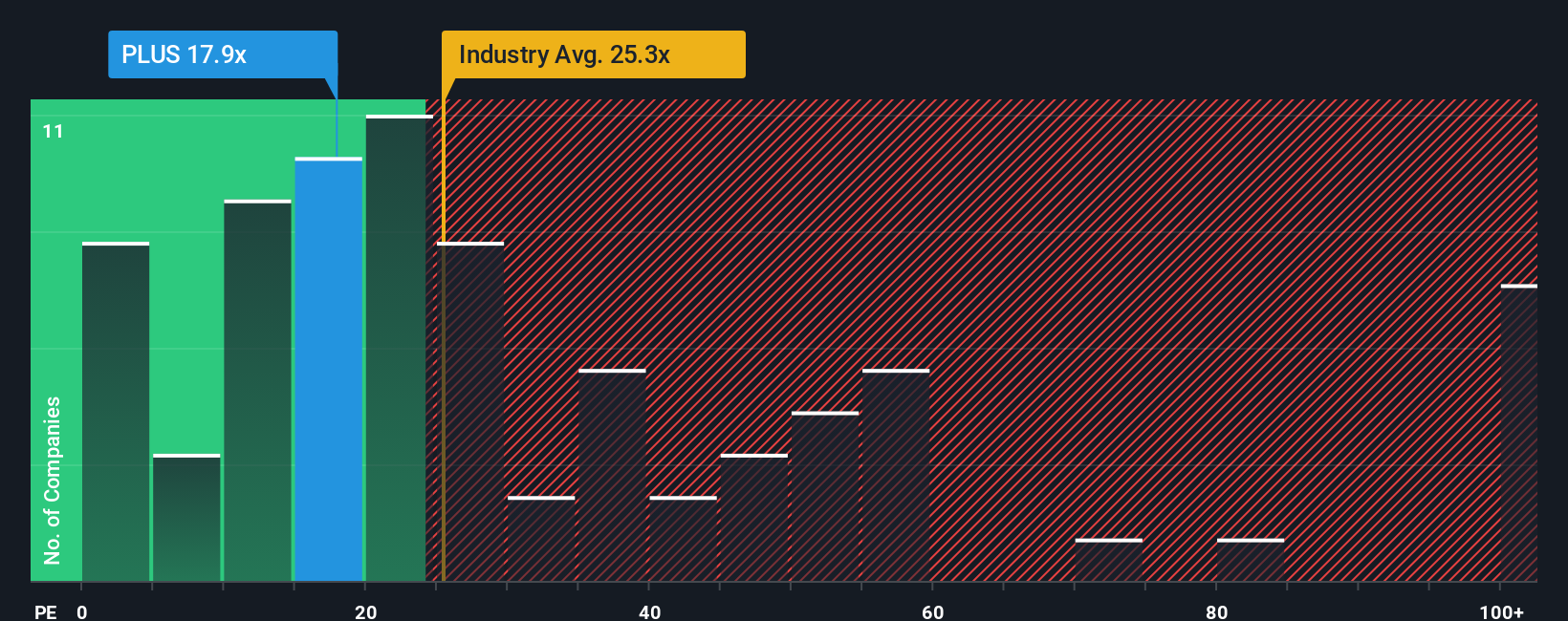

- If you are wondering whether ePlus at around US$83.88 is offering fair value or hiding a margin of safety, you are not alone.

- The stock has seen short term pullbacks, with a 3.4% decline over the last 7 days and 4.3% over the last 30 days, while still sitting on a 20.0% return over 1 year and 88.4% over 5 years.

- These mixed returns have kept interest alive in how the market is currently sizing up ePlus, as investors weigh its recent share price softness against its longer term record. This article was created to provide ongoing, evergreen coverage of the company so you have a clear and up to date view of what that pricing might reflect.

- ePlus currently scores 5 out of 6 on our valuation checks, giving it a valuation score of 5. Next we will walk through the key valuation approaches behind that number, before finishing with a framework that can help you make more sense of where value truly sits.

Find out why ePlus's 20.0% return over the last year is lagging behind its peers.

Approach 1: ePlus Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of a company’s future cash flows and then discounts them back to today’s dollars to arrive at an implied value per share.

For ePlus, the model used is a 2 Stage Free Cash Flow to Equity approach. On a last twelve months basis, free cash flow is reported as a loss of about $68.2 million. Looking ahead, the projections used in the model show free cash flow moving to $151.7 million by the year ending March 2028, with further annual figures out to 2035 based on a mix of analyst input and extrapolations.

Bringing all those future cash flows back to today and dividing by the shares outstanding gives an estimated intrinsic value of about $124.41 per share. Compared with the recent share price of roughly $83.88, this suggests the stock is around 32.6% undervalued according to this DCF output.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ePlus is undervalued by 32.6%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: ePlus Price vs Earnings

For a profitable business like ePlus, the P/E ratio is a useful way to see what you are paying for each dollar of earnings. It keeps the focus on the bottom line, which ultimately supports dividends, buybacks and reinvestment.

What counts as a “normal” P/E really comes down to what investors expect from a company’s future growth and how risky they think those earnings are. Higher growth or lower perceived risk can justify a higher multiple, while slower growth or higher risk usually calls for a lower one.

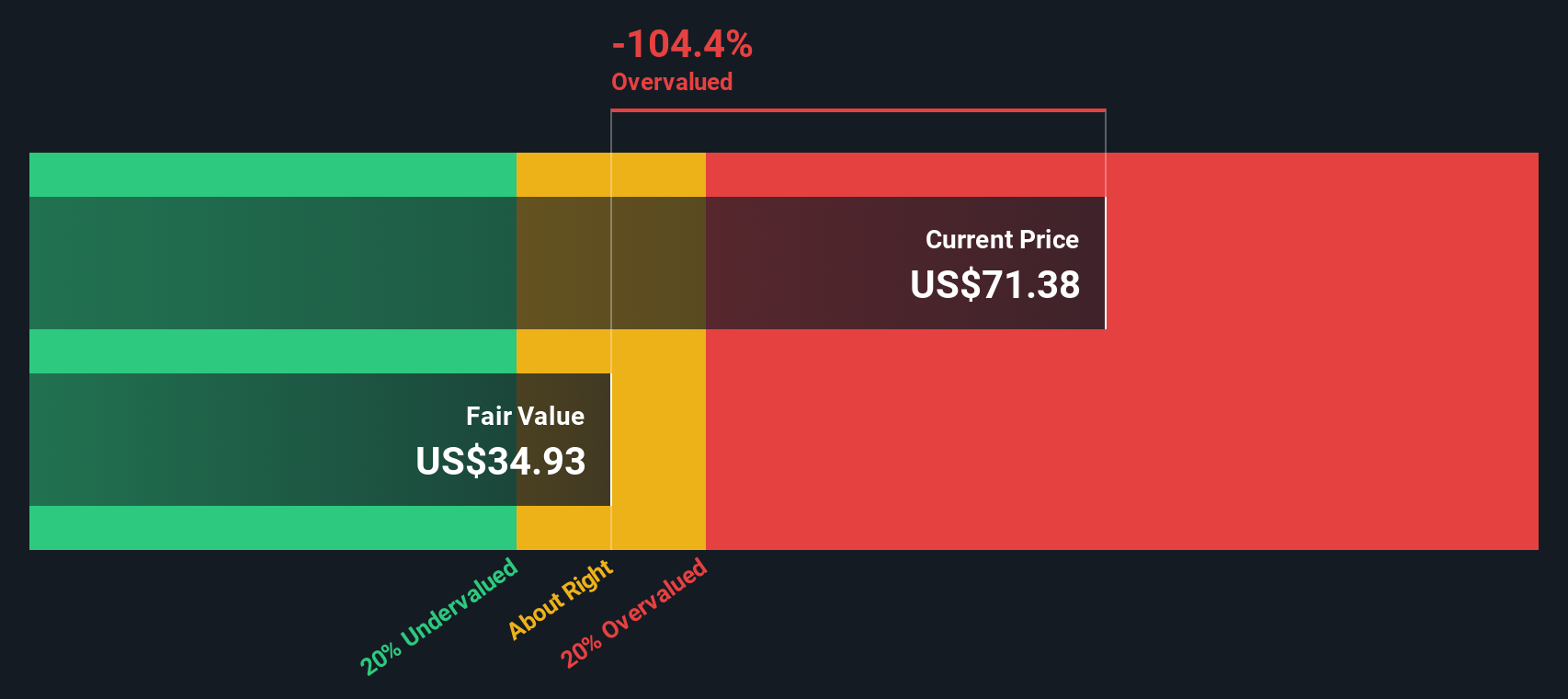

ePlus currently trades on a P/E of 14.81x. That sits below the Electronic industry average of 28.31x and also below the peer group average of 19.87x. Simply Wall St’s “Fair Ratio” for ePlus is 20.30x. This is a proprietary estimate of what the P/E might be given factors like its earnings growth profile, industry, profit margins, market value and company specific risks.

Because the Fair Ratio blends these company specific drivers, it can be more tailored than a simple comparison with broad industry or peer averages. Lining up the Fair Ratio of 20.30x against the current 14.81x suggests the shares are trading below that fair multiple.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

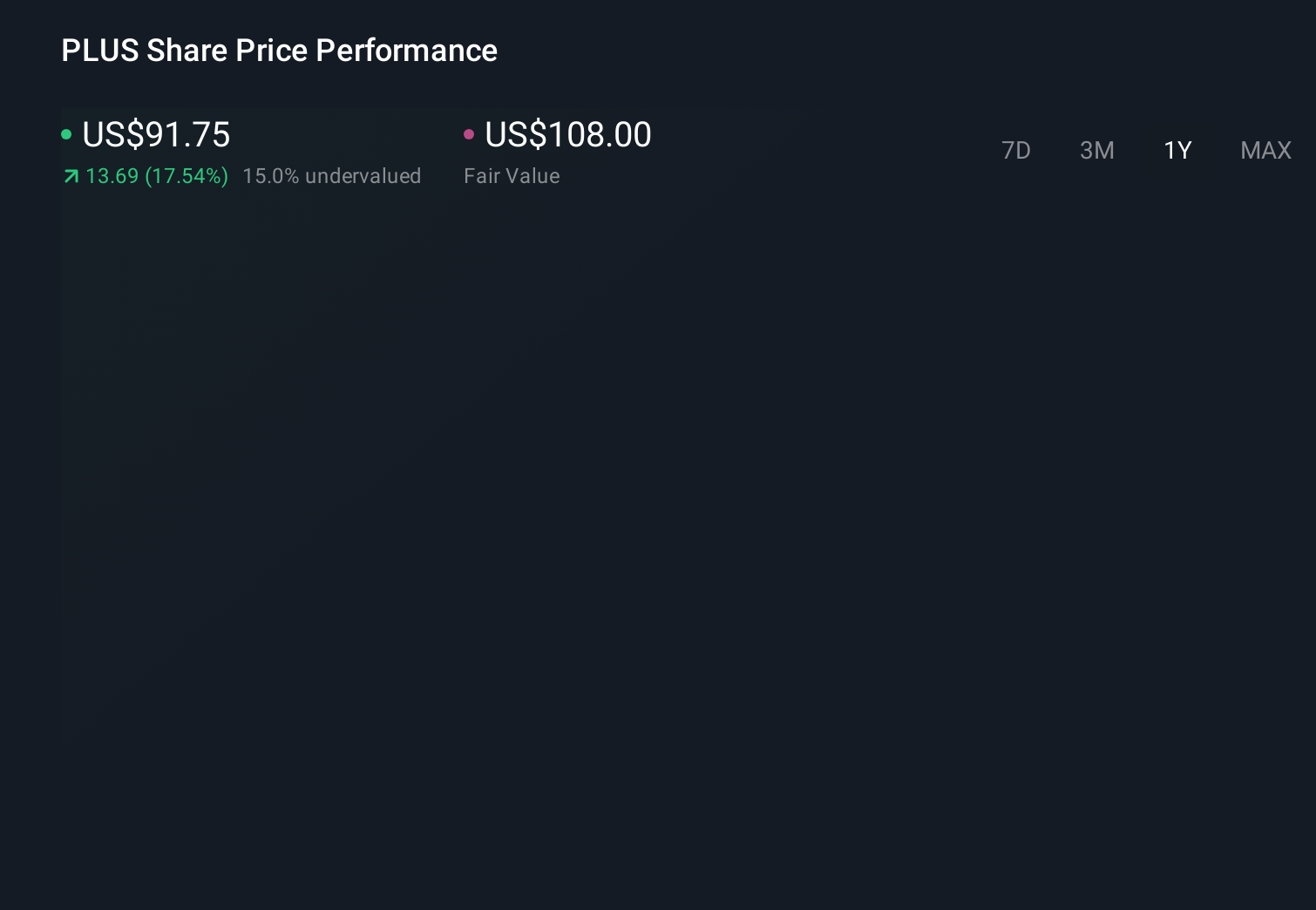

Upgrade Your Decision Making: Choose your ePlus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St's Community page that lets you connect your view of ePlus's story to a clear set of revenue, earnings and margin forecasts. These then roll up into a fair value you can compare to the current share price. They update automatically as new news or earnings arrive, and can even differ meaningfully from other investors. For example, someone who accepts the consensus fair value of US$108 and a future P/E of 28.85x can compare their view to a more cautious Narrative that leans on lower margins or slower revenue growth and therefore lands on a lower fair value. This helps each investor decide whether the gap between their fair value and the market price looks attractive or stretched.

Do you think there's more to the story for ePlus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.