- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

ePlus (PLUS): Examining Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for ePlus.

After posting sharp short-term gains, ePlus has pushed its share price to $84.88 and built strong momentum over the past quarter. Even so, the company’s 1-year total shareholder return remains in negative territory, indicating that recent enthusiasm is balancing against earlier declines. Long-term investors have still fared well, with robust three- and five-year total returns.

If ePlus’s recent momentum has you interested in finding what else is powering ahead, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

This recent surge in price raises an important question for investors: Is ePlus currently undervalued based on its fundamentals, or has the market already priced in any future growth potential?

Most Popular Narrative: 21.4% Undervalued

With ePlus's fair value estimated at $108 per share and the stock closing at $84.88, the most closely followed narrative contends that the market is significantly underpricing its future prospects. The valuation gap sparks an important debate about where the company's growth trajectory is headed versus what investors are currently willing to pay.

Persistent demand for AI-powered infrastructure, security, and cloud solutions across industries is expected to accelerate. ePlus's focused investments in AI consultative capabilities and AI-related "plumbing" (compute, networking, security) position the company to capture outsized revenue growth as enterprise adoption of digital transformation initiatives gathers pace.

How does ePlus justify a valuation that stands well above its current stock price? The secret sauce behind the price target lies in a bullish forecast for recurring revenue and margin improvement, plus confidence in the power of its next-generation tech offerings. Want to see what assumptions and bold predictions really drive this valuation? Continue reading to discover the precise growth levers that make up this narrative's story.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent growth could prove unsustainable if large customer deals do not repeat or if margin compression from lower-value contracts continues.

Find out about the key risks to this ePlus narrative.

Another View: How Do Market Multiples Compare?

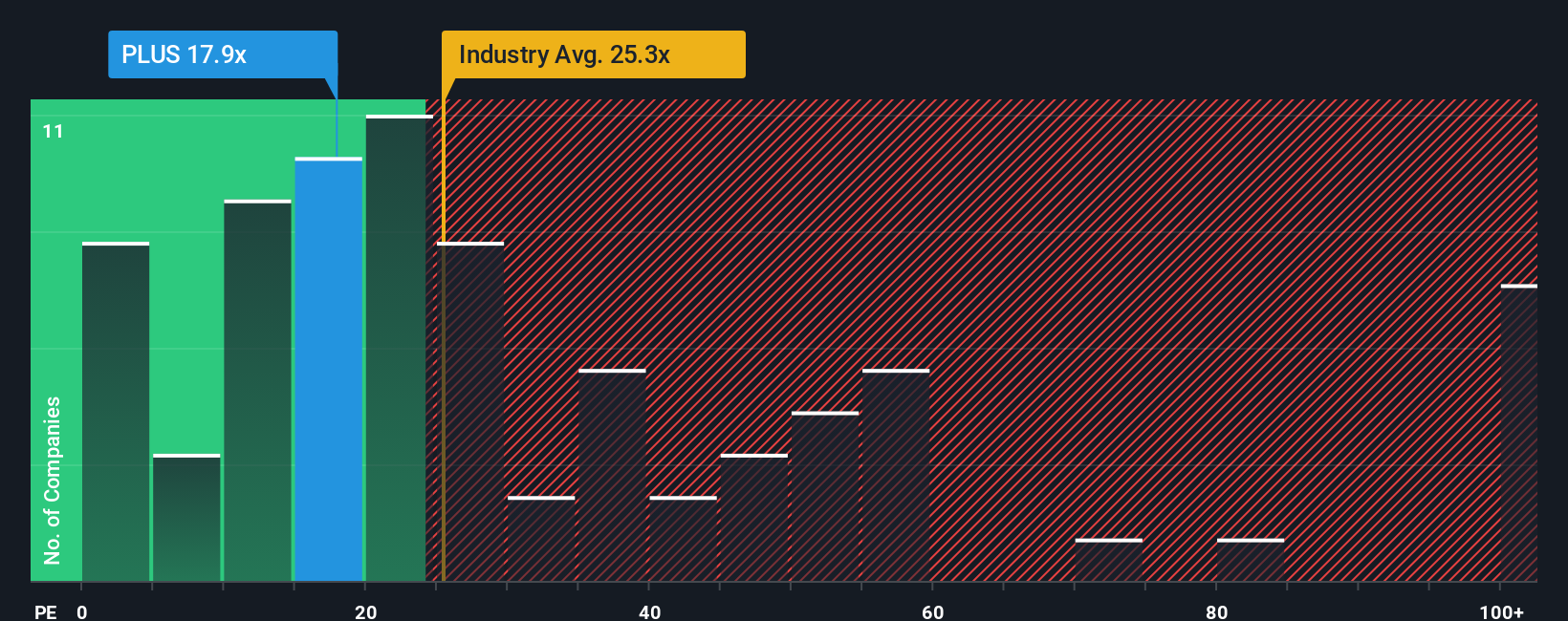

Looking through the lens of the price-to-earnings ratio, ePlus trades at 17.3 times earnings. This is slightly higher than its peer group (16.5x), but noticeably lower than the broader US Electronic industry, which is currently at 24.9x. Compared to its own fair ratio of 18.4x, ePlus sits just below where the market could move. Does this gap reveal opportunity, or raise concerns about how investors are pricing future risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ePlus Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the market to move without you. Smart investors seek out the next opportunity. Get ahead of the crowd with these tailored stock ideas:

- Earn steady income and secure your financial base by reviewing these 16 dividend stocks with yields > 3%, offering yields above 3% for consistent cash flow potential.

- Capitalize on powerful trends in artificial intelligence by investigating these 24 AI penny stocks, helping to redefine industries and transform tomorrow’s business landscape.

- Seek untapped value and growth potential. Evaluate these 870 undervalued stocks based on cash flows, trading at attractive valuations based on cash flows before they catch broader attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives