This article will reflect on the compensation paid to Patrick Lo who has served as CEO of NETGEAR, Inc. (NASDAQ:NTGR) since 2002. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for NETGEAR

Comparing NETGEAR, Inc.'s CEO Compensation With the industry

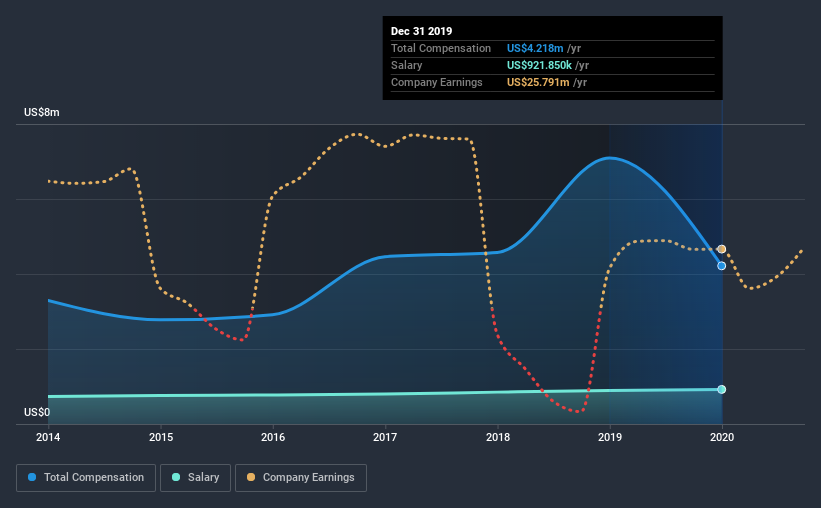

According to our data, NETGEAR, Inc. has a market capitalization of US$984m, and paid its CEO total annual compensation worth US$4.2m over the year to December 2019. We note that's a decrease of 41% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$922k.

For comparison, other companies in the same industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$2.5m. Accordingly, our analysis reveals that NETGEAR, Inc. pays Patrick Lo north of the industry median. Moreover, Patrick Lo also holds US$14m worth of NETGEAR stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$922k | US$895k | 22% |

| Other | US$3.3m | US$6.2m | 78% |

| Total Compensation | US$4.2m | US$7.1m | 100% |

On an industry level, roughly 28% of total compensation represents salary and 72% is other remuneration. NETGEAR sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

NETGEAR, Inc.'s Growth

NETGEAR, Inc. has reduced its earnings per share by 26% a year over the last three years. In the last year, its revenue is up 10%.

The decline in EPS is a bit concerning. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has NETGEAR, Inc. Been A Good Investment?

With a total shareholder return of 2.6% over three years, NETGEAR, Inc. has done okay by shareholders. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As previously discussed, Patrick is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look great when you realize that the company has been suffering from negative EPS growth for the last three years. While shareholder returns are acceptable, they don't delight. So you may want to delve deeper, because we don't think the amount Patrick makes is justifiable.

Shareholders may want to check for free if NETGEAR insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading NETGEAR or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NETGEAR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:NTGR

NETGEAR

Provides connectivity solutions the Americas; Europe, the Middle East, Africa; and the Asia Pacific.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026