- United States

- /

- Communications

- /

- NasdaqGS:NTCT

Will Omnis KlearSight for Kubernetes Redefine NetScout Systems' (NTCT) Cloud Visibility Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, NETSCOUT SYSTEMS, INC. introduced the Omnis KlearSight Sensor for Kubernetes, a new solution delivering real-time deep observability and actionable insights for large, encrypted, cloud-native environments.

- KlearSight enables organizations to monitor application-layer communications across complex, multi-cluster Kubernetes deployments without needing encryption keys, addressing critical visibility challenges in modern cloud infrastructure.

- We'll examine how this launch of advanced Kubernetes observability could shape NetScout's position in network security and cloud monitoring solutions.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NetScout Systems Investment Narrative Recap

For shareholders, the core belief hinges on NetScout’s ability to lead in cloud observability and cybersecurity, where innovation is vital to stay ahead of escalating digital threats. The Omnis KlearSight Sensor announcement addresses a pressing need for visibility in encrypted, cloud-native environments, which could further underpin enterprise demand and the cybersecurity segment’s momentum, a major short-term catalyst. However, the biggest risk remains whether NetScout can sustain growth as cloud migrations continue and technology stacks consolidate.

Of recent company news, the July upgrade to AI-powered DDoS protection stands out given the overlap with the KlearSight launch. Both emphasize NetScout’s focus on using advanced technology to solve real-world security and monitoring challenges, supporting the thesis that ongoing product innovation is critical for customer retention and growth. Maintaining this trajectory will depend on...

Read the full narrative on NetScout Systems (it's free!)

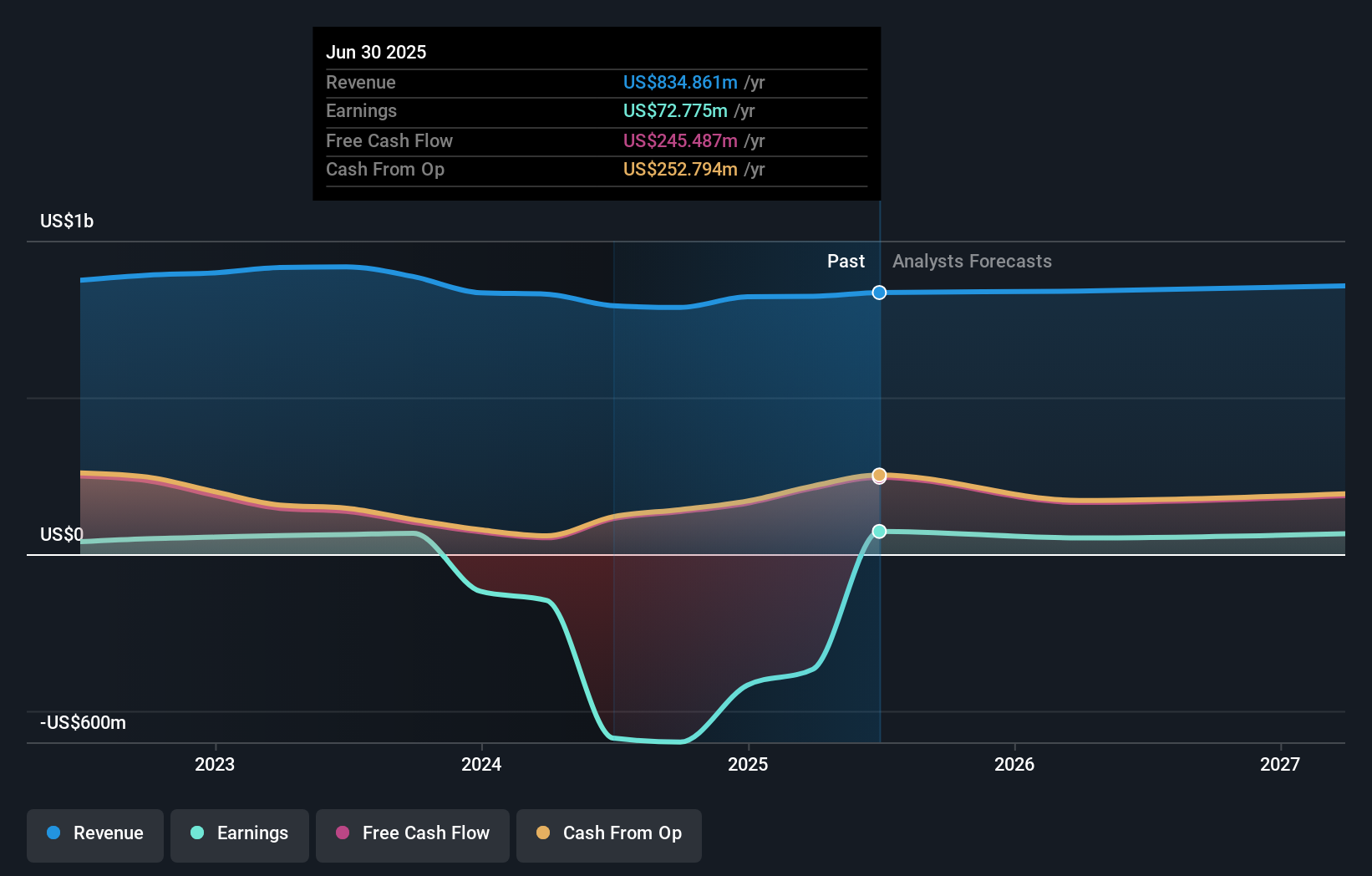

NetScout Systems' outlook forecasts $905.7 million in revenue and $49.6 million in earnings by 2028. This assumes annual revenue growth of 2.8% and a decrease in earnings of $23.2 million from the current level of $72.8 million.

Uncover how NetScout Systems' forecasts yield a $28.76 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value for NetScout between US$28.76 and US$43.00, reflecting broad differences in how investors value the company's growth prospects. As cloud adoption surges, many view product innovation in Kubernetes visibility as a key factor that could drive long-term performance, explore how these perspectives align or differ from your own.

Explore 2 other fair value estimates on NetScout Systems - why the stock might be worth as much as 60% more than the current price!

Build Your Own NetScout Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetScout Systems research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NetScout Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetScout Systems' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetScout Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTCT

NetScout Systems

Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives