- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

Napco Security Technologies (NASDAQ:NSSC) Is Increasing Its Dividend To $0.125

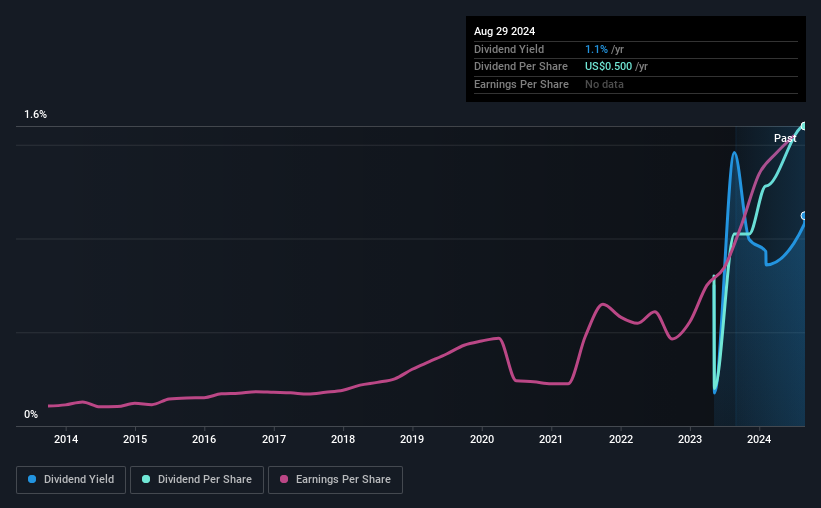

Napco Security Technologies, Inc.'s (NASDAQ:NSSC) dividend will be increasing from last year's payment of the same period to $0.125 on 3rd of October. This takes the annual payment to 1.1% of the current stock price, which is about average for the industry.

Check out our latest analysis for Napco Security Technologies

Napco Security Technologies' Earnings Easily Cover The Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, Napco Security Technologies was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 19.9%. If the dividend continues on this path, the payout ratio could be 25% by next year, which we think can be pretty sustainable going forward.

Napco Security Technologies Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Napco Security Technologies has grown earnings per share at 32% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We Really Like Napco Security Technologies' Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 7 analysts we track are forecasting for Napco Security Technologies for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NSSC

Napco Security Technologies

Engages in the development, manufacturing, and sale of electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.