- United States

- /

- Communications

- /

- NasdaqCM:GNSS

Genasys (NASDAQ:GNSS) shareholders are up 13% this past week, but still in the red over the last three years

Genasys Inc. (NASDAQ:GNSS) shareholders will doubtless be very grateful to see the share price up 80% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 37% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Genasys

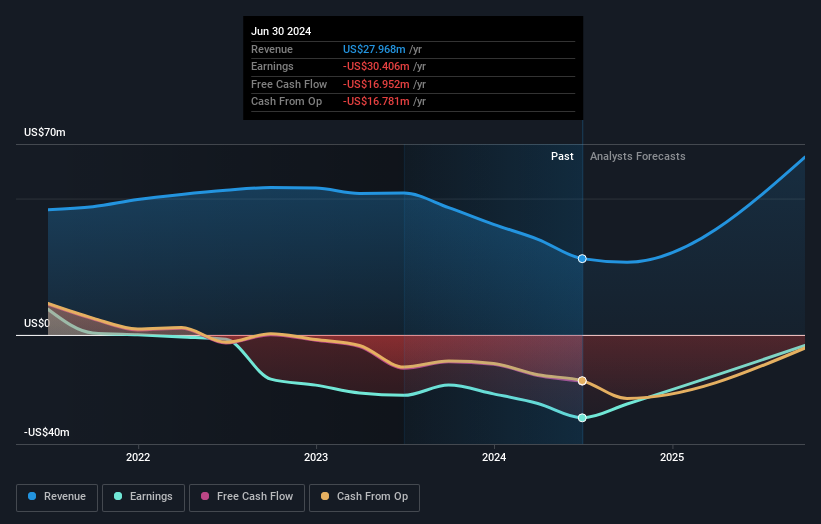

Given that Genasys didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Genasys saw its revenue shrink by 10% per year. That's not what investors generally want to see. The annual decline of 11% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Genasys shareholders gained a total return of 8.5% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.9% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Genasys you should be aware of, and 1 of them is significant.

Genasys is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GNSS

Genasys

Designs, develops, and sells critical communications hardware and software solutions to alert, inform, and protect people principally in the Asia Pacific, North and South America, Europe, the Middle East, and Africa.

Limited growth with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026