- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

Could Recognition Initiatives Offset Operational Hurdles for PC Connection (CNXN) Amid Limited Investment Capacity?

Reviewed by Sasha Jovanovic

- Connection (PC Connection, Inc.; NASDAQ: CNXN) recently announced the winners of its 5th annual IT Superhero Awards at the Connection Technology Summit in Phoenix, Arizona, recognizing IT professionals for innovation, dedication, and expertise.

- The company's charitable donations as part of its Connection Cares initiative highlight a commitment to social impact, though recent commentary points to operational challenges, including annual sales declines and limited investment capacity.

- With the company's ongoing business hurdles and constrained investment ability in focus, we'll now explore how this shapes PC Connection's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

PC Connection Investment Narrative Recap

To be a shareholder in PC Connection (NASDAQ: CNXN), investors must have confidence in the company's ability to transition from its legacy focus on hardware reselling toward higher-margin IT solutions and services, capitalizing on digital transformation trends. The recent recognition of IT professionals and emphasis on charitable giving signal positive company culture, but these initiatives are not likely to materially affect near-term catalysts, such as the company's ability to harness advanced technology demand, or the current risk of sustained sales and margin pressure.

Among recent company announcements, the launch of Copilot+ PCs in partnership with Microsoft and Qualcomm stands out. This aligns closely with PC Connection’s push into AI-enabled and advanced tech solutions, directly supporting its pipeline and addressing a key growth catalyst: increasing organizational investment in digital upgrades and next-generation IT infrastructure.

Yet, in contrast, investors should be aware that ongoing reliance on hardware reselling could...

Read the full narrative on PC Connection (it's free!)

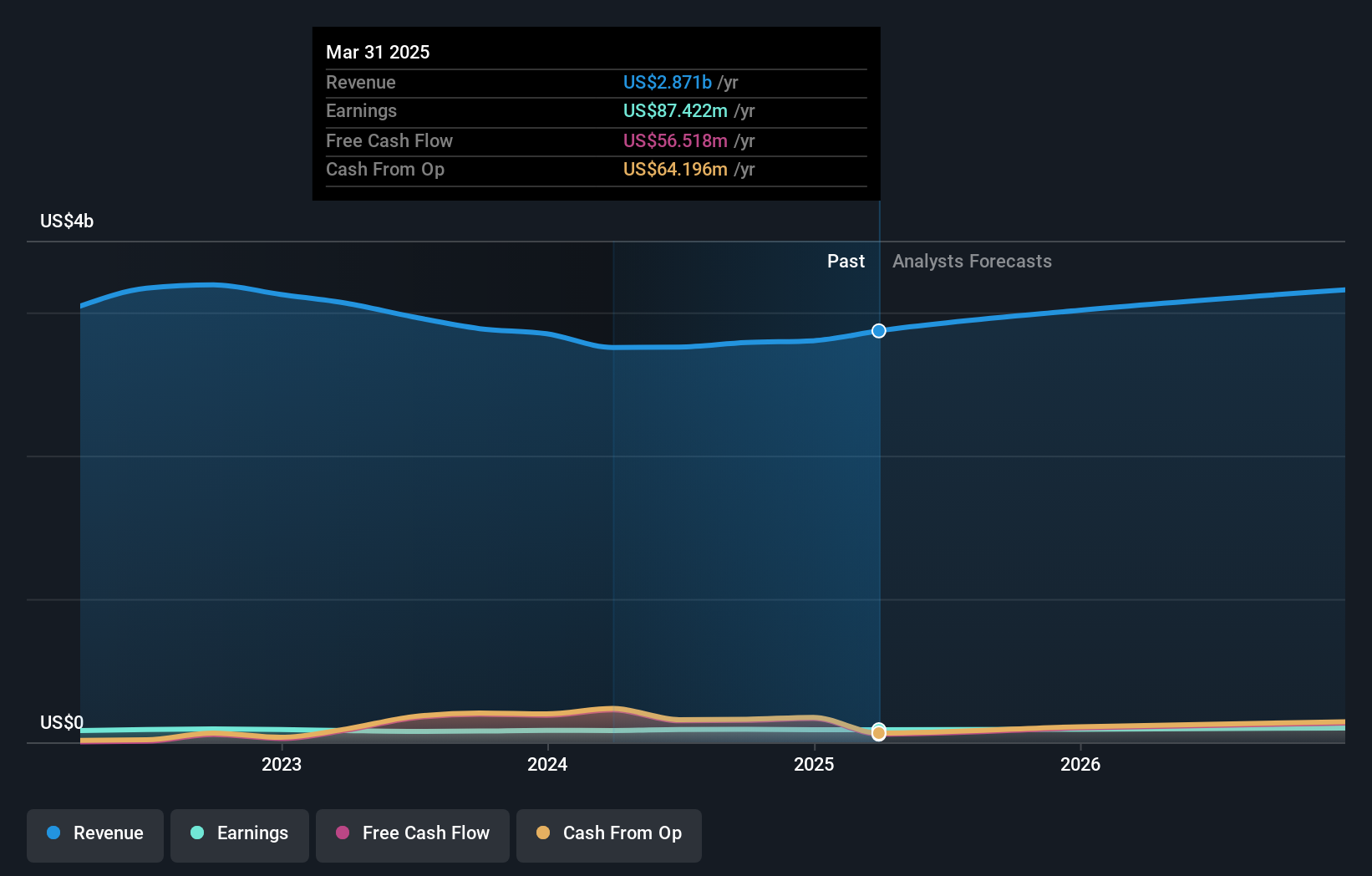

PC Connection's outlook anticipates $3.4 billion in revenue and $116.0 million in earnings by 2028. This requires 5.4% annual revenue growth and a $30.0 million earnings increase from current earnings of $86.0 million.

Uncover how PC Connection's forecasts yield a $76.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for CNXN range from US$65.56 to US$96.49, based on three independent analyses. While some participants see deep value, continued pressure on gross margins remains a focal point that could shape future returns, consider multiple perspectives when forming your view.

Explore 3 other fair value estimates on PC Connection - why the stock might be worth just $65.56!

Build Your Own PC Connection Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PC Connection research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PC Connection research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PC Connection's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives