- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Avnet (AVT) Valuation: Weighing Revenue Growth Against Profit Pressures After Latest Quarterly Report

Reviewed by Simply Wall St

Avnet (AVT) shares caught investor attention after the company’s latest quarterly earnings showed revenue outpacing analyst forecasts, with strong performance in Asia and in Farnell. Despite this, profits slipped and guidance missed expectations.

See our latest analysis for Avnet.

After delivering better-than-expected revenue and completing another round of share buybacks, Avnet’s latest quarter hasn’t overcome sliding sentiment. Despite short-term optimism from strong Asian sales, the 1-year total shareholder return stands at -14.3%, reflecting a year of fading momentum. Over a longer period, shareholders who remained invested have seen significant gains, with Avnet’s 5-year total return at an impressive 86.4%.

If you’re watching how tech stocks are adjusting after mixed earnings, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With Avnet’s shares trading at a discount to analyst price targets and recent results showing mixed signals, investors are left to question whether there is untapped value here or if the market is already factoring in future growth.

Most Popular Narrative: 10.8% Undervalued

Avnet's latest narrative sets its fair value well above the current share price, challenging the notion that tech distribution is stuck in slow growth. This perspective points to future earnings power and margin expansion as central drivers for a stronger upside.

Expanded investment in digital infrastructure, proprietary customer platforms, and improved e-commerce capabilities—particularly at Farnell—strengthen customer experience and retention, enhancing Avnet's ability to capture market share in high-growth sectors (cloud/AI, industrial automation, EVs). This is expected to drive higher-margin recurring revenues and operating leverage.

Want to understand the rationale behind this bullish fair value? The narrative hinges on a dramatic turnaround in profitability, with earnings projections and future multiples that might raise eyebrows. Wondering what makes analysts believe Avnet can close this value gap? Dive deeper and get the full story.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from lower-profit Asian sales and weak EMEA demand remain key risks that could stall Avnet’s recovery narrative.

Find out about the key risks to this Avnet narrative.

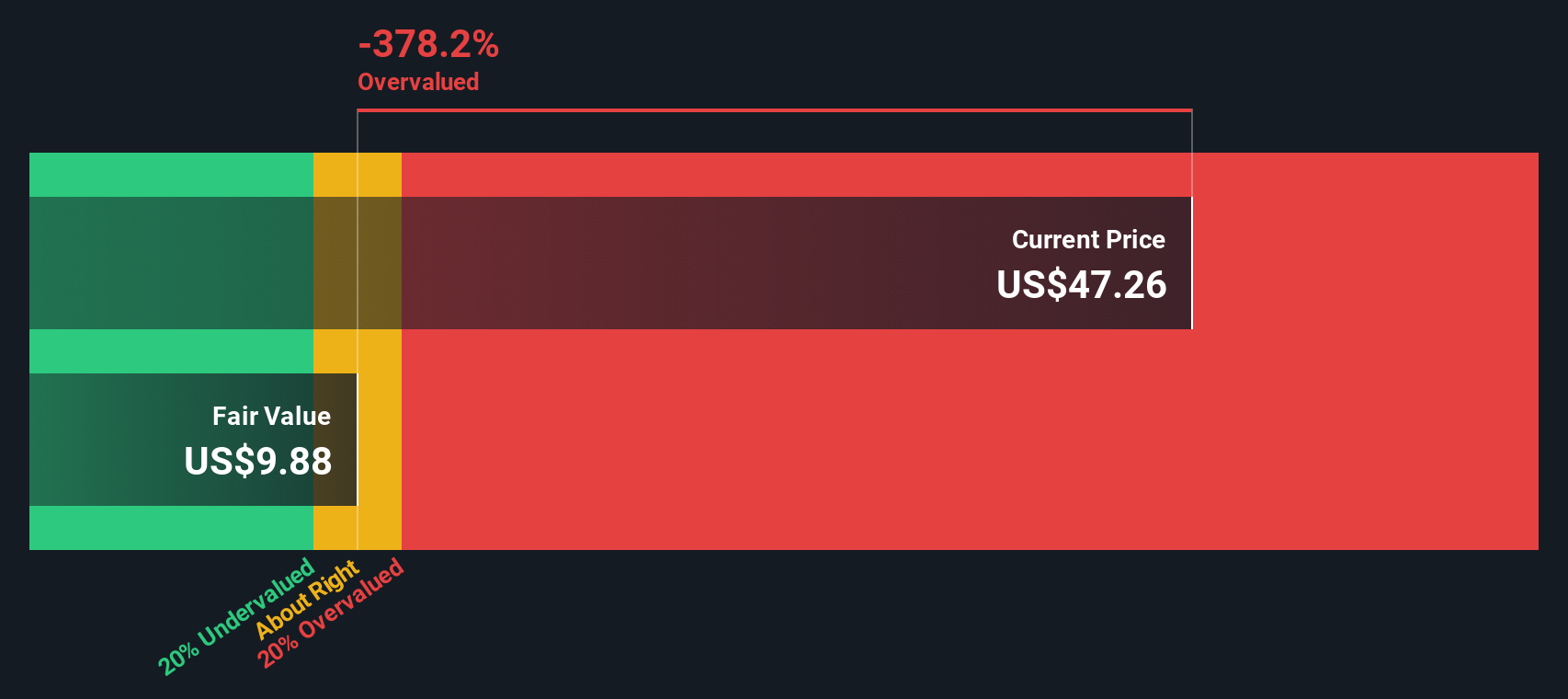

Another View: Discounted Cash Flow Questions the Upside

While analysts see Avnet as undervalued based on future earnings and multiples, our SWS DCF model tells a different story, estimating fair value at just $9.87, which is far below the current share price. This big gap raises a critical question for investors: which forecast should you believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avnet Narrative

If you see things differently or want to dig into the data your own way, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Avnet research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Give yourself an edge by hunting for your next big move among tomorrow’s innovators and proven winners using these tailored picks:

- Capture big yields and reliable income by checking out these 16 dividend stocks with yields > 3% with strong payout histories and above-average returns.

- Get ahead of the next AI boom and seize your chance to own a piece of the future through these 24 AI penny stocks targeting breakthroughs in artificial intelligence.

- Spot undervalued opportunities before the market does by digging into these 870 undervalued stocks based on cash flows, where solid financials meet attractive price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives