Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

High Growth Tech Stocks To Watch In August 2024

Reviewed by Simply Wall St

The market has stayed flat over the past 7 days but is up 25% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying high-growth tech stocks that can capitalize on these favorable conditions becomes crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.76% | 28.05% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Rhythm Pharmaceuticals (NasdaqGM:RYTM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in therapies for rare neuroendocrine diseases with a market cap of $2.82 billion.

Operations: Rhythm Pharmaceuticals focuses on developing and commercializing therapies for patients with rare neuroendocrine diseases, generating $101.78 million in revenue. The company's market cap stands at $2.82 billion.

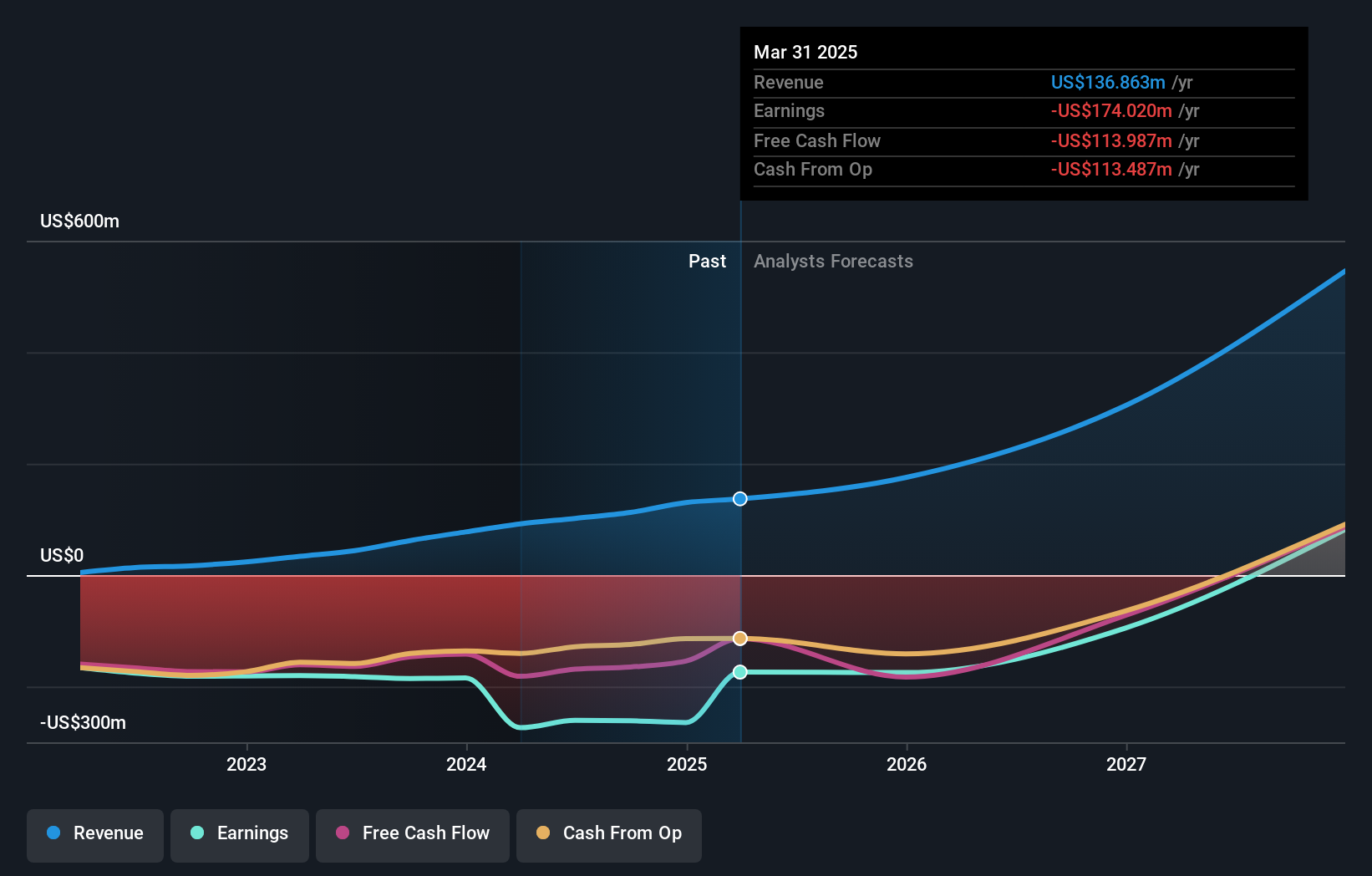

Rhythm Pharmaceuticals is making significant strides with its recent FDA acceptance of the sNDA for IMCIVREE® for treating obesity in children as young as 2 years old, highlighting a potential market expansion. The company's revenue saw a notable increase to $29.08 million in Q2 2024 from $19.22 million the previous year, while R&D expenses reflect their commitment to innovation, contributing significantly to future growth prospects. With earnings forecasted to grow by 66.8% annually and revenue expected to rise by 46.1%, Rhythm's strategic focus on rare genetic diseases positions it well within the high-growth tech landscape.

Altice USA (NYSE:ATUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Altice USA, Inc., along with its subsidiaries, offers broadband communications and video services across the United States, Canada, Puerto Rico, and the Virgin Islands with a market cap of approximately $1.19 billion.

Operations: Altice USA generates revenue primarily through its Cable TV Services, amounting to $9.11 billion. The company operates in multiple regions, including the United States, Canada, Puerto Rico, and the Virgin Islands.

Altice USA's recent financial performance shows a mixed picture, with Q2 2024 sales at $2.24 billion, down from $2.32 billion a year ago, and net income dropping to $15.36 million from $78.3 million. The company is forecasted to see earnings grow by 45.44% annually over the next three years despite an expected revenue decline of -2.1% per year during the same period, reflecting strategic shifts and potential profitability improvements ahead. Altice's R&D expenses are crucial for its innovation efforts in fiber connectivity and digital services, positioning it competitively within the tech landscape despite current challenges in profitability and shareholder equity dynamics.

- Click here to discover the nuances of Altice USA with our detailed analytical health report.

Understand Altice USA's track record by examining our Past report.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software for enterprises in the United States and internationally, with a market cap of approximately $5.50 billion.

Operations: Zeta Global Holdings Corp. generates revenue primarily from its Internet Software & Services segment, amounting to $822.09 million. The company focuses on providing consumer intelligence and marketing automation software through its data-driven cloud platform across various markets globally.

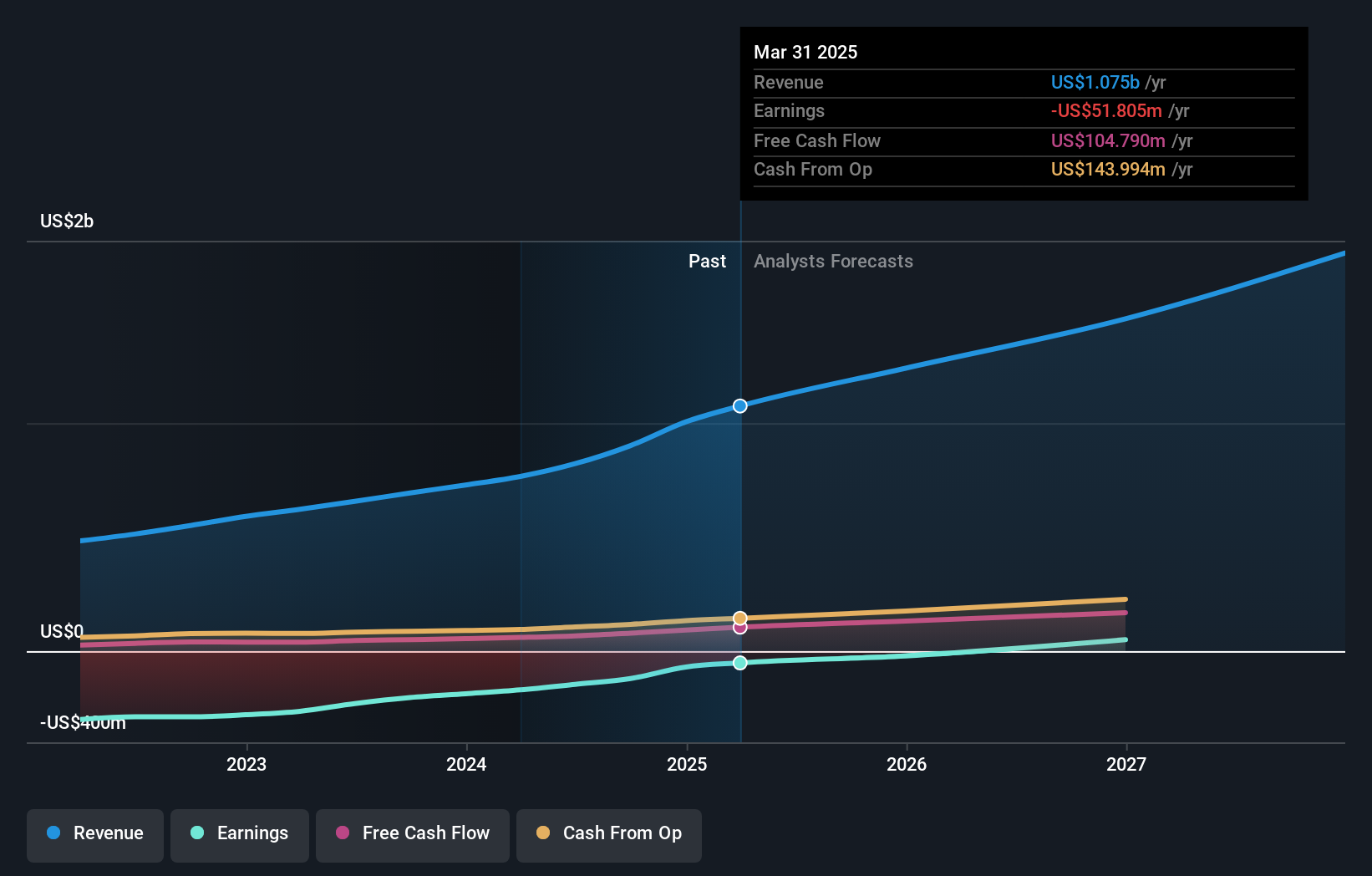

Zeta Global Holdings has shown a notable increase in Q2 2024 sales to $227.84 million from $171.82 million a year ago, reflecting its strong market presence and strategic client partnerships like RallyPoint. The company's R&D expenses have been pivotal, with investments driving innovation and contributing to the AI-powered platform's capabilities. Despite a net loss of $28.07 million for the quarter, this represents an improvement from the previous year's $52.16 million loss, indicating progress towards profitability as forecasted earnings are expected to grow by 119%.

- Click here and access our complete health analysis report to understand the dynamics of Zeta Global Holdings.

Gain insights into Zeta Global Holdings' past trends and performance with our Past report.

Make It Happen

- Get an in-depth perspective on all 249 US High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.