Stock Analysis

- United States

- /

- IT

- /

- NYSE:DAVA

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance with a 1.5% increase over the last week and a remarkable 33% climb over the past year, while earnings are projected to grow by 16% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these positive market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.59% | 43.53% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.33% | 62.45% | ★★★★★★ |

| Travere Therapeutics | 27.18% | 69.88% | ★★★★★★ |

| MediaAlpha | 22.72% | 61.31% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Integral Ad Science Holding (NasdaqGS:IAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Integral Ad Science Holding Corp. is a digital advertising verification company with operations in multiple countries including the United States, the United Kingdom, and Japan, and has a market cap of $1.68 billion.

Operations: IAS generates revenue primarily from its Internet Software & Services segment, amounting to $498.16 million. The company focuses on digital advertising verification across various international markets, ensuring the quality and effectiveness of online ads.

Integral Ad Science Holding Corp. (IAS) is demonstrating robust strides in the tech landscape, particularly with its recent innovations and strategic expansions. Notably, on October 10, 2024, IAS unveiled a pioneering optimization solution for advertisers on Meta platforms—this tool enhances brand safety by preventing ad placements near unsuitable content, signaling a significant advancement in digital advertising standards. Furthermore, IAS's commitment to R&D is evident as it allocated $12.2 million to these efforts last year alone, underscoring its dedication to leading-edge solutions and maintaining a competitive edge in the market. This investment represents a substantial portion of their revenue (41.4%), highlighting the company's strategic focus on long-term innovation rather than immediate returns. These moves are pivotal as IAS not only aims to expand its technological capabilities but also seeks to redefine industry benchmarks through substantial contributions to research and development.

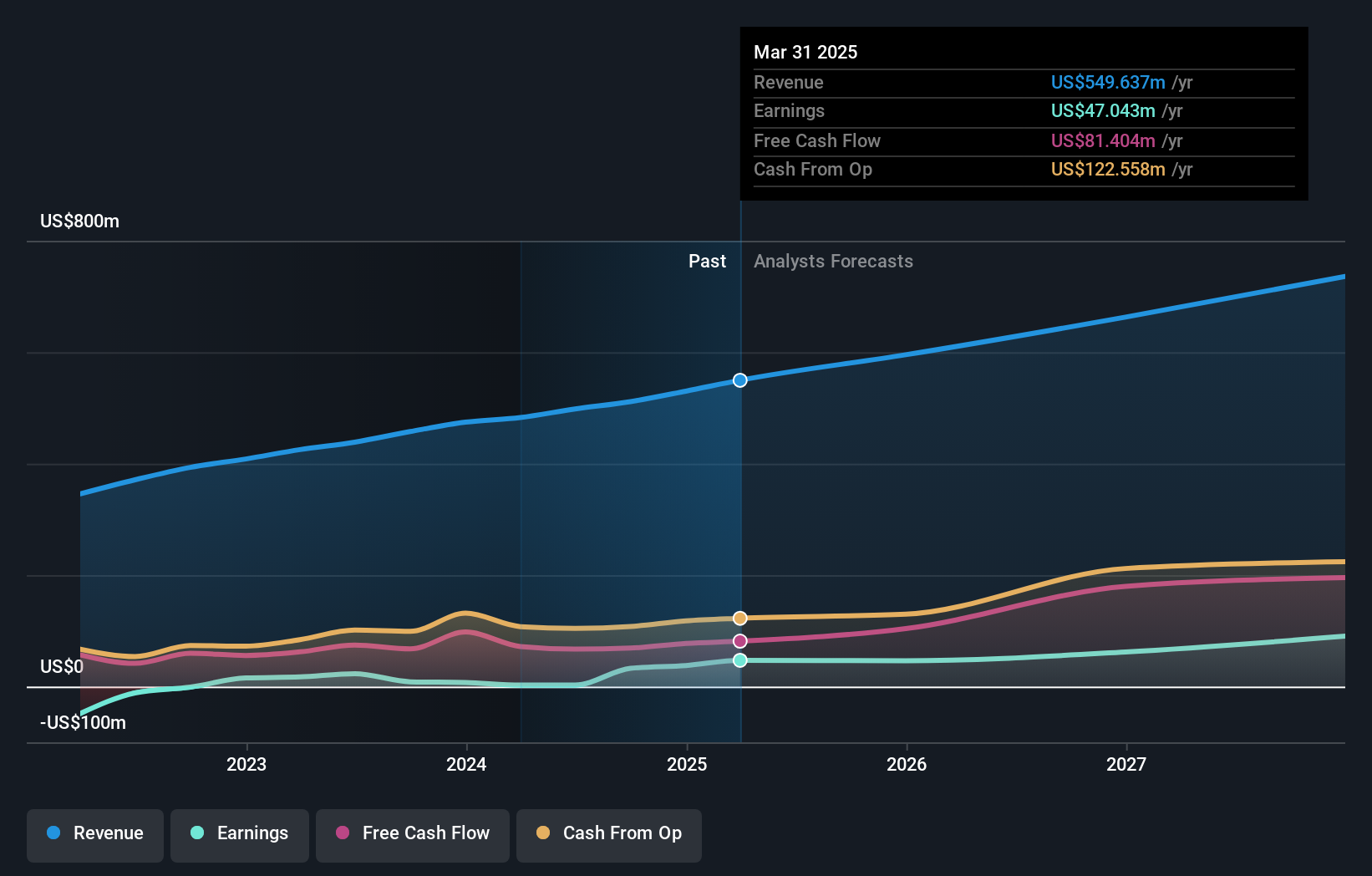

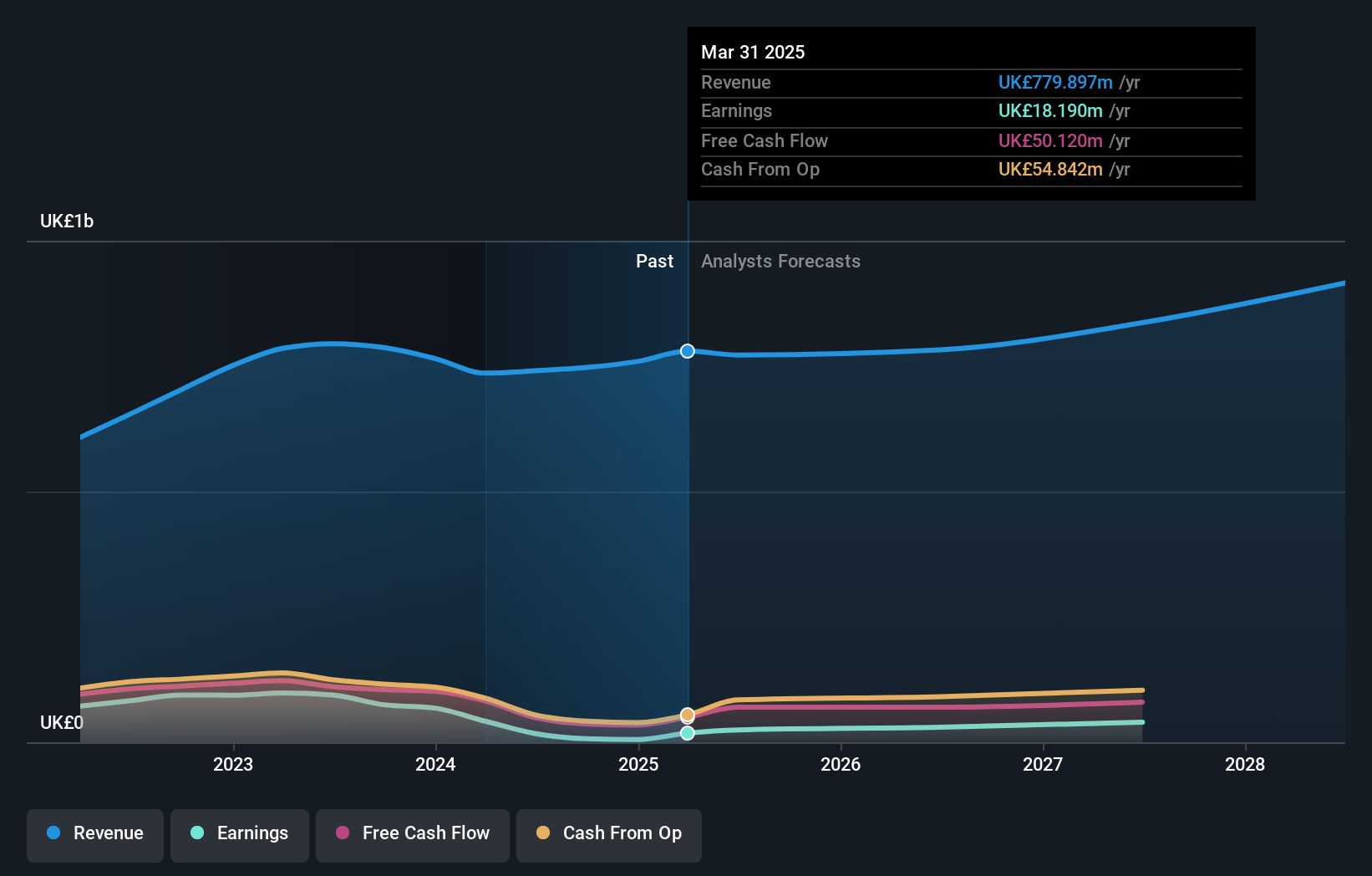

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endava plc, along with its subsidiaries, offers technology services across North America, Europe, the United Kingdom, and internationally with a market cap of $1.46 billion.

Operations: Endava generates revenue primarily from its computer services segment, amounting to £740.76 million. The company operates across various regions, including North America and Europe.

Endava has faced challenges, reflected in its recent financial performance with a significant drop in net income from GBP 94.16 million to GBP 17.12 million year-over-year and a shift from net income to a net loss of GBP 1.85 million in the latest quarter. Despite these hurdles, the company is positioning for recovery, projecting revenue growth between 10.0% and 11.5% next year, signaling resilience and adaptability in its strategy to navigate market fluctuations effectively. This forward-looking optimism is supported by Endava's commitment to innovation, underscored by substantial R&D investments aimed at fostering long-term growth rather than immediate returns, aligning with industry shifts towards more sustainable business models.

- Dive into the specifics of Endava here with our thorough health report.

Assess Endava's past performance with our detailed historical performance reports.

Teradata (NYSE:TDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Teradata Corporation offers a connected multi-cloud data platform for enterprise analytics and has a market capitalization of approximately $3.02 billion.

Operations: The company generates revenue through its multi-cloud data platform, with significant contributions from the Americas ($1.06 billion), APJ ($259 million), and EMEA ($481 million) regions.

Teradata's recent strategic enhancements in AI, particularly in generative AI (GenAI) applications, underscore its commitment to innovation and practical business solutions. The company announced significant advancements with VantageCloud Lake and ClearScape Analytics, integrating NVIDIA's AI technologies to boost performance across varied use cases. This move is pivotal as it aligns with the industry’s shift towards more accessible and cost-effective AI solutions, leveraging open-source models for better versatility without the high costs associated with large models. These developments are crucial given that Teradata's revenue growth is modest at 0.09% annually, contrasting sharply with an expected earnings surge of 26.6% per year. Moreover, R&D expenses have been strategically channeled to foster these technological advances, ensuring Teradata remains competitive in a rapidly evolving sector where efficient data management and AI integration are key drivers of enterprise growth.

- Click to explore a detailed breakdown of our findings in Teradata's health report.

Evaluate Teradata's historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 253 US High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endava might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAVA

Endava

Provides technology services in North America, Europe, the United Kingdom, and internationally.