Stock Analysis

- United States

- /

- IT

- /

- NYSE:SQSP

3 High Insider Ownership US Growth Companies With Earnings Growth Up To 70%

Reviewed by Simply Wall St

As global markets experience fluctuations influenced by economic data and geopolitical tensions, investors are keenly watching the U.S. market for stable investment opportunities. High insider ownership in growth companies can be a strong signal of confidence in the company’s future, making such stocks potentially attractive in these uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 27.5% | 20.9% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

| Li Auto (NasdaqGS:LI) | 29.3% | 21.8% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

| BBB Foods (NYSE:TBBB) | 23.6% | 76.5% |

| Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | 61.9% |

Let's uncover some gems from our specialized screener.

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corcept Therapeutics Incorporated focuses on the discovery and development of drugs for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market capitalization of approximately $2.82 billion.

Operations: The company generates revenue primarily through the discovery, development, and commercialization of pharmaceutical products, totaling $523.53 million.

Insider Ownership: 11.5%

Earnings Growth Forecast: 26.4% p.a.

Corcept Therapeutics, a growth-oriented company with substantial insider ownership, reported a significant increase in Q1 2024 earnings to US$27.76 million from US$15.88 million the previous year. This financial uptick aligns with their proactive clinical trials, including the recent completion of patient enrollment in CATALYST and positive results from the GRACE trial for relacorilant, enhancing its portfolio in treating endocrine disorders. Despite robust earnings growth forecasted at 26.41% annually, revenue growth projections are relatively modest at 13.7% per year, suggesting a cautious but progressive trajectory for the company's financial health and market position.

- Click here and access our complete growth analysis report to understand the dynamics of Corcept Therapeutics.

- In light of our recent valuation report, it seems possible that Corcept Therapeutics is trading behind its estimated value.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers cloud-based communications and collaboration solutions globally, with a market capitalization of approximately $3.26 billion.

Operations: The company generates its revenue primarily from internet software and services, amounting to approximately $2.25 billion.

Insider Ownership: 10.2%

Earnings Growth Forecast: 70.5% p.a.

RingCentral, a company with significant insider ownership, is poised for profitability within three years, outpacing average market growth. Despite its revenue growth forecast of 7.2% per year lagging behind the broader US market's 8.3%, it trades at 54.8% below estimated fair value and anticipates a very high Return on Equity of 54.7% in three years. Recent strategic moves include raised earnings guidance for 2024 and innovative product launches enhancing enterprise workflow efficiencies through AI integration, positioning it well for future competitiveness.

- Delve into the full analysis future growth report here for a deeper understanding of RingCentral.

- Our comprehensive valuation report raises the possibility that RingCentral is priced lower than what may be justified by its financials.

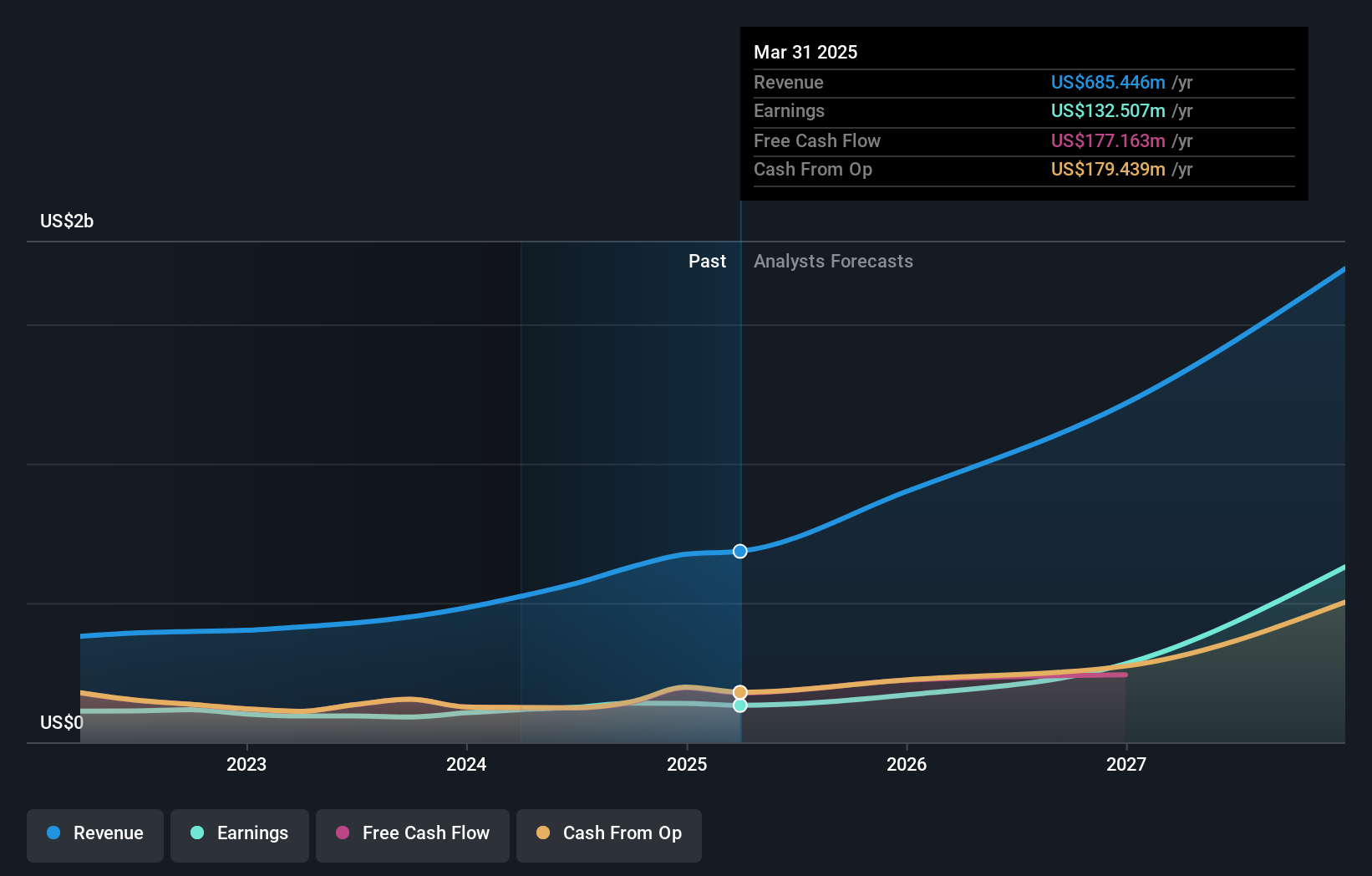

Squarespace (NYSE:SQSP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Squarespace, Inc. provides a platform in the U.S. and internationally that allows businesses and independent creators to establish an online presence, expand their brands, and manage operations, with a market capitalization of approximately $5.25 billion.

Operations: The company generates its revenue primarily from Internet Software & Services, totaling approximately $1.06 billion.

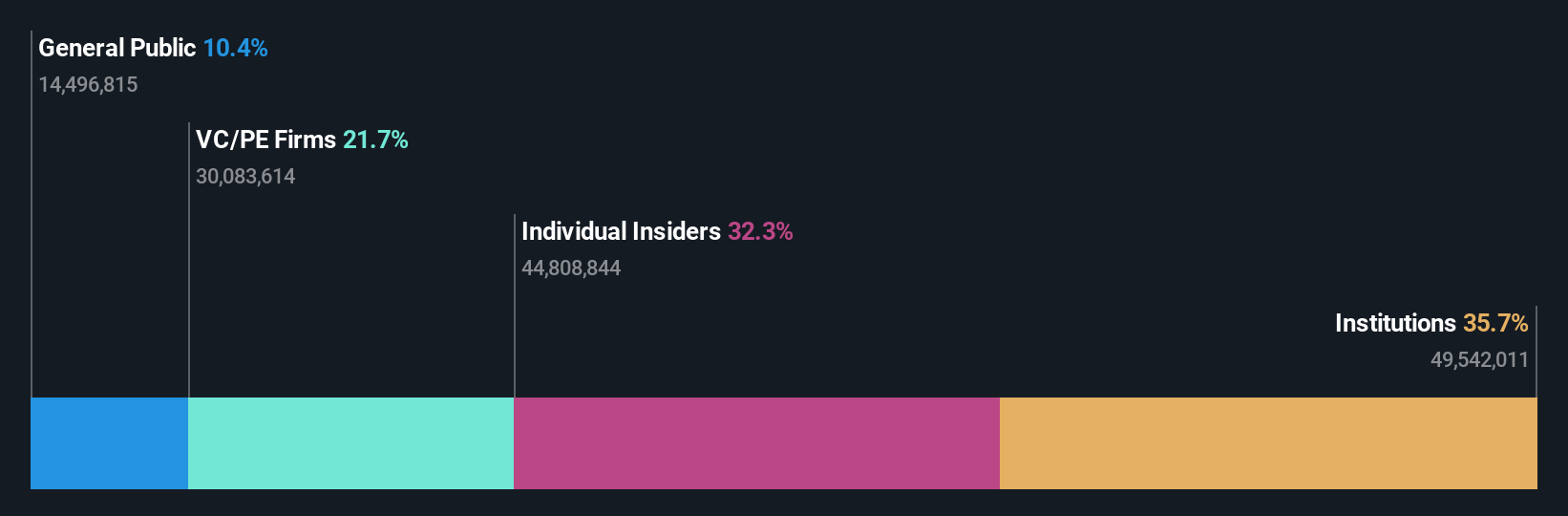

Insider Ownership: 34.2%

Earnings Growth Forecast: 35.1% p.a.

Squarespace, with substantial insider ownership, is on track to profitability in the next three years, outperforming average market growth. The company's recent financial performance shows a significant turnaround with sales increasing to US$281.15 million from US$237.03 million year-over-year and net income improving despite a previous loss. Forecasted revenue growth at 12.5% per year exceeds the US market prediction of 8.3%. Additionally, Squarespace announced a share repurchase program valued at up to US$500 million, underscoring confidence in its future prospects.

- Click here to discover the nuances of Squarespace with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Squarespace's current price could be quite moderate.

Taking Advantage

- Get an in-depth perspective on all 187 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Squarespace is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQSP

Squarespace

Operates platform for businesses and independent creators to build online presence, grow their brands, and manage their businesses across the internet in the United States and internationally.

Reasonable growth potential with imperfect balance sheet.