Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

The market has stayed flat over the past 7 days but has risen 23% in the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Soleno Therapeutics (NasdaqCM:SLNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing novel therapeutics for rare diseases, with a market cap of $1.90 billion.

Operations: Soleno Therapeutics focuses on developing and commercializing novel therapeutics for rare diseases. The company is currently in the clinical stage and does not yet generate revenue.

Soleno Therapeutics has been making significant strides in the biotech sector, with its recent FDA acceptance for DCCR's New Drug Application targeting Prader-Willi syndrome. The company's R&D expenses reflect a commitment to innovation, with $21.85 million reported as net loss in Q2 2024, compared to $8.48 million last year. Forecasts indicate an impressive 68.16% annual earnings growth and a revenue increase of 64.5% per year, suggesting strong future prospects despite current unprofitability.

- Dive into the specifics of Soleno Therapeutics here with our thorough health report.

Understand Soleno Therapeutics' track record by examining our Past report.

ACADIA Pharmaceuticals (NasdaqGS:ACAD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ACADIA Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing innovative medicines for central nervous system disorders and rare diseases in the United States, with a market cap of $2.75 billion.

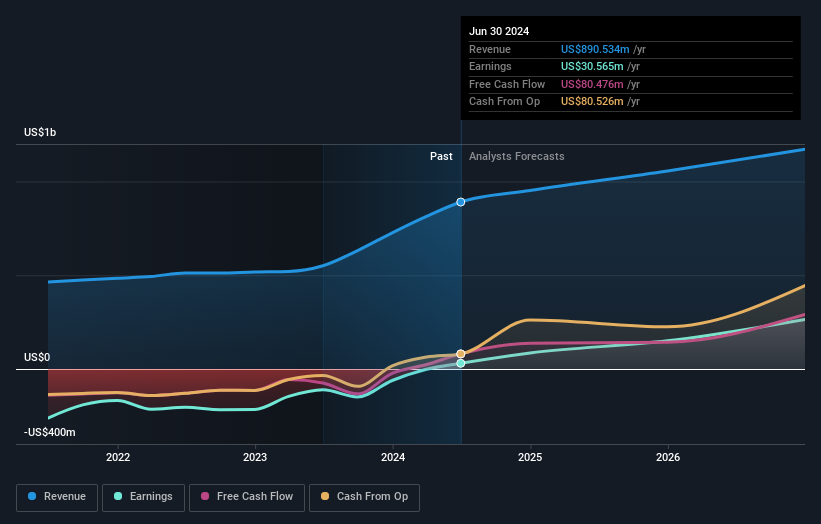

Operations: ACADIA Pharmaceuticals generates revenue primarily from the development and commercialization of innovative medicines, amounting to $890.53 million. The company focuses on addressing unmet medical needs in central nervous system disorders and rare diseases within the United States.

ACADIA Pharmaceuticals has demonstrated notable progress with a 46.47% increase in Q2 revenue to $241.96 million and a significant rise in net income to $33.39 million from $1.11 million the previous year. The company's R&D expenses, crucial for its innovative treatments like DAYBUE™ for Rett syndrome, were substantial but strategically justified, contributing to its robust earnings growth of 41.7% annually—outpacing the US market's 15%. With revised full-year revenue guidance between $930 million and $980 million, ACADIA's commitment to advancing biotech solutions remains evident despite industry challenges.

Guidewire Software (NYSE:GWRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guidewire Software, Inc. offers a comprehensive platform for property and casualty insurers globally and has a market cap of $12.30 billion.

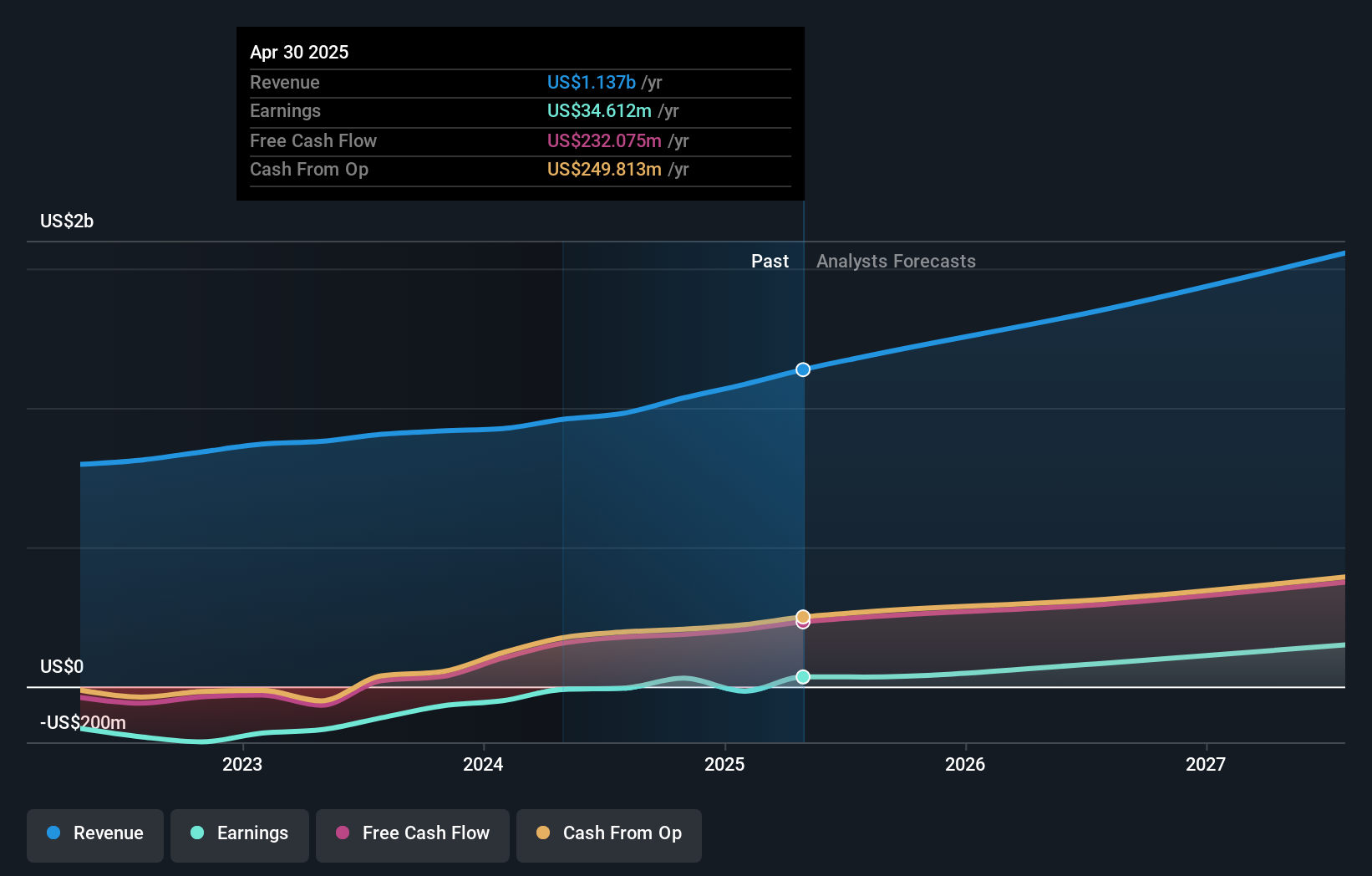

Operations: The company generates its revenue primarily through its software and programming segment, which brought in $958.94 million. With a focus on providing solutions to property and casualty insurers, Guidewire Software supports its clients with a robust technological platform tailored to industry needs.

Guidewire Software has shown a consistent focus on innovation, particularly through its recent product announcements like the HazardHub Enhanced Wildfire Score and the Kufri cloud update. The company’s R&D expenses, accounting for 11.0% of revenue, underscore its commitment to technological advancement. Guidewire's revenue grew by 16% year-over-year to $688.98 million for the nine months ending April 30, 2024, with earnings forecasted to grow at an impressive rate of 46.1%. Additionally, Guidewire repurchased shares worth $261.45 million in the past year, reflecting confidence in its strategic direction and financial health.

- Click here to discover the nuances of Guidewire Software with our detailed analytical health report.

Make It Happen

- Unlock our comprehensive list of 249 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.