- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean Holdings, Inc.'s (NYSE:DOCN) 31% Share Price Surge Not Quite Adding Up

Despite an already strong run, DigitalOcean Holdings, Inc. (NYSE:DOCN) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 29%.

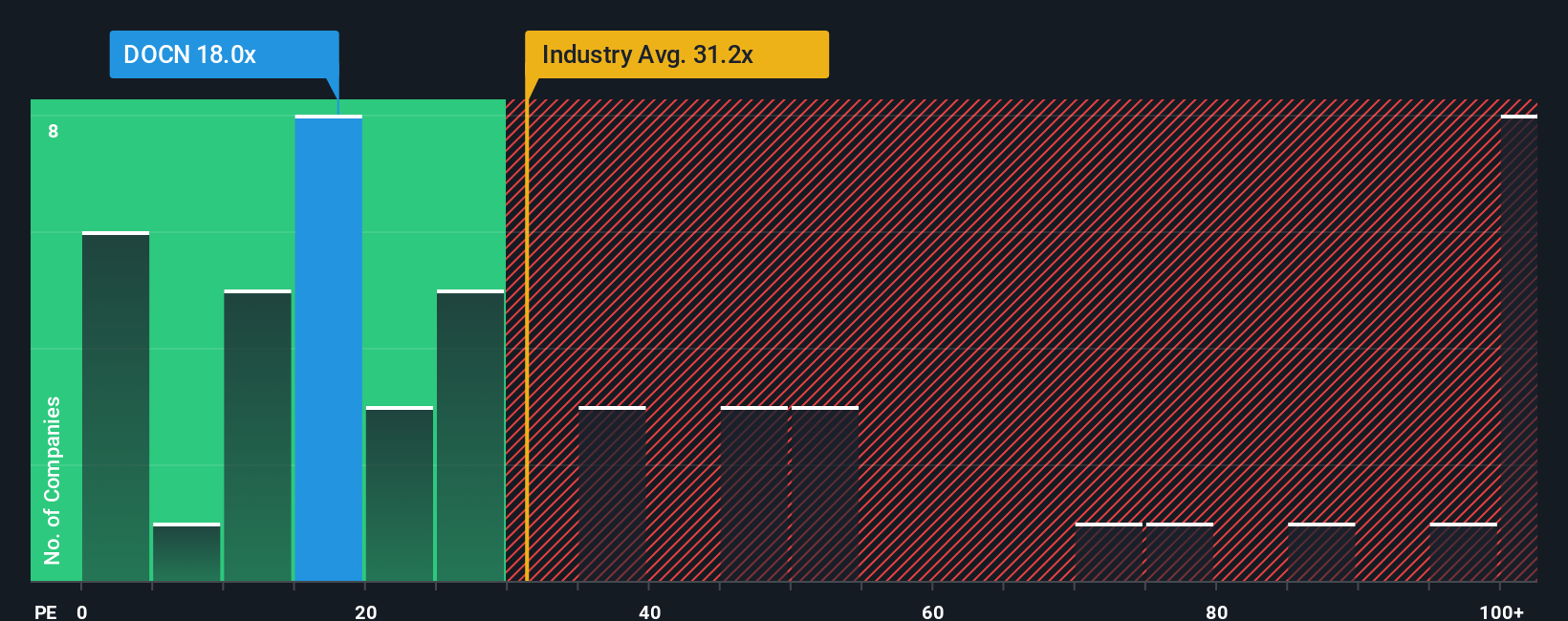

Even after such a large jump in price, you could still be forgiven for feeling indifferent about DigitalOcean Holdings' P/E ratio of 18x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

DigitalOcean Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for DigitalOcean Holdings

How Is DigitalOcean Holdings' Growth Trending?

The only time you'd be comfortable seeing a P/E like DigitalOcean Holdings' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 203%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 58% as estimated by the eleven analysts watching the company. That's not great when the rest of the market is expected to grow by 16%.

In light of this, it's somewhat alarming that DigitalOcean Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On DigitalOcean Holdings' P/E

Its shares have lifted substantially and now DigitalOcean Holdings' P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of DigitalOcean Holdings' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for DigitalOcean Holdings (1 doesn't sit too well with us) you should be aware of.

You might be able to find a better investment than DigitalOcean Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives