- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN): Assessing Valuation After Q3 Beat, Strong AI Contracts, and Upgraded Growth Guidance

Reviewed by Simply Wall St

DigitalOcean (DOCN) just posted third quarter results that surpassed expectations, with 16% revenue growth and a new high in organic annual recurring revenue. The company also signed large new contracts with AI-native enterprise clients, which helped lift its future guidance.

See our latest analysis for DigitalOcean Holdings.

After a year of steady progress, DigitalOcean’s strong Q3 momentum has only added fuel to the recent rally, sending the share price up 34% over the past month and an impressive 57% in the last 90 days. For shareholders, the one-year total return now stands at 30%, with three-year total returns topping 54%. This is a clear sign that investors are responding to both improving fundamentals and the company’s aggressive push into the AI space.

If DigitalOcean’s surge has you curious about other innovative tech movers, now is the perfect time to check out the full list using our discovery tool: See the full list for free.

With shares soaring and DigitalOcean’s latest guidance implying even stronger growth ahead, the big question for investors now is whether there is still room to run or if the recent rally already reflects all the good news.

Most Popular Narrative: 12.5% Overvalued

With the most tracked narrative estimating a fair value of $44.45, well below the recent $50.00 share price, it suggests the stock’s surge may have gotten ahead of fundamentals. Here’s a crucial catalyst straight from the narrative itself:

The proliferation of easy-to-consume AI platform services (Gradient AI Platform & Agents) lowers barriers for SaaS providers and software developers to integrate AI, likely to drive higher customer acquisition, cross-sell, and upsell activity across the product ecosystem, positively affecting ARPU and long-term revenue stability.

Curious what’s fueling this bold valuation call? The interplay of surging platform adoption and ambitious growth assumptions holds the key. Get the full picture; one analyst lever behind this number could surprise you.

Result: Fair Value of $44.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from hyperscale cloud providers and execution risks in scaling AI services could quickly challenge DigitalOcean’s current growth trajectory.

Find out about the key risks to this DigitalOcean Holdings narrative.

Another View: Peer Comparisons Paint a Different Picture

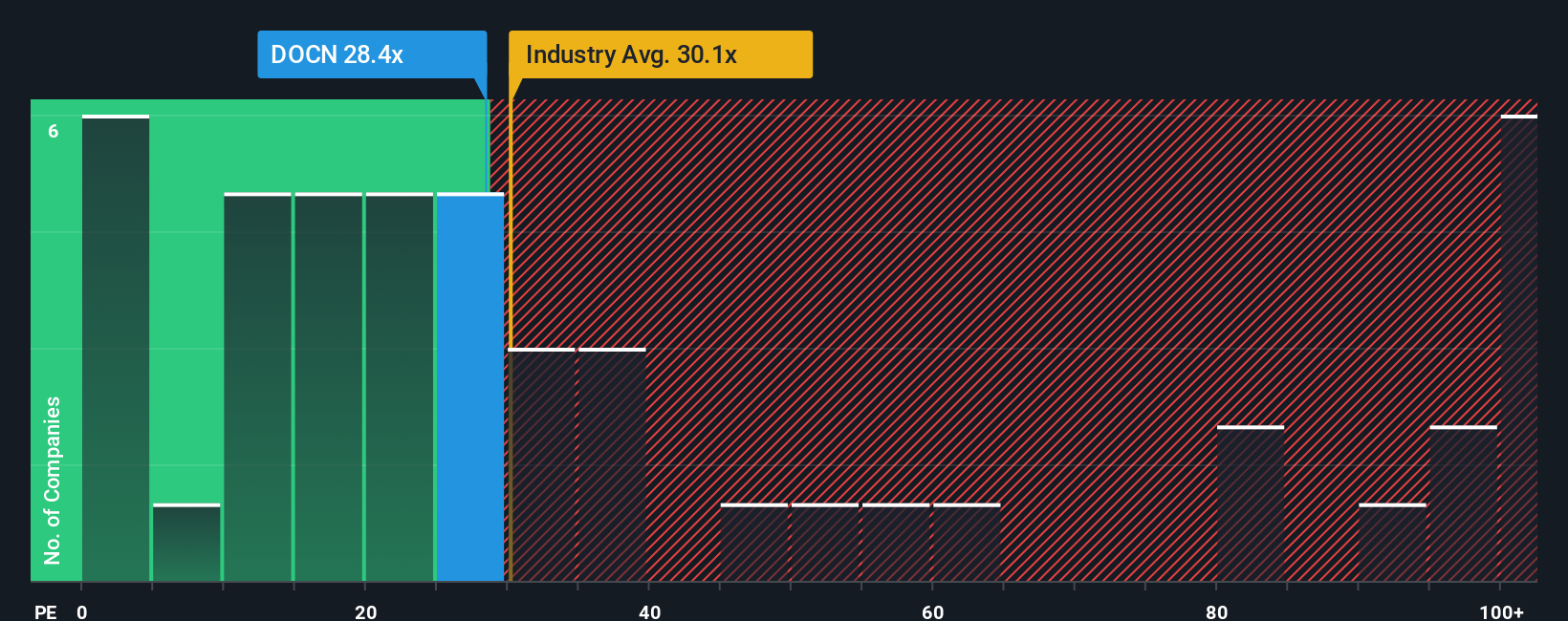

Looking through the lens of price-to-earnings, DigitalOcean trades at 18.2 times earnings, which is much lower than both the U.S. IT industry average (30.5x) and key peers (82.9x). However, this is still above the fair ratio of 15.8x, which could hint at some overenthusiasm creeping in. Does this relatively cheap multiple signal an overlooked value, or is the market simply reassessing risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalOcean Holdings Narrative

If you have a different take or want to dive deeper into the numbers yourself, crafting your own personal outlook only takes a few minutes. Do it your way

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip away. Using the Simply Wall Street Screener, you can quickly pinpoint stocks positioned for success across fast-changing markets and themes.

- Tap into market trends and gain an edge with these 854 undervalued stocks based on cash flows, surfacing stocks that the market might be overlooking right now.

- Accelerate your search for companies at the forefront of healthcare innovation by checking out these 32 healthcare AI stocks and see which names are poised to shape the future.

- Boost your portfolio’s income by exploring these 15 dividend stocks with yields > 3% offering attractive yields above 3% from financially solid businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives