- United States

- /

- IT

- /

- NasdaqGS:VRSN

VeriSign (VRSN): Exploring Valuation Following Strong Share Price Gains

Reviewed by Simply Wall St

VeriSign (VRSN) shares have seen some movement recently, with the stock posting a 21% gain so far this year and up 36% over the past year. Many investors are watching how the company’s fundamentals align with its steady multi-year performance.

See our latest analysis for VeriSign.

VeriSign's momentum has accelerated over the past year, as the company's strong fundamentals and modest growth spark renewed investor interest. After a robust 1-year total shareholder return of nearly 36%, recent share price movements reflect ongoing confidence in the firm's long-term prospects.

If you'd like to see what other fast-moving companies with strong insider confidence look like, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Despite the recent gains, investors now face a crucial question: does VeriSign’s current price reflect all its future growth, or is there still room for upside if the stock is undervalued?

Most Popular Narrative: 15.8% Undervalued

With analysts setting a fair value of $295.50 for VeriSign, well above the last close at $248.68, markets are noticing a considerable potential upside, anchored by bullish projections on cash returns and solid domain trends.

"VeriSign is experiencing sequentially improving trends in domain name registrations, with new registrations and renewal rates increasing, potentially boosting revenue growth in the coming quarters. The company is implementing new marketing programs which are showing early signs of success in increasing domain registrations, possibly enhancing revenue streams as these programs gain traction."

Want to see the math behind this bullish case? Discover which growth levers and profit assumptions drive this eye-catching valuation. The real story is in the targeted expansion and confident long-term forecasts. Details you won’t want to miss.

Result: Fair Value of $295.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased parked domain advertising changes or shifts in registrant quality trends could still challenge the bullish outlook for VeriSign’s future growth.

Find out about the key risks to this VeriSign narrative.

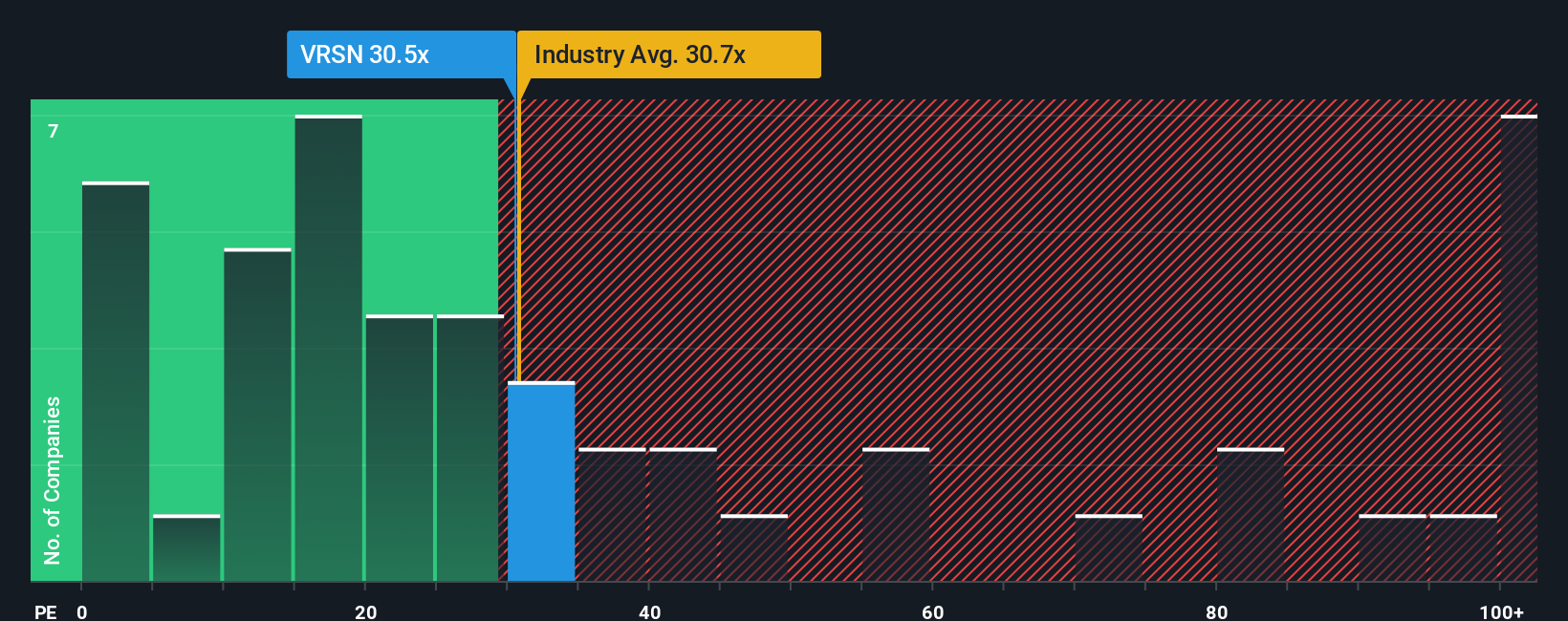

Another View: P/E Ratio Highlights Relative Value

While analysts see VeriSign as undervalued based on future cash flows, another approach looks at its price-to-earnings ratio. VeriSign trades at 28.4x, not only undercutting the IT industry average of 31.3x but also peers at 77.1x, and sits below a fair ratio of 30x. This suggests the market could still adjust its valuation, so is there hidden value or potential risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out VeriSign for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own VeriSign Narrative

If you think the current case doesn’t quite fit your perspective or you’d rather dig into the numbers yourself, it’s quick and easy to build your own view in just a few minutes with Do it your way.

A great starting point for your VeriSign research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to just one opportunity? Expand your investing horizon today and target fast-growing trends that might otherwise slip past your radar.

- Capture tomorrow's breakthroughs by reviewing these 26 AI penny stocks, which are shaping industries with artificial intelligence innovation and scalable growth potential.

- Supercharge your portfolio's income with these 15 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3% and a proven track record of rewarding shareholders.

- Get ahead of the curve with these 82 cryptocurrency and blockchain stocks, focusing on businesses advancing blockchain technology and digital currencies for the next era of finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives