- United States

- /

- IT

- /

- NasdaqGS:SHOP

Will Robust Revenue Growth and Declining Margins Shift Shopify's (SHOP) Long-Term Investment Narrative?

Reviewed by Sasha Jovanovic

- Shopify recently reported its third quarter results, revealing revenue of US$2.84 billion and net income of US$264 million, accompanied by guidance for fourth quarter revenue growth in the mid to high 20s percent year-over-year.

- Client announcements from ONNIT and LiquiDonate highlighted major merchant migrations and app relaunches that leverage Shopify's ecosystem to improve subscription management, drive operational efficiency, and provide sustainability benefits through inventory donations.

- We’ll examine how robust revenue growth but declining profit margins, impacted by loan losses, shapes Shopify’s investment narrative and outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Shopify Investment Narrative Recap

To own Shopify shares, an investor needs to believe in the company’s role as a core infrastructure for the global shift toward unified commerce, underpinned by strong revenue growth, expanding enterprise adoption, and new monetization layers. Despite robust top-line results, the latest earnings highlight thin profit margins and loan losses, which remain the main risks and near-term catalysts; recent news on large merchant migrations is positive but doesn’t materially shift these short-term forces.

The ONNIT migration to Shopify’s ecosystem stands out, as it reinforces Shopify’s appeal to high-volume brands aiming to streamline operations and boost recurring revenues. While this supports the broader catalyst of moving upmarket and deepening enterprise penetration, it does not directly address near-term profitability pressures from rising credit losses or regulatory concerns.

However, investors should also weigh the risk that even as Shopify grows rapidly, elevated compliance costs and competition may pressure operating margins…

Read the full narrative on Shopify (it's free!)

Shopify's outlook anticipates $18.5 billion in revenue and $2.7 billion in earnings by 2028. This projection relies on an annual revenue growth rate of 22.6% and a $0.4 billion increase in earnings from the current $2.3 billion.

Uncover how Shopify's forecasts yield a $165.87 fair value, a 4% upside to its current price.

Exploring Other Perspectives

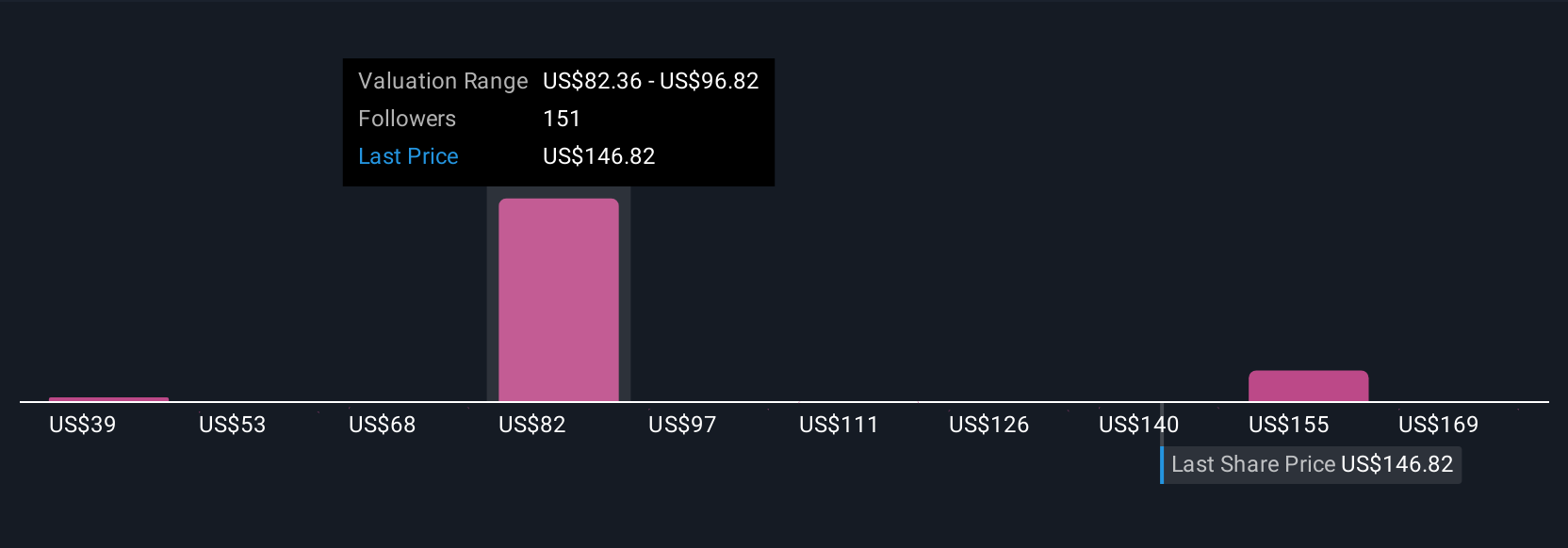

Twenty-three members of the Simply Wall St Community value Shopify between US$82 and US$200 per share, with estimates scattered across this wide spectrum. Against this backdrop, ongoing margin pressures and competition highlight why thoughtful consideration of multiple viewpoints is important for your investment research.

Explore 23 other fair value estimates on Shopify - why the stock might be worth 48% less than the current price!

Build Your Own Shopify Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shopify research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shopify's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives