- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP) One-Off $582M Gain Clouds Margin Quality, Challenges Growth Sustainability Narratives

Reviewed by Simply Wall St

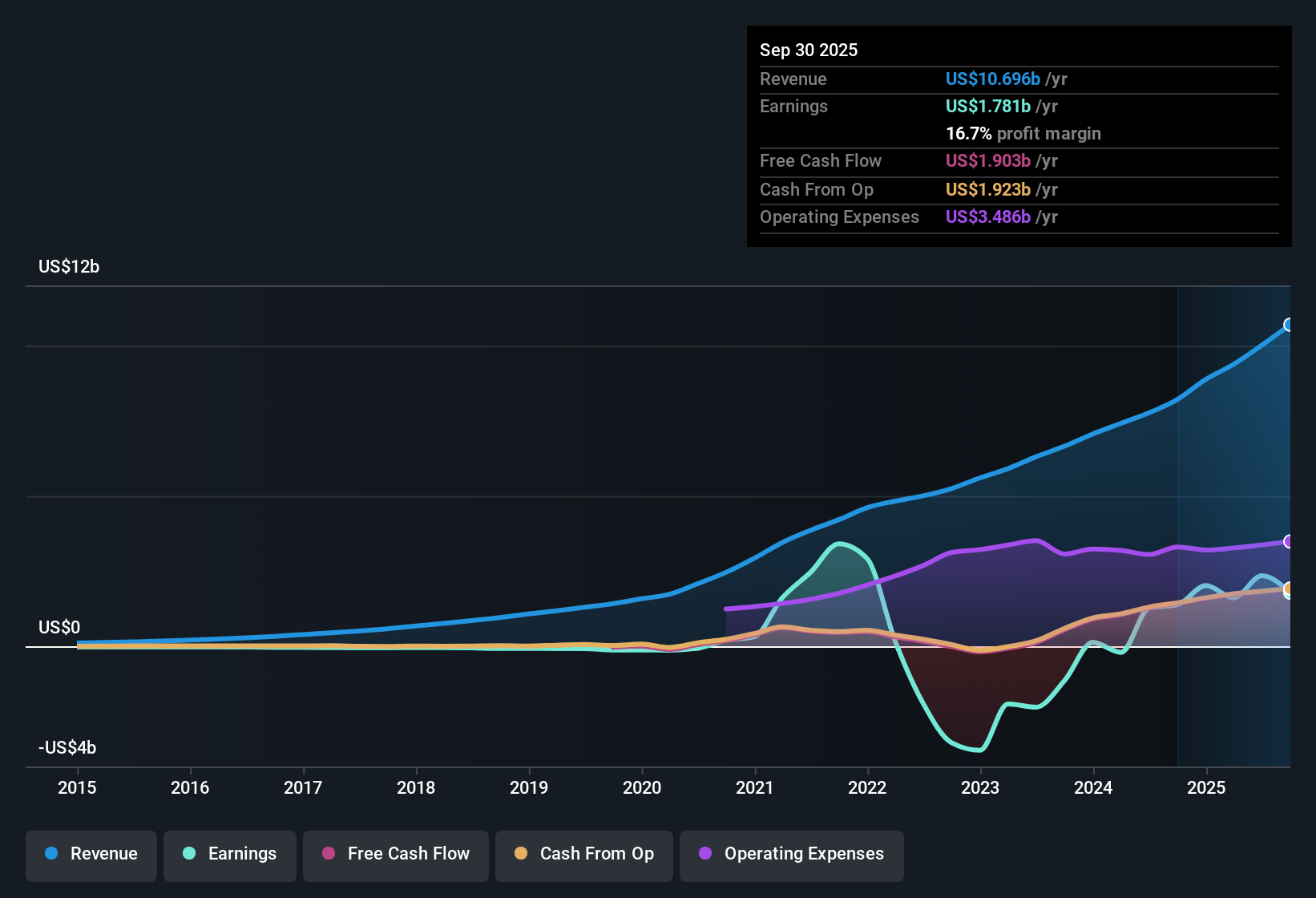

Shopify (SHOP) posted forecast-beating numbers with earnings expected to grow 20.53% per year and annual profit growth of 20.5%, while revenue is anticipated to climb 18.5%. Both figures surpass US market averages of 16% for earnings and 10.5% for revenue. The company’s net profit margin edged slightly lower to 16.7% from 16.8% last year, and results were recently buoyed by a one-off $582 million gain in the twelve months to September 30, 2025. Investors are likely scrutinizing whether Shopify’s recent acceleration, with 28.8% earnings growth over the past year compared to its 6.4% five-year average, marks a sustainable shift or simply the effect of non-recurring boosts.

See our full analysis for Shopify.Next, we’ll put these headline results side by side with Simply Wall St’s most popular narratives about Shopify to see where expectations meet reality and where surprises could emerge.

See what the community is saying about Shopify

PE Ratio Towers Over Peers

- Shopify’s Price-to-Earnings ratio stands at 119.1x, which is more than four times the US IT industry average of 28.9x and nearly triple its peer average of 41.4x, signaling a substantial valuation premium.

- Analysts' consensus view draws attention to this steep premium by noting that to justify the current levels, Shopify would need to reach $2.7 billion in earnings by 2028 while continuing to support a PE ratio of nearly 100x, much higher than industry standards.

- Consensus narrative also highlights analyst disagreement, with targets ranging from $114.0 to $200.0 and questions whether such a valuation is sustainable if profit margins continue to shrink as forecast.

- This valuation gap challenges the notion that high growth alone can offset the risks of margin compression and one-off earnings gains, urging investors to scrutinize the underlying quality of Shopify’s earnings trajectory.

- To see how the consensus narrative interprets Shopify’s valuation against its growth prospects, analysts dissect how earnings projections and premium multiples are shaping a higher-stakes story for investors. 📊 Read the full Shopify Consensus Narrative.

One-Off Gain Clouds Margin Signal

- The most recent $582 million non-recurring gain helped push net profit margin to 16.7% this year, but that figure has slipped compared to last year’s 16.8%, suggesting underlying operating profitability may not be improving as headline profit growth implies.

- Analysts' consensus view points out that as Shopify pushes further into international markets and invests in AI-driven features for merchants, operating leverage is being tested.

- Consensus comments that while international gross merchandise volume grew at 42% year-over-year and product innovation is strong, potential increases in cost structure and regulatory costs, especially outside North America, could weigh further on net margins.

- Analysts are forecasting a decline in profit margins from 23.4% today to 14.6% over the next three years, raising doubts about whether recent profitability can be sustained once the one-off gain fades.

Growth Story Drives Analyst Disagreement

- There is notable divergence among analysts about Shopify’s path forward, with the most bullish expecting $3.2 billion in annual earnings by 2028 and the most bearish seeing only $2.1 billion, a more than $1 billion spread that highlights uncertainty about how fast Shopify’s engine can run.

- Analysts' consensus view ties this debate directly to Shopify’s rapid revenue expansion and ambitious upmarket push.

- While consensus recognizes strength in international growth and the expansion of the financial ecosystem, it also flags risks around exposure to small and medium-sized businesses, especially in weaker economies that could drag down recurring revenues during downturns.

- Consensus notes that in order to hit the $18.5 billion revenue target by 2028, Shopify must both expand its addressable market and overcome rising customer acquisition costs as e-commerce becomes more crowded and competitive.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Shopify on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that others might have missed? Share your angle and put your narrative together in just a few minutes. Do it your way

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Shopify’s sky-high valuation and slipping margins highlight the risks investors face when growth expectations outpace profit quality and sustainability.

If you’re seeking companies with more attractive valuations and a stronger margin of safety, check out these 840 undervalued stocks based on cash flows to discover others that could offer better value for your next investment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives